Investors with a lot of money to spend have taken a bearish stance on Salesforce (NYSE:CRM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 29 uncommon options trades for Salesforce.

This isn't normal.

The overall sentiment of these big-money traders is split between 41% bullish and 48%, bearish.

Out of all of the special options we uncovered, 14 are puts, for a total amount of $626,979, and 15 are calls, for a total amount of $686,825.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $370.0 for Salesforce, spanning the last three months.

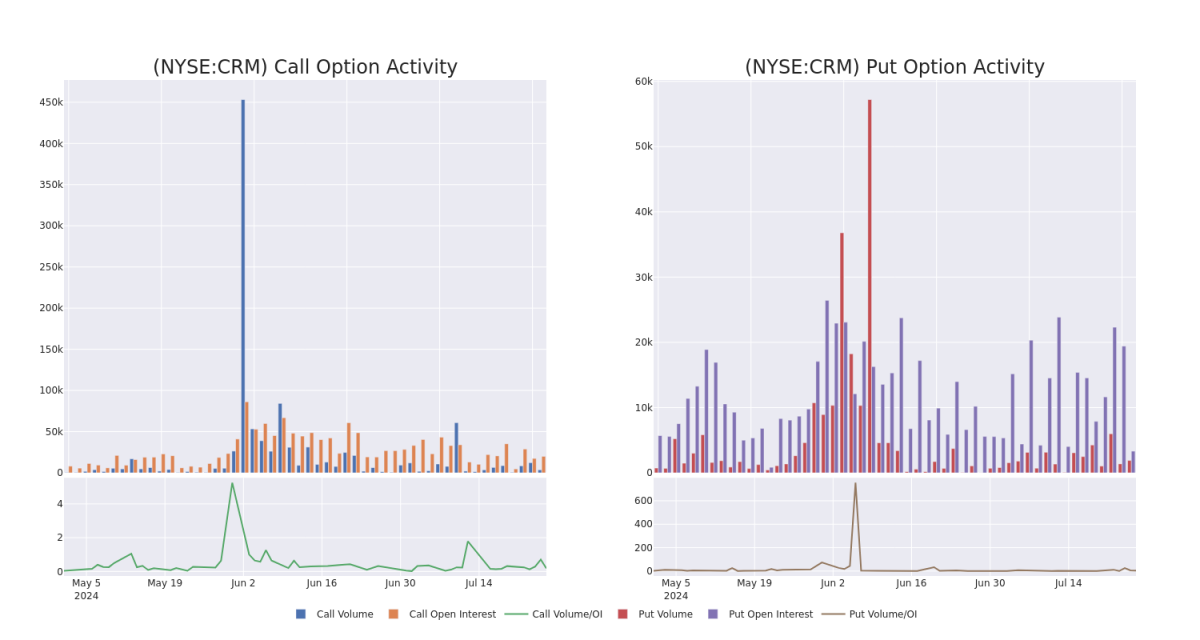

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Salesforce's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Salesforce's substantial trades, within a strike price spectrum from $150.0 to $370.0 over the preceding 30 days.

Salesforce Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | PUT | TRADE | BULLISH | 01/17/25 | $21.2 | $20.9 | $20.9 | $260.00 | $119.1K | 1.4K | 55 |

| CRM | CALL | TRADE | BEARISH | 09/20/24 | $15.85 | $15.6 | $15.69 | $260.00 | $78.4K | 2.7K | 174 |

| CRM | CALL | SWEEP | BULLISH | 09/20/24 | $15.6 | $15.35 | $15.53 | $260.00 | $77.5K | 2.7K | 83 |

| CRM | PUT | TRADE | NEUTRAL | 09/06/24 | $15.0 | $14.45 | $14.7 | $265.00 | $73.5K | 0 | 52 |

| CRM | CALL | TRADE | BULLISH | 09/06/24 | $12.65 | $12.3 | $12.6 | $265.00 | $66.7K | 12 | 100 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Salesforce's Current Market Status

- Trading volume stands at 1,845,289, with CRM's price up by 0.52%, positioned at $264.08.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 30 days.

What The Experts Say On Salesforce

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $250.0.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Neutral rating for Salesforce, targeting a price of $250.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.