Financial giants have made a conspicuous bullish move on ConocoPhillips. Our analysis of options history for ConocoPhillips (NYSE:COP) revealed 10 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $244,371, and 4 were calls, valued at $203,869.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $111.0 for ConocoPhillips during the past quarter.

Volume & Open Interest Development

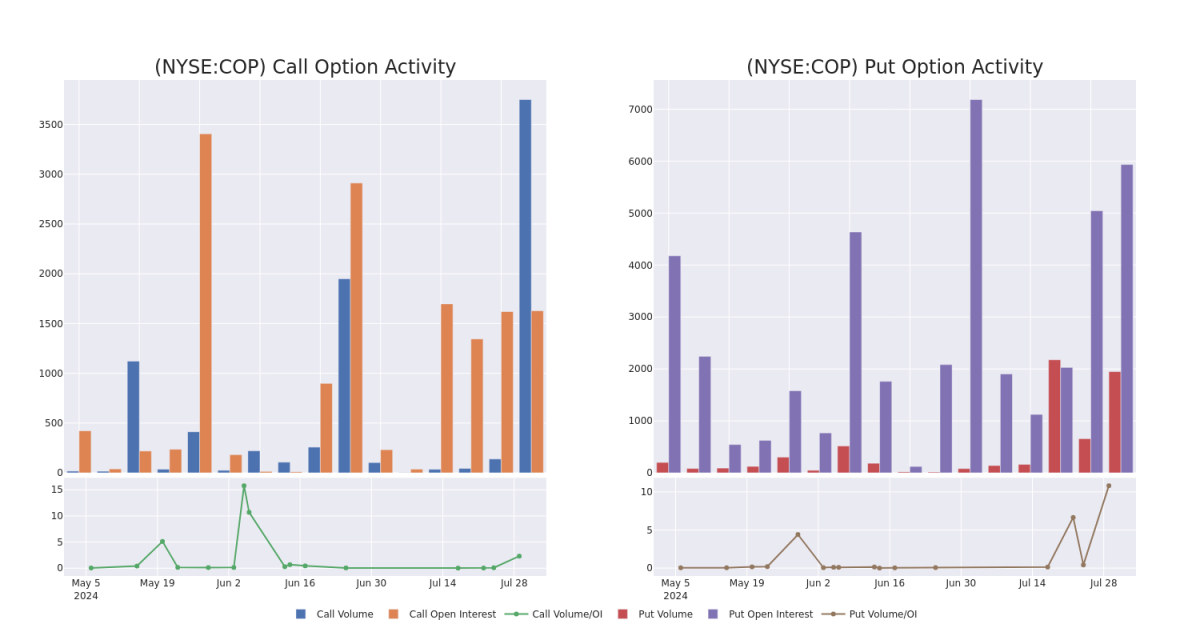

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ConocoPhillips's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ConocoPhillips's substantial trades, within a strike price spectrum from $90.0 to $111.0 over the preceding 30 days.

ConocoPhillips Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | CALL | SWEEP | BULLISH | 09/20/24 | $3.45 | $3.4 | $3.45 | $110.00 | $84.5K | 1.6K | 745 |

| COP | PUT | TRADE | BULLISH | 09/20/24 | $1.2 | $1.09 | $1.11 | $100.00 | $82.4K | 1.5K | 963 |

| COP | CALL | SWEEP | BULLISH | 09/20/24 | $3.4 | $3.35 | $3.4 | $110.00 | $57.1K | 1.6K | 1.3K |

| COP | PUT | SWEEP | BEARISH | 11/15/24 | $1.54 | $1.53 | $1.53 | $95.00 | $40.1K | 206 | 262 |

| COP | PUT | SWEEP | BULLISH | 08/09/24 | $3.75 | $3.05 | $3.5 | $111.00 | $37.1K | 41 | 117 |

About ConocoPhillips

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

Where Is ConocoPhillips Standing Right Now?

- With a volume of 2,614,164, the price of COP is down -1.89% at $108.76.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 3 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.