Financial giants have made a conspicuous bearish move on Johnson & Johnson. Our analysis of options history for Johnson & Johnson (NYSE:JNJ) revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $117,603, and 6 were calls, valued at $283,044.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $135.0 to $170.0 for Johnson & Johnson over the last 3 months.

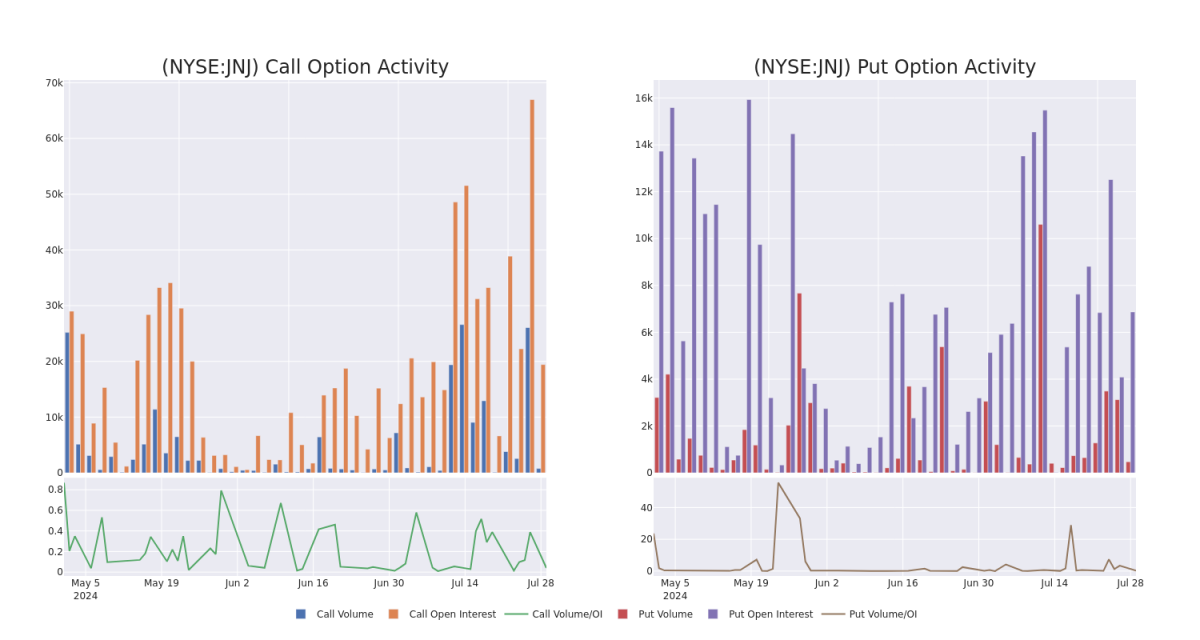

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Johnson & Johnson's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Johnson & Johnson's significant trades, within a strike price range of $135.0 to $170.0, over the past month.

Johnson & Johnson 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | CALL | TRADE | BEARISH | 12/18/26 | $15.05 | $13.9 | $14.3 | $170.00 | $100.1K | 15 | 70 |

| JNJ | CALL | TRADE | BEARISH | 08/16/24 | $5.6 | $5.45 | $5.5 | $155.00 | $55.0K | 9.8K | 120 |

| JNJ | CALL | SWEEP | BEARISH | 01/17/25 | $21.85 | $21.45 | $21.5 | $140.00 | $36.5K | 623 | 29 |

| JNJ | PUT | SWEEP | BEARISH | 09/20/24 | $2.42 | $2.39 | $2.4 | $155.00 | $36.4K | 3.8K | 202 |

| JNJ | CALL | SWEEP | BEARISH | 09/20/24 | $1.67 | $1.66 | $1.67 | $165.00 | $35.9K | 7.9K | 481 |

About Johnson & Johnson

Johnson & Johnson is the world's largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company's sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

Having examined the options trading patterns of Johnson & Johnson, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Johnson & Johnson Standing Right Now?

- With a volume of 5,597,868, the price of JNJ is down -1.64% at $158.0.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 78 days.

Professional Analyst Ratings for Johnson & Johnson

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $178.8.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $175.

- An analyst from TD Cowen persists with their Buy rating on Johnson & Johnson, maintaining a target price of $185.

- Reflecting concerns, an analyst from Daiwa Capital lowers its rating to Neutral with a new price target of $150.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $215.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Johnson & Johnson, which currently sits at a price target of $169.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.