Morgan Stanley strategist Michael Wilson said that as investors worry that inflation will decline and affect corporate pricing power, stocks closely linked to the economy will be dragged down by dimming prospects for U.S. corporate profits. On the product structure side, the 10-30 billion yuan products operating income were 401/1288/60 million yuan, respectively.

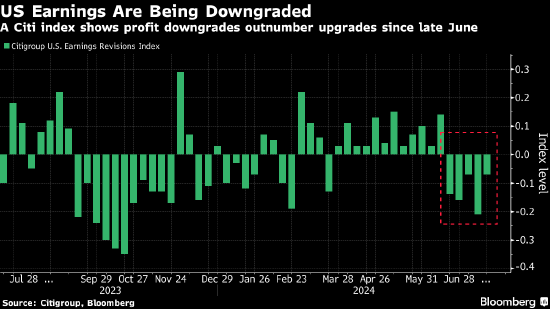

Wilson was one of the most well-known bearish strategists on the U.S. stock market last year. He said that a measure of upward revisions to earnings expectations relative to downward revisions has turned weak - a typical situation at this time of year, mainly driven by cyclical industries.

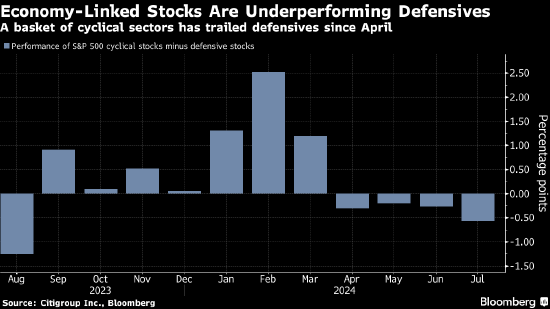

Wilson said: "In our view, this does not support broad cyclicality rotation." He added that the market "may also focus on the view that falling inflation may become a headwind for cyclical industries, as cyclical industries rely heavily on pricing power."

Since mid-July, when the S&P 500 hit a new high, concerns that the slowdown in the economy will prompt the Federal Reserve to cut interest rates faster and more drastically than expected have shaken the benchmark index. Interchange data shows that the market has fully digested a rate cut by the Fed in September.

According to Citigroup data, since late June, the number of companies that have lowered their earnings expectations for a basket of stocks that track spending has been broadly higher than the number that have raised them. Meanwhile, cyclical stocks in the S&P 500 have lagged behind more defensive sectors since April.

The largest technology stocks have also been affected by recent sell-offs as investors prefer smaller stocks with lower valuations. Wilson of Morgan Stanley said he continued to recommend large-cap stocks, "although we are closely monitoring the fundamentals and technical situation of small-cap stocks."

"We still believe that growth stocks in small-cap stocks have better risk/return profiles and will benefit from lower capital costs as the Federal Reserve cuts interest rates," Wilson said.

RBC Capital Markets strategist Lori Calvasina also said that the trend of adjusting earnings expectations does not support further rotation by market leaders.

"Although the results of the first few giant growth stocks companies released challenging news," Calvasina wrote in a statement, the top 10 stocks in the Standard & Poor's 500 Index have seen higher upward revisions to profit forecasts than other stocks in the index. "We have not yet seen a clear shift towards small-cap stocks."