UBS: The recent pullback is an opportunity to increase positions

Tomorrow, the market will welcome another financial report from the tech giant Microsoft.

The previous Google earnings report accelerated the correction of technology stocks. Presumably, Microsoft's earnings report will also set off turbulent waves in the market.

Regarding Microsoft's second-quarter earnings report, the market currently has two questions: 1) How much money did AI make for it? 2) How much more will we invest in AI in the future?

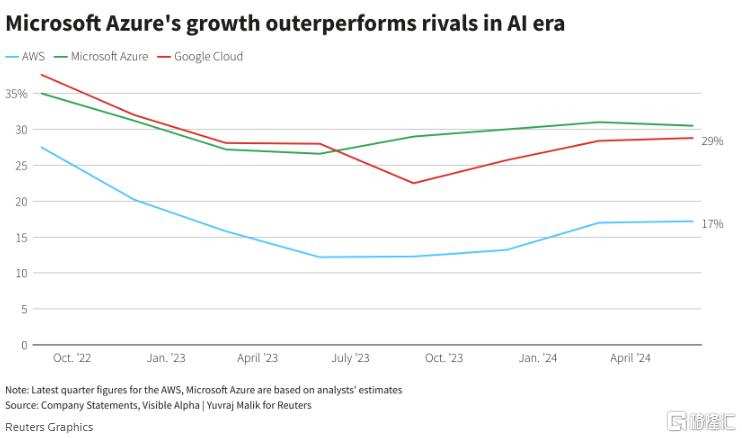

How is the cloud business growing?

The market expects Microsoft's revenue for the second quarter to be 64.5 billion US dollars, up 14.6% year on year, compared with 17% growth rate in the previous quarter; earnings per share were 2.94 US dollars, compared to 2.69 US dollars in the same period last year.

In terms of specific business, what investors are most concerned about is the growth of the Azure cloud computing business. The performance of this business will be related to whether the giant's huge investment in AI infrastructure is reasonable.

Microsoft is expected to report that in the second quarter, the month-on-month growth of the Azure cloud computing business remained stable, at about 31%.

As investment in AI may take some time to pay off, the market is paying more and more attention to the capital expenditure of technology companies.

According to analysts' forecasts, Microsoft's capital expenditure for the second quarter increased by about 53% year-on-year to 13.64 billion US dollars. This is a significant increase compared to the $10.95 billion spent in the first quarter.

Continue to invest more?

Last week, Google releasedEarnings ReportIt shows that capital expenditure for the second quarter exceeded expectations by nearly 1 billion US dollars, and capital expenditure for the rest of this year will reach or exceed 12 billion US dollars, but the growth brought to Google by AI is still moderate.

In response, Google's CEO believes that it is currently in the early stages of a transformative field, and the risk of underinvestment is far higher than overinvestment.

Earlier, Microsoft also stated that it needs to invest in data centers to overcome capacity limitations that hinder its use of AI.

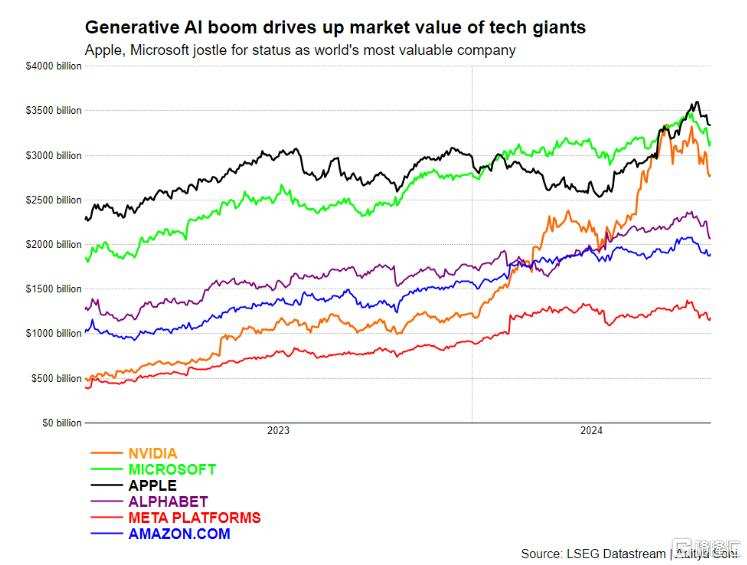

The huge investment of tech giants in AI frightened the market. In addition, technology stocks had already risen quite a bit in the early stages, and some investors chose to settle down and stay safe, which led to an acceleration of the pullback.

In the 4 trading days since July 24, Nvidia has a cumulative decline of 8.97%, Google-A has a cumulative decline of 6.74%, Tesla has a cumulative decline of 5.8%, Meta has a cumulative decline of 4.7%, Microsoft has a cumulative decline of 4.07%, Apple has a cumulative decline of 3.01%, and Amazon has a cumulative decline of 1.72%.

In response, D.A. Davidson analyst Gil Luria stated, “Investors will be very concerned about Microsoft's ability to continue to accelerate revenue growth, especially the AI-related part. Investors may be disappointed if accelerated revenue growth is not realized and capital expenditure continues to rise.”

Additionally, Apple, Amazon, Microsoft, and Meta will also release financial reports one after another this week.

How do you view the short-term pullback?

Despite the recent correction, some major Wall Street banks are still optimistic about the future of technology stocks.

UBS believes that this is a good opportunity for long-term investors to buy on dips, and technology stocks still have attractive valuations, fundamentals, and technical aspects:

In terms of valuation, UBS points out that in the past 10 years, technology stocks have experienced a 10% sell-off almost every year, so it is not unusual for the NASDAQ 100 index to drop 9% recently.

The healthy sell-off in technology stocks has also made the valuation of this rapidly growing industry more attractive, especially compared to the previous bubble.

Although the tech industry seems expensive after rebounding this year, the price-earnings ratio is still far below that of the internet bubble era.

Fundamentally, UBS expects the tech industry's net profit to increase by 20%-25% in the second quarter.

Today's technology leaders still provide high-quality profit margins, strong free cash flow, and a sound balance sheet, which is a positive driving force at a time of slowing economic activity.

Moreover, this growth should continue for many years, as the AI revolution requires significant investment in architectures, such as Nvidia's GPU chips and new data centers.

On the technical side, UBS analyzed that bear squeeze, call option activity, and bank hedging have boosted small-cap stock rotation trading, but this situation will not last forever.

The impact of rotation trading quickly dissipates, as this technical factor usually dissipates after about a month.

Therefore, UBS believes that the environment is still favorable to high-quality technology stocks, and investors should ensure sufficient exposure to AI beneficiaries.