The market is quietly waiting for the dense financial reports of large technology stocks and the Federal Reserve decision on Wednesday. Pre-market trading, Tesla rose more than 1%, CrowdStrike fell more than 5%, and most of the popular China concept stocks fell.

Before the US stock market opened today, the European and American stock markets showed a mild upward trend with little volatility. The three major US stock indexes rose slightly, Tesla continued its upward trend before the market, Microsoft and AMD are due to release their quarterly reports soon, and the stock price remains stable. Most popular China concept stocks are down.

Most European stock indexes opened higher. France and Germany's GDP data were released today. France's second-quarter GDP surpassed expectations year-on-year and quarter-on-quarter, while Germany's GDP unexpectedly declined.

Before the US stock market opens, Procter & Gamble, Merck Pharmaceuticals, Pfizer Pharmaceuticals, and others will release their earnings reports. After the market, Microsoft, AMD, and others will release their earnings reports.

The three major US stock indexes rose slightly, with Tesla up more than 1% and CrowdStrike down more than 5%. Most popular China concept stocks are down.

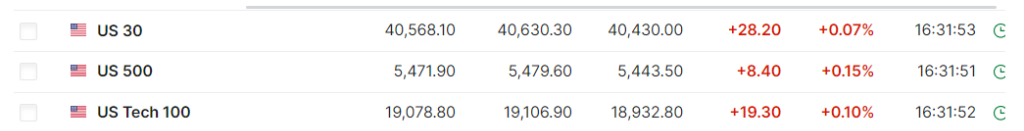

Currently, Dow futures are up 0.07%, S&P 500 futures are up 0.15%, and Nasdaq 100 futures are up 0.1%.

Among popular technology stocks, Amazon, Apple, Taiwan Semiconductor, and others rose slightly. Tesla continued its upward trend from yesterday, rising 1.5% before the market. Previously, Goldman Sachs had listed Tesla as the preferred auto stock, replacing Ford, and predicted that its stock price still has 40% room for growth.

Most popular China concept stocks are down, with Xpeng down more than 2%, Li Auto down nearly 2%, and JD.com and New Oriental down more than 1%.

CrowdStrike fell 5.16% before the US stock market opened, closing at $245.46. On the news, Delta Air Lines reportedly hired well-known lawyer David Boies to seek compensation from CrowdStrike and Microsoft for the large-scale network outage that happened earlier.

Most of the European Stoxx 50 index rose, while most of the '11 Arhats' were down, with Astrazeneca down more than 2%.

France's second-quarter GDP surpassed expectations year-on-year and quarter-on-quarter, while Germany's GDP unexpectedly declined according to the data.

France's second-quarter GDP exceeded expectations, with Q2 GDP up 0.3% quarter-on-quarter, higher than the expected and previous 0.2%, and flat with Q1's adjusted 0.3%. Q2 GDP grew 1.1% year-on-year, higher than the expected 0.7% and lower than the previous 1.3%. The French National Institute of Statistics and Economic Studies (INSEE) released the initial GDP estimate for the second quarter.

Most European stock indexes opened higher, the Euro Stoxx 50 index rose 0.39%, the German DAX30 index rose 0.20%, the French CAC40 index rose 0.28%, and the UK FTSE 100 index fell 0.27%.

As of now, the FTSE 100 index has extended its decline to nearly 0.6%.

Crude oil and spot gold remain stable.

In other asset aspects, crude oil and spot gold remain stable. NY silver is up 0.7%.

Yesterday, WTI September crude oil futures closed down $1.35, or 1.75%, at $75.81 per barrel, falling below the 200-day moving average. Brent September crude oil futures closed down $1.35, or 1.66%, at $79.78 per barrel.

The US dollar index rose slightly, and the US dollar against the yen rose 0.4%.

Currently, Wall Street is preparing for a busy corporate earnings week. Heavyweight companies such as Microsoft, Meta, Apple, and Amazon, which account for 40% of the market capitalization of the S&P 500 index, will release their quarterly earnings this week. This is crucial for whether technology stocks can recover from last week's decline.

The Federal Reserve's interest rate policy meeting is about to begin, and investors expect the Fed to cut interest rates twice by 25 basis points this year.