Revenues Not Telling The Story For Frequency Electronics, Inc. (NASDAQ:FEIM) After Shares Rise 54%

Revenues Not Telling The Story For Frequency Electronics, Inc. (NASDAQ:FEIM) After Shares Rise 54%

The Frequency Electronics, Inc. (NASDAQ:FEIM) share price has done very well over the last month, posting an excellent gain of 54%. The last month tops off a massive increase of 103% in the last year.

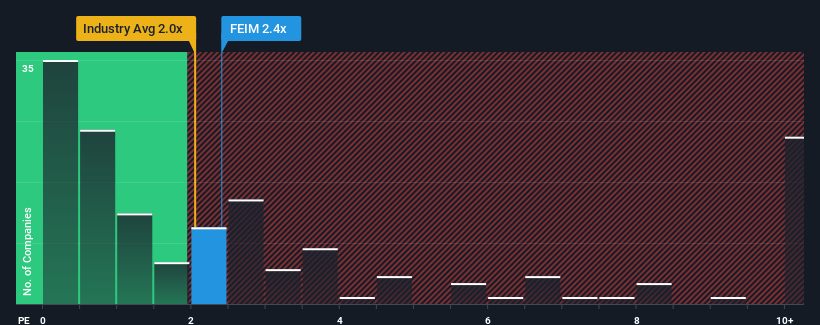

Although its price has surged higher, there still wouldn't be many who think Frequency Electronics' price-to-sales (or "P/S") ratio of 2.4x is worth a mention when the median P/S in the United States' Electronic industry is similar at about 2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Frequency Electronics Performed Recently?

Recent times have been quite advantageous for Frequency Electronics as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Frequency Electronics will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Frequency Electronics?

In order to justify its P/S ratio, Frequency Electronics would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 7.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Frequency Electronics is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Frequency Electronics' P/S?

Frequency Electronics' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Frequency Electronics revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Having said that, be aware Frequency Electronics is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com