Deep-pocketed investors have adopted a bullish approach towards Lam Research (NASDAQ:LRCX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LRCX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Lam Research. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 12 are puts, totaling $788,230, and 2 are calls, amounting to $235,055.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $810.0 to $1180.0 for Lam Research during the past quarter.

Insights into Volume & Open Interest

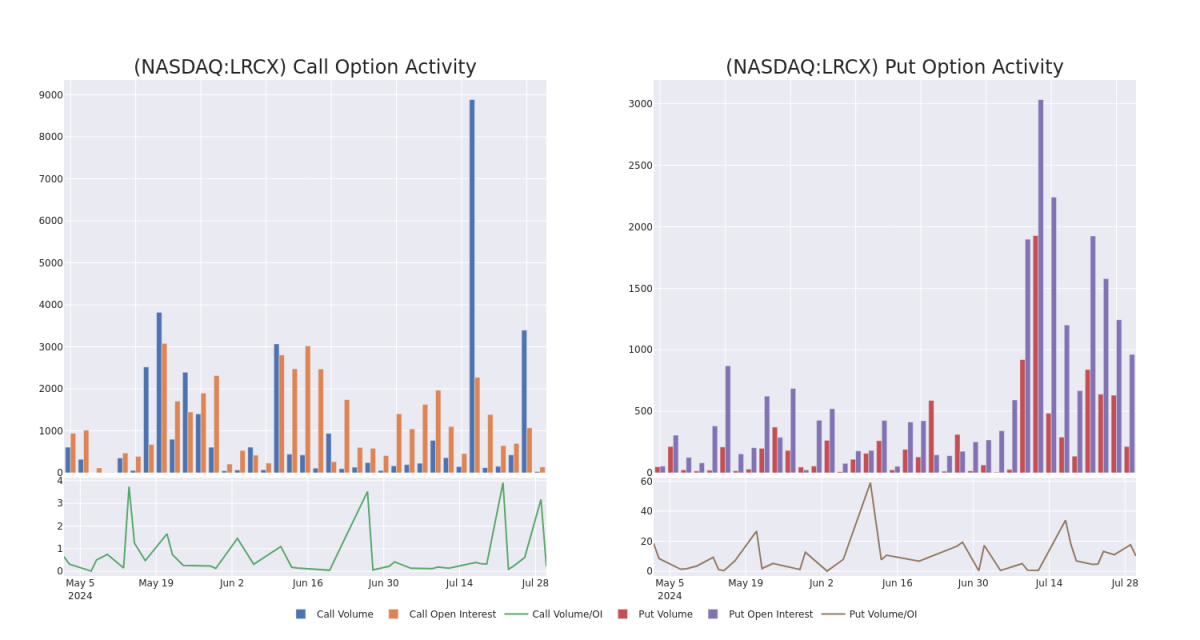

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lam Research's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lam Research's substantial trades, within a strike price spectrum from $810.0 to $1180.0 over the preceding 30 days.

Lam Research Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | CALL | TRADE | BEARISH | 09/20/24 | $70.6 | $68.95 | $68.95 | $880.00 | $199.9K | 68 | 30 |

| LRCX | PUT | TRADE | BULLISH | 09/20/24 | $48.2 | $47.7 | $47.7 | $880.00 | $162.1K | 95 | 4 |

| LRCX | PUT | TRADE | BULLISH | 09/20/24 | $47.95 | $47.25 | $47.25 | $880.00 | $113.4K | 95 | 62 |

| LRCX | PUT | SWEEP | BEARISH | 08/02/24 | $22.0 | $21.95 | $22.0 | $870.00 | $103.4K | 70 | 61 |

| LRCX | PUT | TRADE | BEARISH | 08/02/24 | $111.3 | $102.8 | $107.9 | $1000.00 | $64.7K | 81 | 6 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Having examined the options trading patterns of Lam Research, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Lam Research

- Currently trading with a volume of 164,457, the LRCX's price is down by -0.64%, now at $886.61.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 1 days.

What Analysts Are Saying About Lam Research

In the last month, 1 experts released ratings on this stock with an average target price of $1200.0.

- Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Neutral rating on Lam Research with a target price of $1200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.