Alibaba Group Holding (NYSE:BABA) and Amazon.Com Inc (NASDAQ:AMZN) rival online marketplace Temu faces backlash from suppliers in China over its aggressive effort to reshape its business model radically.

The Chinese group, owned by the $177 billion e-commerce giant PDD Holdings Inc (NASDAQ:PDD), recently sought to recruit Amazon merchants with goods in warehouses in the U.S. and EU, the Financial Times reports.

This move aims to protect Temu's business if governments close a tax loophole that has fueled its growth.

Also Read: Alibaba Stock Soars As New Service Fees Boost Revenue

It would also reduce delivery times by storing goods closer to shoppers, enabling Temu to sell bulkier and higher-margin products such as furniture and home appliances.

The pivot to suppliers with overseas warehouses marks a transition from a "fully managed" to a "semi-managed" model, where merchants take on shipping, warehousing, and last-mile delivery costs previously handled by Temu.

Several Chinese suppliers in Guangzhou have expressed doubts about this change, citing increased risks.

Dozens of suppliers have protested at Temu's offices in Guangzhou over the fines, with one showing evidence of 279 fines totaling 114 million Chinese yuan ($16 million).

To overcome this resistance, Temu promises to promote sellers by giving their products top slots on its platform if they sign up for the new model and offers a $3 subsidy per order for specific clothing items.

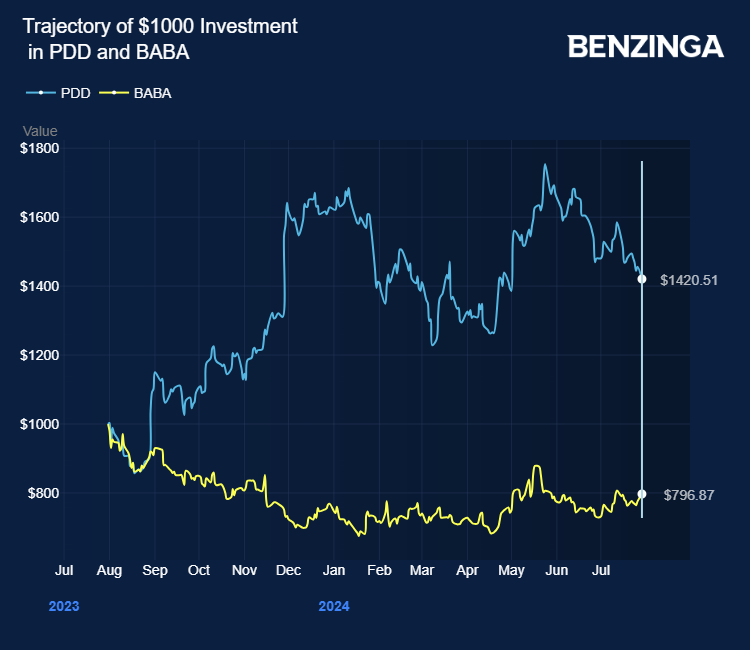

PDD Holdings stock gained over 42% in the last 12 months. Alibaba stock lost over 23%.

Price Action: PDD shares traded lower by 1.68% at $125.45 at the last check on Tuesday.

Also Read:

- Alibaba's Taobao Introduces Free Overseas Shipping to Compete with Rivals

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock