Deep-pocketed investors have adopted a bullish approach towards Exxon Mobil (NYSE:XOM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in XOM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Exxon Mobil. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 61% leaning bullish and 30% bearish. Among these notable options, 5 are puts, totaling $341,354, and 8 are calls, amounting to $382,937.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $110.0 and $125.0 for Exxon Mobil, spanning the last three months.

Insights into Volume & Open Interest

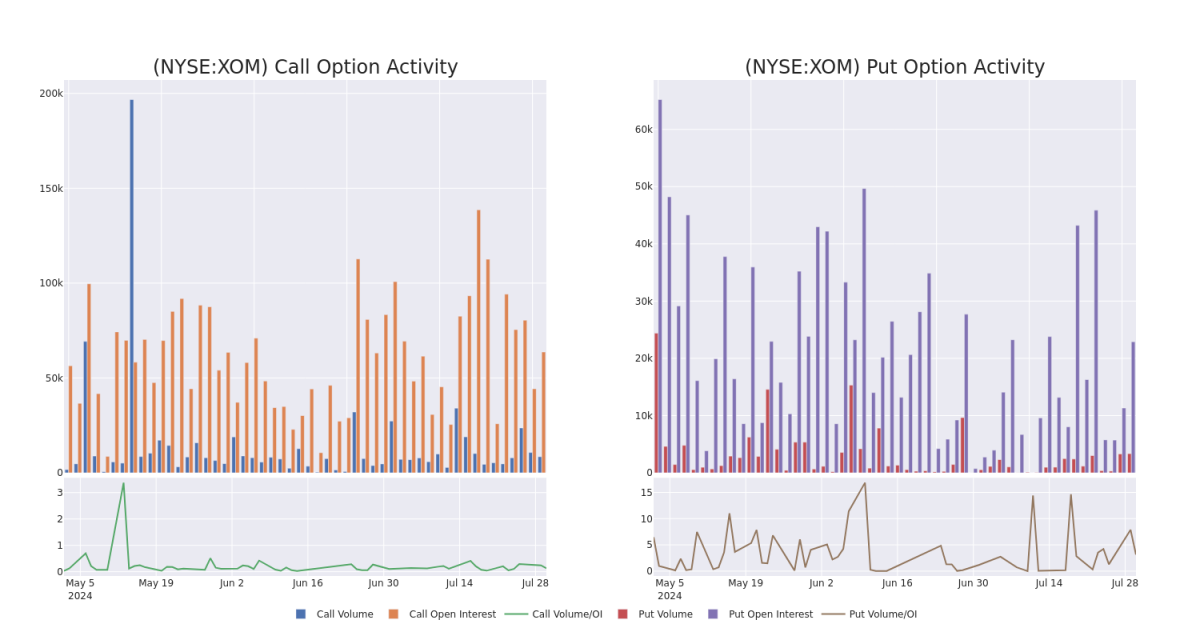

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Exxon Mobil's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Exxon Mobil's whale activity within a strike price range from $110.0 to $125.0 in the last 30 days.

Exxon Mobil Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | PUT | SWEEP | BULLISH | 08/16/24 | $2.57 | $2.56 | $2.57 | $117.00 | $121.8K | 251 | 613 |

| XOM | PUT | SWEEP | BULLISH | 08/16/24 | $0.49 | $0.45 | $0.46 | $110.00 | $113.4K | 20.4K | 2.4K |

| XOM | CALL | SWEEP | BULLISH | 08/16/24 | $1.3 | $1.13 | $1.3 | $120.00 | $91.5K | 17.9K | 1.3K |

| XOM | CALL | SWEEP | BULLISH | 08/02/24 | $0.73 | $0.66 | $0.73 | $119.00 | $59.5K | 3.3K | 2.1K |

| XOM | CALL | SWEEP | BEARISH | 08/02/24 | $0.77 | $0.76 | $0.76 | $119.00 | $49.4K | 3.3K | 4.1K |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

Following our analysis of the options activities associated with Exxon Mobil, we pivot to a closer look at the company's own performance.

Exxon Mobil's Current Market Status

- Currently trading with a volume of 2,776,995, the XOM's price is up by 1.27%, now at $117.58.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 3 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Exxon Mobil with Benzinga Pro for real-time alerts.