Financial giants have made a conspicuous bullish move on Block. Our analysis of options history for Block (NYSE:SQ) revealed 20 unusual trades.

Delving into the details, we found 65% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $569,392, and 13 were calls, valued at $1,196,167.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $77.5 for Block over the last 3 months.

Insights into Volume & Open Interest

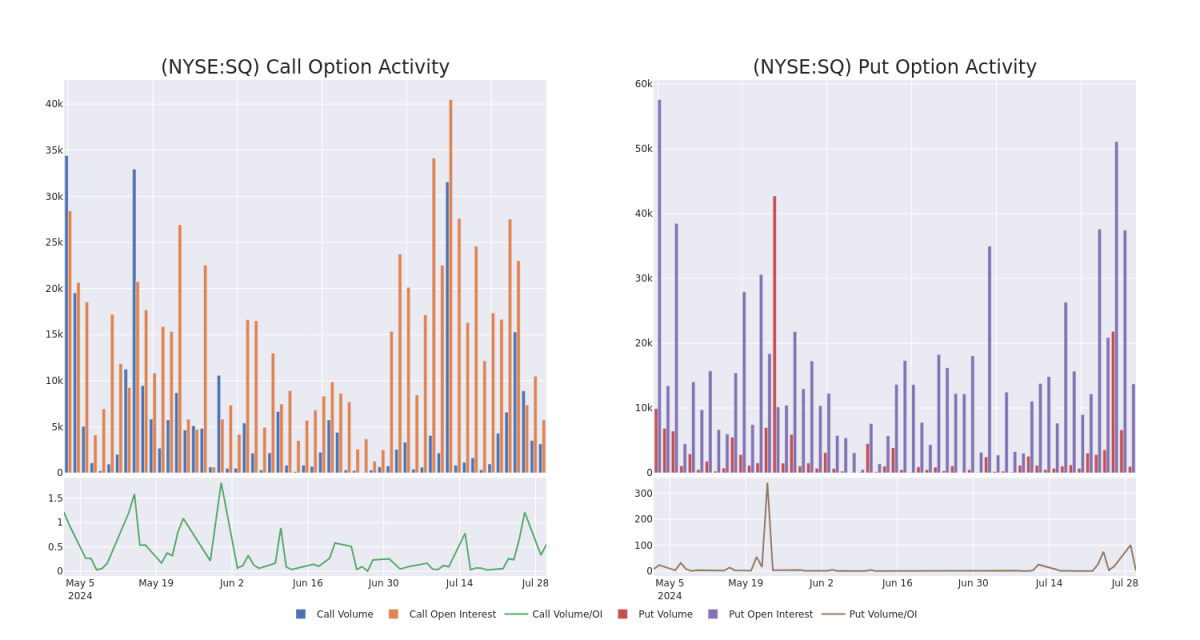

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $40.0 to $77.5 over the preceding 30 days.

Block Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | SWEEP | BULLISH | 03/21/25 | $10.0 | $9.9 | $9.9 | $62.50 | $247.5K | 585 | 250 |

| SQ | CALL | SWEEP | BULLISH | 08/16/24 | $3.1 | $3.05 | $3.05 | $65.00 | $201.2K | 3.2K | 815 |

| SQ | CALL | SWEEP | BULLISH | 12/18/26 | $21.5 | $20.95 | $21.34 | $62.50 | $197.5K | 31 | 92 |

| SQ | CALL | SWEEP | BULLISH | 12/18/26 | $21.75 | $20.85 | $21.85 | $62.50 | $172.5K | 31 | 196 |

| SQ | CALL | TRADE | BEARISH | 12/20/24 | $23.25 | $22.55 | $22.82 | $40.00 | $171.1K | 70 | 75 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

In light of the recent options history for Block, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Block

- Trading volume stands at 2,753,515, with SQ's price up by 0.08%, positioned at $60.79.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 2 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.