Deep-pocketed investors have adopted a bullish approach towards Adobe (NASDAQ:ADBE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ADBE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for Adobe. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 36% bearish. Among these notable options, 11 are puts, totaling $552,142, and 8 are calls, amounting to $612,014.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $410.0 to $940.0 for Adobe over the recent three months.

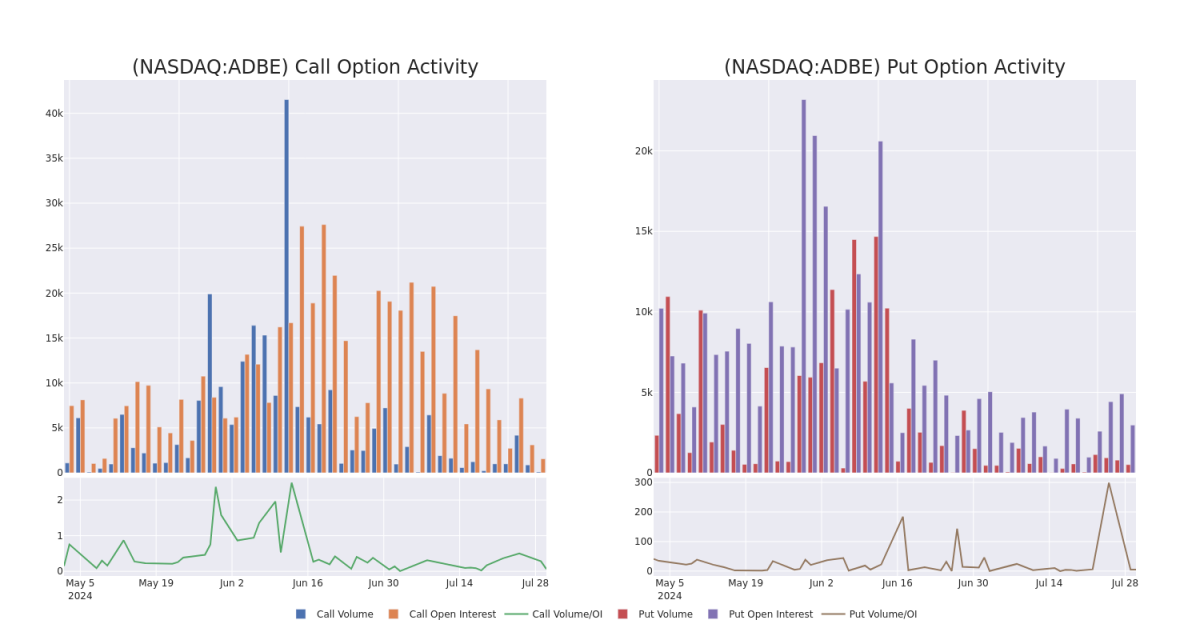

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Adobe's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Adobe's significant trades, within a strike price range of $410.0 to $940.0, over the past month.

Adobe Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | CALL | SWEEP | BULLISH | 01/17/25 | $145.05 | $142.4 | $145.0 | $415.00 | $319.1K | 3 | 22 |

| ADBE | PUT | TRADE | BEARISH | 12/20/24 | $36.8 | $36.7 | $36.8 | $530.00 | $77.2K | 163 | 46 |

| ADBE | PUT | TRADE | BULLISH | 12/20/24 | $37.45 | $36.7 | $36.7 | $530.00 | $73.4K | 163 | 24 |

| ADBE | PUT | TRADE | BULLISH | 11/15/24 | $33.9 | $33.35 | $33.35 | $535.00 | $66.7K | 37 | 25 |

| ADBE | CALL | SWEEP | BULLISH | 01/17/25 | $149.45 | $147.45 | $149.45 | $410.00 | $59.8K | 505 | 5 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Having examined the options trading patterns of Adobe, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Adobe

- Trading volume stands at 482,413, with ADBE's price down by -0.3%, positioned at $534.98.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 44 days.

What The Experts Say On Adobe

1 market experts have recently issued ratings for this stock, with a consensus target price of $635.0.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Adobe, targeting a price of $635.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.