Whales with a lot of money to spend have taken a noticeably bullish stance on Broadcom.

Looking at options history for Broadcom (NASDAQ:AVGO) we detected 89 trades.

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 34% with bearish.

From the overall spotted trades, 37 are puts, for a total amount of $3,398,909 and 52, calls, for a total amount of $6,311,122.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $23.0 to $220.0 for Broadcom over the recent three months.

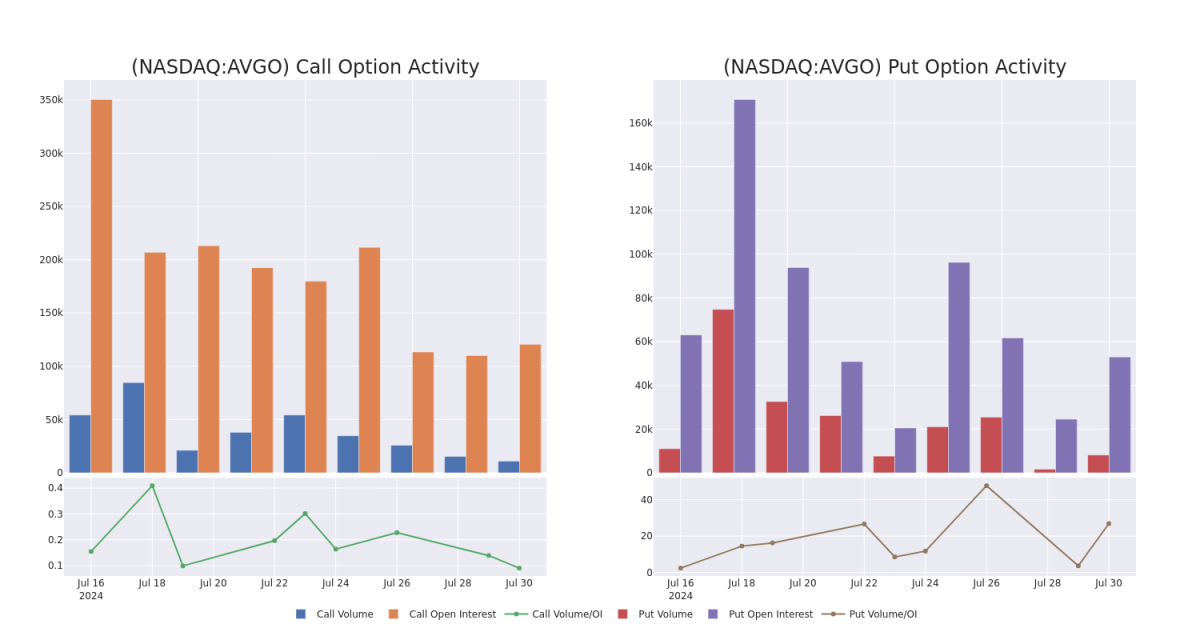

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Broadcom's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Broadcom's significant trades, within a strike price range of $23.0 to $220.0, over the past month.

Broadcom Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | PUT | TRADE | BULLISH | 12/19/25 | $14.3 | $11.1 | $11.7 | $122.00 | $468.0K | 40 | 400 |

| AVGO | PUT | SWEEP | BULLISH | 09/20/24 | $4.1 | $4.0 | $4.0 | $133.00 | $358.0K | 9.2K | 855 |

| AVGO | PUT | SWEEP | BEARISH | 11/15/24 | $4.3 | $4.1 | $4.3 | $124.00 | $215.0K | 64 | 500 |

| AVGO | CALL | TRADE | NEUTRAL | 12/19/25 | $19.5 | $17.2 | $18.5 | $175.00 | $185.0K | 0 | 100 |

| AVGO | CALL | TRADE | NEUTRAL | 06/20/25 | $70.7 | $69.3 | $70.0 | $80.00 | $140.0K | 1.6K | 32 |

About Broadcom

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

Where Is Broadcom Standing Right Now?

- Currently trading with a volume of 11,126,841, the AVGO's price is down by -3.08%, now at $145.6.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 30 days.

What Analysts Are Saying About Broadcom

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $1002.0.

- An analyst from TD Cowen persists with their Buy rating on Broadcom, maintaining a target price of $210.

- An analyst from Oppenheimer persists with their Outperform rating on Broadcom, maintaining a target price of $200.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Broadcom, targeting a price of $2400.

- Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Overweight rating on Broadcom with a target price of $2000.

- An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on Broadcom, which currently sits at a price target of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.