High-rolling investors have positioned themselves bullish on Gilead Sciences (NASDAQ:GILD), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GILD often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Gilead Sciences. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $64,660, and 7 calls, totaling $1,088,730.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $80.0 for Gilead Sciences during the past quarter.

Analyzing Volume & Open Interest

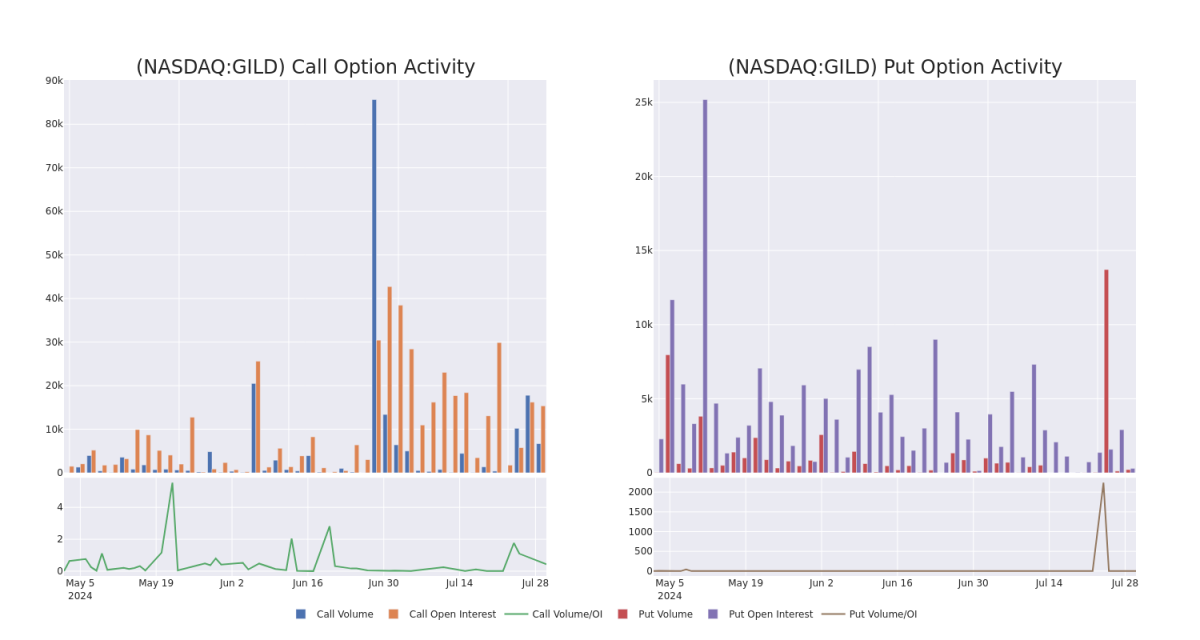

In terms of liquidity and interest, the mean open interest for Gilead Sciences options trades today is 2609.33 with a total volume of 6,913.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Gilead Sciences's big money trades within a strike price range of $55.0 to $80.0 over the last 30 days.

Gilead Sciences 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BEARISH | 08/16/24 | $4.55 | $4.4 | $4.47 | $74.00 | $447.0K | 3.8K | 1.0K |

| GILD | CALL | SWEEP | BEARISH | 08/16/24 | $4.45 | $4.3 | $4.3 | $74.00 | $430.0K | 3.8K | 3.0K |

| GILD | PUT | TRADE | BEARISH | 08/02/24 | $3.05 | $2.52 | $3.05 | $80.00 | $64.6K | 294 | 218 |

| GILD | CALL | TRADE | BULLISH | 01/16/26 | $24.1 | $24.1 | $24.1 | $55.00 | $53.0K | 96 | 22 |

| GILD | CALL | SWEEP | BEARISH | 08/16/24 | $8.4 | $8.3 | $8.3 | $70.00 | $51.4K | 6.5K | 93 |

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of combination drug Harvoni, and the Kite, Forty Seven, and Immunomedics acquisitions boost Gilead's exposure to cell therapy and noncell therapy in oncology.

Following our analysis of the options activities associated with Gilead Sciences, we pivot to a closer look at the company's own performance.

Current Position of Gilead Sciences

- Trading volume stands at 2,803,605, with GILD's price up by 0.15%, positioned at $77.85.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 9 days.

Expert Opinions on Gilead Sciences

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $79.0.

- An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $74.

- In a positive move, an analyst from Raymond James has upgraded their rating to Outperform and adjusted the price target to $93.

- Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Neutral rating on Gilead Sciences with a target price of $70.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.