Affirm Holdings Inc (NASDAQ:AFRM) stock gained after B of A Securities analyst Jason Kupferberg upgraded the stock from Neutral to Buy with a price target of $36.

Kupferberg noted GAAP profitability may be closer than expected by consensus.

The analyst said the fourth-quarter print and guide could be a positive catalyst, and fiscal 2025 forecasts seem achievable.

Also Read: Affirm Faces Regulatory Shake-Up with New CFPB Rules

A lower interest rate regime should also support RLTC (revenue minus transaction costs, the most crucial P&L metric), Kupferberg said, who is bullish on new and expanded partnerships, i.e., Apple Inc (NASDAQ:AAPL).

Credit risk continues to be well-controlled, the analyst noted.

At its November 2023 investor forum, Affirm Holdings detailed a medium-term profitability framework that Kupferberg noted as achievable given expense prudence year-to-date. In the context of this framework, Kupferberg said the Street is mis-modeling warrant expense and share-based compensation.

As warrant expense and Stock-based compensation (SBC) expense grind lower, the analyst forecasted GAAP profitability to arrive in fiscal 2026 faster than consensus.

Kupferberg flagged the increasing market expectations of three rate cuts in 2024 and four in 2025. A lower interest rate environment would be beneficial to Affirm Holdings' funding costs and for gain on loan sales.

As per the analyst, Affirm Holdings recently moved its merchants to a 36% annual percentage rate (APR) cap on loans, up from 30% previously, which should remain a tailwind for yields and Gross Merchandise Value (GMV) growth.

Given recent share price underperformance, Kupferberg noted the fourth-quarter print could be a positive catalyst.

Affirm Holdings may communicate a more bullish message on profitability while delivering fourth-quarter upside and guiding fiscal 2025 solidly in line, as per the analyst.

New Apple relationships, further scaling of Affirm Card, and potential geographic expansion of existing large partnerships like Amazon.Com Inc (NASDAQ:AMZN) and Shopify Inc (NYSE:SHOP) should all support fiscal 2025 and 2026 forecasts, Kupferberg added.

The analyst projected fiscal 2024 sales of $2.27 billion, fiscal 2025 sales of $2.75 billion and fiscal 2026 sales of $3.24 billion.

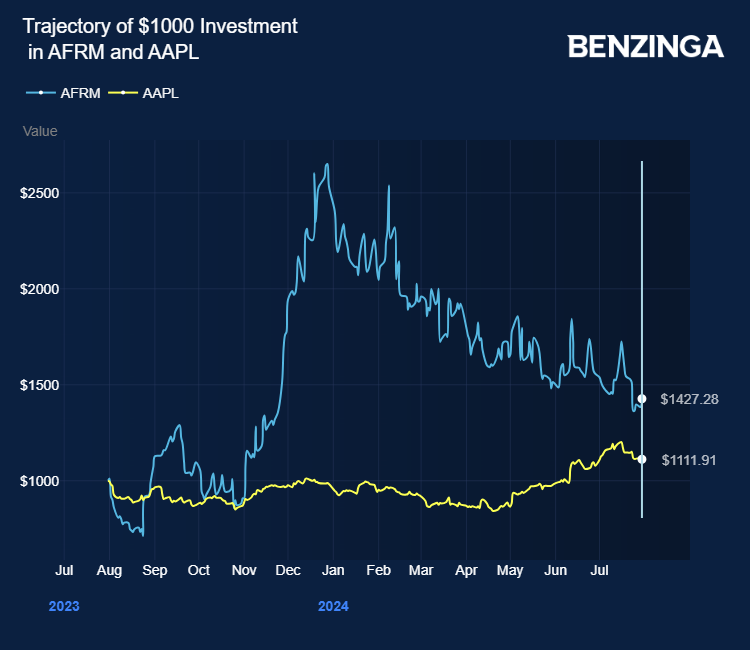

Price Action: AFRM shares closed trading higher by 2.31% at $27.46 on Tuesday.

Photo via Company