On Tuesday, Nvidia, which ranked first in trading volume on the US stock market, fell 7.04%, with a turnover of 49.34 billion US dollars. According to the latest AI Server report by TrendForce, Nvidia will launch a new platform, Blackwell, before the end of 2024. At that time, large CSPs (cloud-based service providers) will begin building AI Server data centers for the Blackwell new platform, and the penetration rate of liquid cooling solutions is estimated to be 10%.

According to a research paper released by Apple on Monday, Apple relies on chips designed by Google, not industry leader Nvidia, to build two key components of its upcoming AI tools and feature suite's artificial intelligence software infrastructure.

Tesla, which ranked second in trading volume on the US stock market, fell 4.08%, with a turnover of 22.463 billion US dollars. The National Highway Traffic Safety Administration (NHTSA) of the United States stated on Tuesday that Tesla is calling back more than 1.8 million electric vehicles in the United States, mainly due to the risk that Tesla's software system cannot detect an unlocked engine hood. It is understood that an unlocked engine hood can be fully opened and block the driver's sight, thereby increasing the risk of collision. The day before this bearish news was released, Tesla's stock price rebounded by more than 5% in the context of bullish sentiment.

Tesla has already started releasing airborne software updates that detect whether the electric vehicles' engine hoods of all types can respond to being opened and send notifications to customers, according to the latest NHTSA statement.

Microsoft, which ranked third in trading volume on Tuesday, fell 0.89%, with a turnover of 11.823 billion US dollars. Microsoft will release its financial report after the post-market trading on Tuesday. Just days after the blue screen incident, Microsoft reported partial interruptions in office applications and cloud services.

Microsoft is currently investigating issues with some users being unable to use its Office applications and cloud services properly, which are affecting multiple services, including Outlook, Word, and Excel. User reports show that the number of complaints about these issues has increased rapidly since 7 am on Tuesday New York time.

In addition, Microsoft posted on social network X early Tuesday morning, stating that the issue also affected multiple Microsoft 365 services and features. Microsoft 365 includes common office applications such as Outlook, Word, and Excel.

Apple, which ranked fourth in trading volume on Tuesday, rose 0.26%, with a turnover of 8.806 billion US dollars. A research paper released by Apple on Monday showed that Apple relies on chips designed by Google, not industry leader Nvidia, to build the artificial intelligence software infrastructure for its upcoming AI tools and feature suite's two key components.

AMD, which ranked fifth in trading volume on the US stock market, fell 0.94%, with a turnover of 8.668 billion US dollars. AMD officially announced the second-generation frame generation technology AFMF 2, which is still a solution based on the driver software level (Nvidia takes hardware acceleration), with a focus on significantly reducing latency, optimizing smoothness, improving performance, supporting more games, and more settings and gameplay.

Amazon, which ranked sixth in trading volume on the US stock market, fell 0.81%, with a turnover of 6.514 billion US dollars. Amazon has filed documents with the Delaware federal court, alleging that Nokia has infringed 12 patents related to cloud computing technology. Amazon stated that Nokia's abuse of Amazon Web Services technology to support its own cloud services.

CrowdStrike, which ranked seventh in trading volume, fell 9.72%, with a turnover of 6.002 billion US dollars. According to reports, Delta Air Lines has hired prominent lawyer David Boies, who is known as the "Wall Street Ace Lawyer," to claim against CrowdStrike and Microsoft because the software updates of the two defendant companies this month caused thousands of flight cancellations at Delta and incurred huge losses.

Earlier, due to a software update error, CrowdStrike caused about 8.5 million Windows computers worldwide to have blue-screen crashes, disrupting the normal operation of multiple industries such as aviation, banking and medical care. The impact on airlines was particularly severe, and Delta Air Lines was one of the biggest victims of this major system failure.

It is estimated that this incident caused Delta Air Lines losses of $350 million to $500 million. After nearly 7,000 flights were cancelled, Delta Air Lines is dealing with over 176,000 refund or compensation requests.

Broadcom, which ranked ninth in trading volume on the US stock market, fell 4.46%, with a turnover of 4.48 billion US dollars. Optical module analysts said that by calculating the production capacity of Broadcom's 100G and 200GEML optical chips, and the supply capacity of Lumentum, Coherent, and Mitsubishi's 100GEML optical chips, it is estimated that due to the large-scale shipment of 1.6T optical modules in 2025, the optical chips of 200GEML have a greater chance of being in short supply.

Meta Platforms, which ranked tenth in trading volume on Tuesday, fell 0.54%, with a turnover of 5.086 billion US dollars. Meta Platforms announced that it will launch a new tool called AI Studio based on the Llama 3.1 model, allowing users to create, share, and design personalized AI chatbots. Users can also share their AI characters on social media platforms.

In addition, Meta will announce its second-quarter performance data after the US stock market closes on July 31. According to Wall Street analysts' expected data compiled by Visible Alpha, Facebook's parent company, Meta Platforms, is expected to report total revenue of approximately US$38.35 billion in the second quarter of 2024, an increase of about 20% compared to the same period last year. Analysts generally expect net income to be approximately US$12.31 billion, or earnings per share of US$4.71, which is expected to significantly increase by 58% compared to the same period last year.

Merck Pharmaceuticals, which ranked eleventh in trading volume on the US stock market, fell 9.81%, marking the largest single-day decline since 2021 and a turnover of 4.143 billion US dollars. The company's second-quarter performance was strong, but its full-year guidance was weaker than expected.

Second-quarter revenue and adjusted EPS have both exceeded Wall Street's expectations, due to strong sales of its heavyweight cancer drug Keytruda, other treatments in its oncology and vaccine combinations, and a newly launched cardiovascular drug. The revenue for the second fiscal quarter was 16.11 billion USD, a YoY increase of 7%, and the market expectation was 15.84 billion USD.

This pharmaceutical giant also raised its full-year sales forecast to $63.4 billion to $64.4 billion, slightly higher than the guidance of $63.1 billion to $64.3 billion provided by the company in April, due to increased demand for key products, especially oncology treatments. However, Merck lowered its adjusted earnings per share guidance from the previous $8.53 to $8.65 to $7.94 to $8.04 per share. The company said the adjustment reflected one-time costs associated with its acquisition of Harpoon Therapeutics and EyeBio, at $0.26 and $0.51 per share, respectively.

At the moment of the performance announcement, Merck was preparing to offset the loss caused by the expiration of Keytruda's patent in 2028 through a series of new trades and the launch of key drugs. This includes Winrevair, a drug approved in the United States in March for the treatment of a progressive and life-threatening lung disease. Some analysts predict that global sales of Winrevair will reach $5 billion by 2030. Capvaxive is another key product of Merck, a vaccine designed to protect adults from bacterial infections caused by pneumococcus, which can cause serious illnesses and lung infections. The vaccine was approved in the United States last month.

As of Monday's close, Merck's stock price has risen 17% year-to-date, outperforming most of its U.S. pharmaceutical peers and the S&P 500. However, as of press time, the stock fell more than 2% in pre-market trading on Tuesday.

TSMC, which ranked twelfth in trading volume on the US stock market, fell 3.42%, with a turnover of 3.233 billion US dollars. According to informed sources, TSMC will hold a groundbreaking ceremony for its first chip factory in Europe in Dresden, Germany next month. The factory is expected to start operation by the end of 2027.

PayPal, which ranked sixteenth in trading volume, rose 8.59% with a turnover of 2.805 billion US dollars. The company's net revenue in the second quarter was US$7.89 billion, and the market estimated US$7.82 billion; the adjusted earnings per share was US$1.19, and the market estimated US$1 per share. In the period, the total payment amount (TPV) of all platforms under the company grew by 11%, reaching 416.81 billion US dollars. The company raised its adjusted profit forecast for the year and expects the adjusted profit growth rate under the Non-GAAP standard to reach "15% to 17%" in 2024, while the profit growth forecast disclosed in the April financial report is the "high single-digit" growth rate.

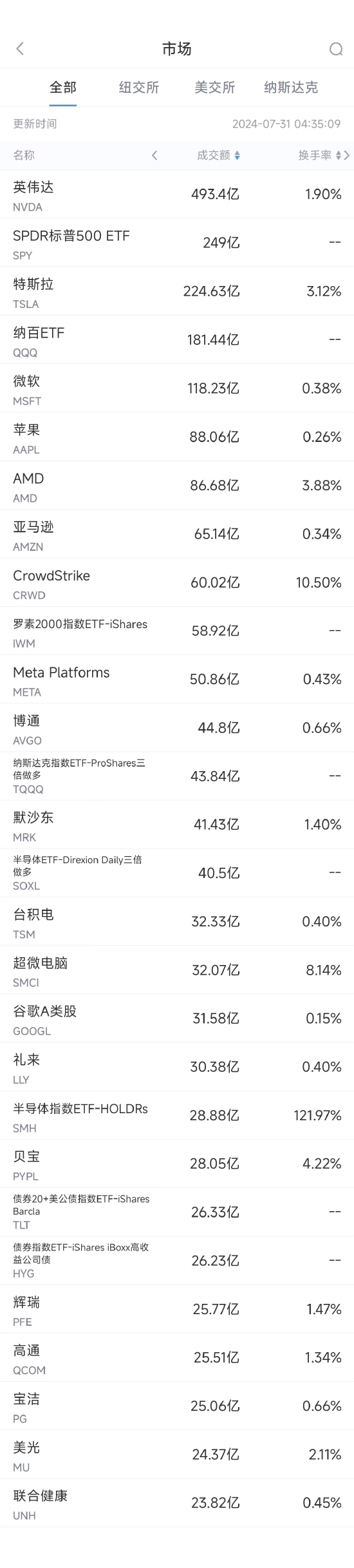

(Screenshot from Sina Finance APP Market section - US Stocks - Market sector, slide left for more data) Download the Sina Finance APP