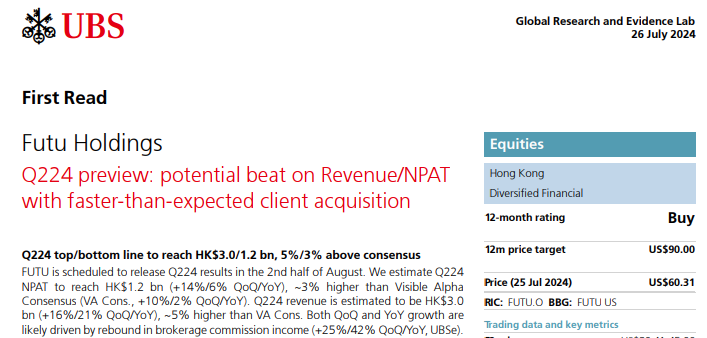

On July 26, UBS released a research report, maintaining a BUY rating on FUTU with a target price of US$90.00

UBS pointed out the following highlights on FUTU:

Client acquisition faster-than-expected; strong rebound in trading commission: 1) client acquisition in HK, SG (and likely JP) accelerated QoQ on improved equity markets sentiment, despite moderation in Malaysia.2) High-single-digit QoQ growth in client AUM is expected, supported by both a strong net inflow of client assets and a slight MTM gain. 3) Rebound in trading commission, as trading volume increases driven by higher velocity. 4) Gross margin of interest income stabilized QoQ. A mid-teens QoQ growth in MFSL balance is expected amid improved market sentiment in Q2.

Key items to watch in upcoming results 1) Q324-to-date paying client acquisition and client asset net inflow in each market. Any potential revision of 2024 full-year guidance. 2) Road map and updates on Japan and Malaysia market development, especially user/client growth and product pipeline.

Key items to watch in upcoming results 1) Q324-to-date paying client acquisition and client asset net inflow in each market. Any potential revision of 2024 full-year guidance. 2) Road map and updates on Japan and Malaysia market development, especially user/client growth and product pipeline.

Valuation: UBS maintains FY25/26 EPS largely unchanged at US$5.8/6.7. UBS maintains the price target at US $90.00 with a Buy rating. FUTU is trading at 11-12x 12-month forward P/E

Key risks to FUTU include:

(1) lower-than-expected international expansion (especially in Japan and Malaysia market)

(2) worse-than-expected market conditions