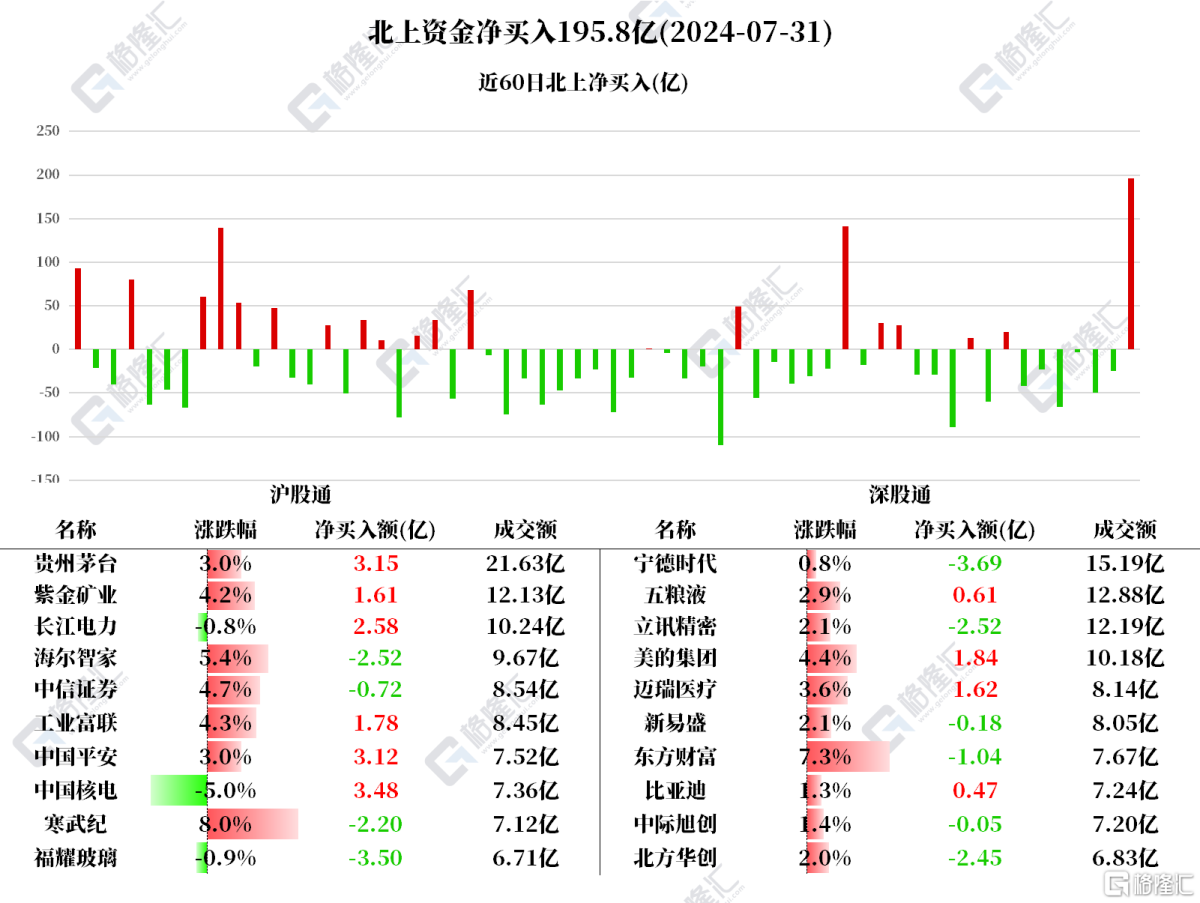

Northbound funds significantly net bought A shares for 19.58 billion yuan, while southbound funds net bought Hong Kong stocks for 2.291 billion Hong Kong dollars.

On July 31, northbound funds significantly net bought A shares by 19.58 billion yuan, a new high since April 26.

Net buying of China National Nuclear Power 0.348 billion yuan, Kweichow Moutai 0.315 billion yuan, Ping An Insurance 0.312 billion yuan, China Yangtze Power 0.258 billion yuan, Midea Group 0.184 billion yuan, Foxconn Industrial Internet 0.178 billion yuan, Shenzhen Mindray Bio-Medical Electronics 0.162 billion yuan, and Zijin Mining Group 0.161 billion yuan.

Net selling of Contemporary Amperex Technology 0.369 billion yuan, Fuyao Glass 0.35 billion yuan, Luxshare Precision Industry 0.252 billion yuan, Haier Smarthome 0.252 billion yuan, Naura Technology Group 0.245 billion yuan, Cambricon Technologies 0.22 billion yuan, and East Money Information 0.104 billion yuan.

Northbound funds net sold A shares by 16.629 billion yuan in July, the second consecutive month of net selling. The cumulative net purchase between January and July this year is 21.948 billion yuan.

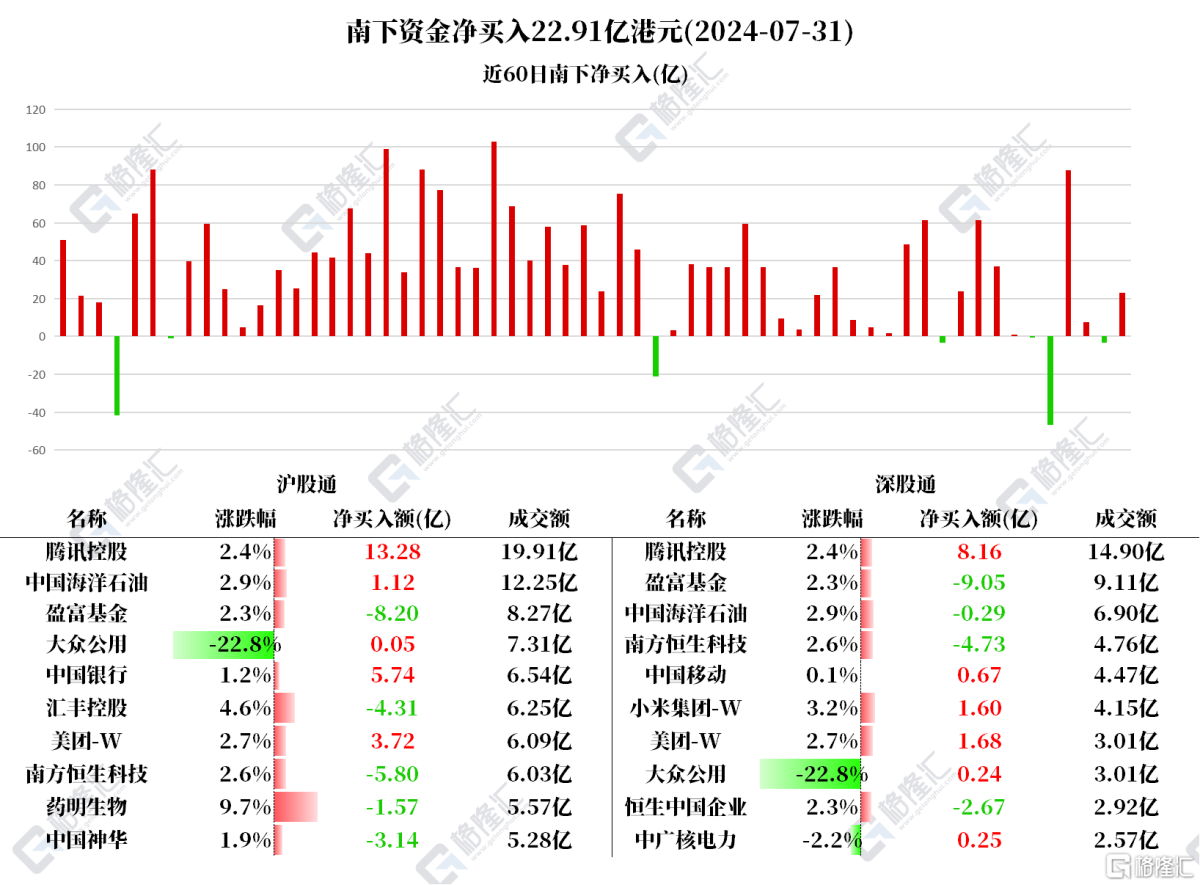

Southbound funds net bought Hong Kong stocks by 2.291 billion Hong Kong dollars.

Net buying of Tencent 2.144 billion yuan, Bank of China 0.573 billion yuan, Meituan 0.539 billion yuan, and Xiaomi 0.16 billion yuan.

Net selling of Tracker Fund of Hong Kong 1.724 billion yuan, CSOP Hang Seng Tech Index ETF 1.053 billion yuan, HSBC Holdings 0.43 billion yuan, China Shenhua Energy 0.313 billion yuan, Hang Seng H-Share Index ETF 0.267 billion yuan, and Wuxi Bio-Medical Electronics 0.157 billion yuan.

According to statistics, southbound funds have been net buying Tencent for 5 consecutive days, totaling 4.091 billion Hong Kong dollars; net buying Xiaomi for 4 consecutive days, totaling 0.444 billion Hong Kong dollars; and net selling China Shenhua Energy for 3 consecutive days, totaling 0.695 billion Hong Kong dollars.

Individual Stocks Concerned: China Mobile: On the news front, Goldman Sachs issued a research report stating that the company's management maintained its expectations for stable growth in revenue and profit in 2024. Due to increased R&D and marketing expenses for enterprise business (cloud, artificial intelligence, industrial internet, etc.), EBITDA profit margin continued to show a downward trend, but the slowdown in depreciation costs helped support the trend of stable net profit margin. The management believes that the dividend payout ratio can be increased from 71% to the target of 75% in 2026. Goldman Sachs believes that stable business growth and steady capital expenditures should help China Mobile gradually increase its dividends. Chinahongqiao:

China National Nuclear Power fell by 5%, and the company's stock price just hit a new high and then fell back. It has fallen by a cumulative 9.59% in the past 5 trading days.

Kweichow Moutai rebounded by 2.99% after 7 consecutive days of losses.

Ping An Insurance rose by 2.98%.

Materials of the companies of North Water

Tencent rose by 2.43%, closing at 362.2 Hong Kong dollars. Everbright Securities maintains a 'buy' rating on Tencent Holdings (00700). 1Q24 Non-IFRS net income increased significantly due to the continuous growth of high gross margin business. Maintains bullish outlook on performance, favorable product cycle recovery, continuous optimization of operating leverage under cost reduction and efficiency enhancement. Adjusts the company's Non-IFRS net income attributable to shareholders for 2024-2026 to 21.155/23.647/225.542 billion yuan respectively, an increase of 13.3%/12.4%/11.3% compared to the previous forecast. Maintains the target price of 430 Hong Kong dollars.

Bank of China rose by 1.16%. Tianfeng Securities believes that the public utility, energy, finance, and telecommunications sectors with high dividend yields are expected to provide considerable relative returns, even if the market volatility increases in the future.

Meituan rose by 2.73%.