Financial giants have made a conspicuous bullish move on McDonald's. Our analysis of options history for McDonald's (NYSE:MCD) revealed 11 unusual trades.

Delving into the details, we found 63% of traders were bullish, while 9% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $77,290, and 9 were calls, valued at $489,825.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $300.0 for McDonald's, spanning the last three months.

Analyzing Volume & Open Interest

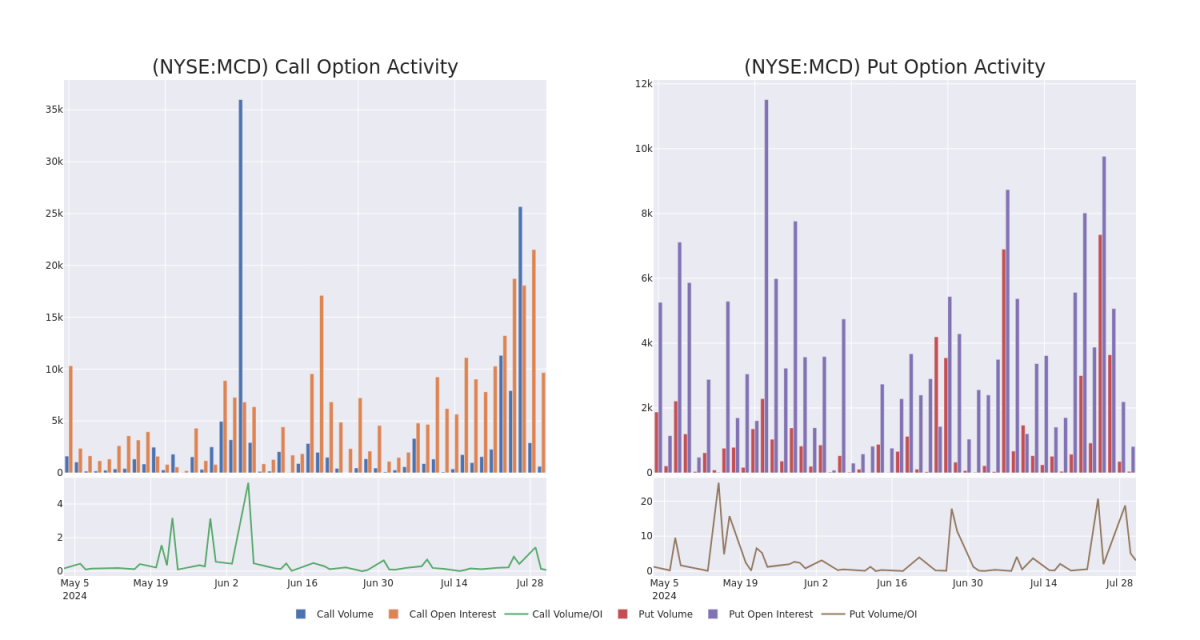

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for McDonald's's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of McDonald's's whale activity within a strike price range from $240.0 to $300.0 in the last 30 days.

McDonald's Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCD | CALL | SWEEP | BULLISH | 08/02/24 | $24.3 | $23.5 | $24.3 | $240.00 | $121.5K | 182 | 53 |

| MCD | CALL | TRADE | BULLISH | 08/09/24 | $26.5 | $24.25 | $26.5 | $240.00 | $79.5K | 175 | 30 |

| MCD | CALL | SWEEP | BULLISH | 09/20/24 | $2.1 | $2.0 | $2.0 | $280.00 | $61.8K | 5.1K | 314 |

| MCD | CALL | TRADE | BULLISH | 09/20/24 | $10.8 | $10.4 | $10.64 | $260.00 | $53.2K | 3.3K | 60 |

| MCD | CALL | TRADE | NEUTRAL | 08/02/24 | $27.0 | $23.95 | $25.7 | $240.00 | $51.4K | 182 | 73 |

About McDonald's

McDonald's is the largest restaurant owner-operator in the world, with 2023 system sales of $130 billion across nearly than 42,000 stores and 115 markets. McDonald's pioneered the franchise model, building its footprint through partnerships with independent restaurant franchisees and master franchise partners around the globe. The firm earns roughly 60% of its revenue from franchise royalty fees and lease payments, with most of the remainder coming from company-operated stores across its three core segments: the United States, internationally operated markets, and international developmental/licensed markets.

After a thorough review of the options trading surrounding McDonald's, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of McDonald's

- With a trading volume of 904,321, the price of MCD is down by -0.27%, reaching $265.73.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 89 days from now.

What Analysts Are Saying About McDonald's

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $294.0.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for McDonald's, targeting a price of $300.

- An analyst from Citigroup persists with their Neutral rating on McDonald's, maintaining a target price of $280.

- An analyst from Barclays has decided to maintain their Overweight rating on McDonald's, which currently sits at a price target of $300.

- An analyst from Wedbush downgraded its action to Outperform with a price target of $295.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $295.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.