Deep-pocketed investors have adopted a bullish approach towards DoorDash (NASDAQ:DASH), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DASH usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for DoorDash. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 33% bearish. Among these notable options, 3 are puts, totaling $406,928, and 6 are calls, amounting to $255,250.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $90.0 and $127.0 for DoorDash, spanning the last three months.

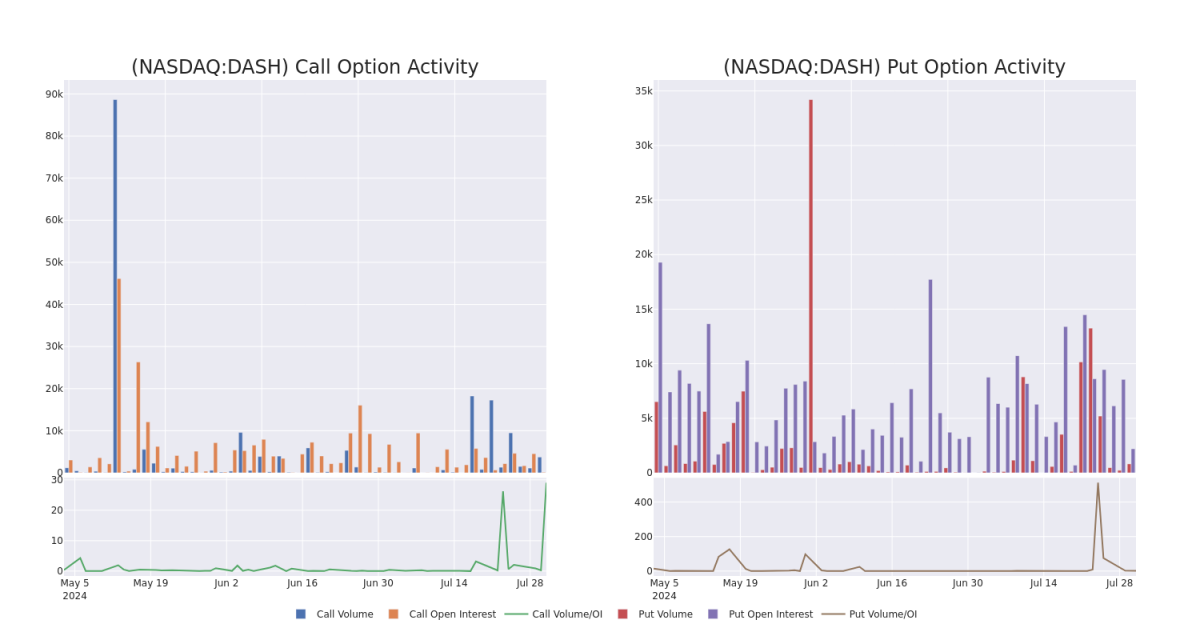

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for DoorDash's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DoorDash's whale activity within a strike price range from $90.0 to $127.0 in the last 30 days.

DoorDash Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DASH | PUT | TRADE | BULLISH | 11/15/24 | $6.7 | $6.55 | $6.6 | $100.00 | $297.0K | 566 | 581 |

| DASH | CALL | SWEEP | BEARISH | 08/02/24 | $1.05 | $1.02 | $1.05 | $127.00 | $91.3K | 60 | 2.0K |

| DASH | PUT | SWEEP | BEARISH | 03/21/25 | $6.65 | $6.35 | $6.4 | $90.00 | $67.2K | 1.6K | 105 |

| DASH | PUT | SWEEP | NEUTRAL | 11/15/24 | $6.65 | $6.45 | $6.54 | $100.00 | $42.7K | 566 | 131 |

| DASH | CALL | SWEEP | BULLISH | 08/02/24 | $1.26 | $1.25 | $1.26 | $127.00 | $36.2K | 60 | 290 |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online food order demand aggregator. Consumers can use its app to order food on-demand for pickup or delivery from merchants mainly in the US. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe. DoorDash provides a marketplace for the merchants to create a presence online, market their offerings, and meet demand by making the offerings available for pickup or delivery. The firm provides similar service to businesses in addition to restaurants, such as grocery, retail, pet supplies, and flowers.

DoorDash's Current Market Status

- Currently trading with a volume of 1,728,681, the DASH's price is up by 2.64%, now at $110.03.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 1 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DoorDash with Benzinga Pro for real-time alerts.