This fundraising was painful.

Global hedge funds have had their ups and downs in recent years, and now another big player has become a 'disruptor'!

Bill Ackman of Pershing Square on Panxing Plaza recently announced that he will raise a closed-end fund with a total size of less than 2 billion dollars.

However, surprisingly, this medium-sized fund was not very successful in its launch.

However, surprisingly, this medium-sized fund was not very successful in its launch.

In order to save face, the company has now announced a rare incentive fee for this fund: No business sharing bonus shall be charged, and management fees shall be waived for the first year.

This has certainly ruffled some feathers in the industry.

Now there will be some competition for the market share!

A zigzag fundraising process

Ackman has long been planning to raise funds for his company, Pershing Square USA, for listing on the stock exchange.

He has packaged the company as a closed-end fund to be listed on the NYSE, initially aiming for an IPO target of $25 billion (equivalent to over RMB 180 billion) in fund size.

If successful, this 'dream' will become one of the largest IPO cases in the United States.

However, the 'hype' for this fundraising has not been smooth sailing.

In late July of this year, the disclosure documents submitted by Ackman to regulators showed that he had lowered the amount raised to $2.5-4 billion.

He also sent a letter to investors stating:"Trading volume is very sensitive to market reactions. Given the novelty of the structure and the very negative trading history of closed-end funds, investors need a great deal of confidence to jump...".

After that, a dramatic scene unfolded.

Pershing Square had previously revealed the identities of institutional investors willing to subscribe to its IPO shares. One of the institutions decided to withdraw its subscription after the news was leaked and refused to comment on the decision.

After greatly reducing the amount raised, Ackman once again postponed his IPO plans until the latest prospectus was released.

This once again shocked the market.

The amount raised has been reduced to $2 billion, equivalent to RMB 14.5 billion.

Compared to the initial 'trumpeted' target of $25 billion, this fund guru has cut 90% of that space.

Pricing details

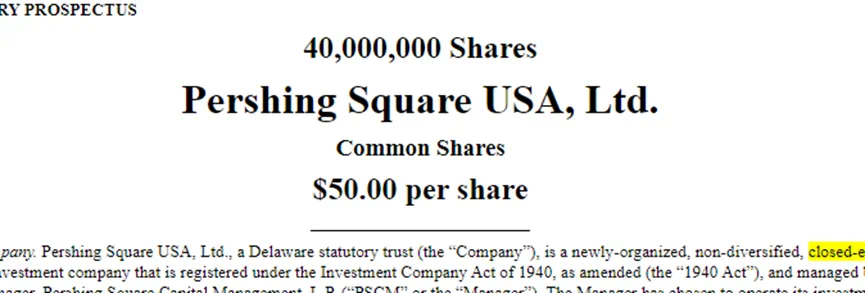

On July 30, Pershing Square filed a revised closed-end investment company registration statement with the U.S. SEC publicized on its website.

(As shown above) The listed entity plans to issue 40 million shares of common stock, priced at $50 per share.

According to the announcement, 15 million shares will be sold to institutional investors, 15 million shares will be sold to retail investors. In addition, the fund manager has subscribed for the remaining 10 million shares.

Based on the announcement and official information, Pershing Square Capital Management, L.P serves as the manager of the issuer, founded in December 2003.

Pershing Square Capital Management is also the manager of Pershing Square Holdings, Ltd, Ackman's core hedge fund platform.

It is worth noting that the manager has promised not to sell, transfer, or otherwise dispose the subscribed shares of this offering for ten years after the IPO is completed.

This is similar to the case of fund managers or fund managers in China's domestic fund offerings following up with the fund, and promising not to redeem within ten years.

What exactly is the listed entity?

Throughout the entire Pershing Square announcement, the key term "closed-end" appears multiple times.

Ackman controls Pershing Square USA, but this is not a public company in the usual sense, but expressed as a closed-end management investment company.

In fact, the listed entity is a closed-end fund.

The announcement explains to investors some points of confusion and compares it to publicly offered mutual funds:

First, closed-end investment companies differ from open-end investment companies (typically referred to as mutual funds). The former usually list their shares for trading on a securities exchange and do not redeem their shares on demand by shareholders. By contrast, the latter issue securities that can be redeemed at net asset value and allow shareholders to redeem at any time.

Second, mutual funds face continuous inflows and outflows of funds, which may complicate portfolio management, whereas closed-end investment companies offer greater flexibility, including investments in relatively illiquid securities.

Operational details

The announcement mentioned operational details at the investment level.

After the closed-end fund is fully funded, it will proceed with actual investments. The following are important information:

First, by investing in and holding 12 to 15 large-cap companies.

Second, in firms listed in the North American market.

Third, they focus on growth.

Fourth, the relevant symbols belong to assets that generate predictable and free cash flow.

Fifth, the company is not substantially affected by macroeconomic factors, commodity prices, regulatory risks, interest rate fluctuations and/or cyclical risks.

The announcement mentioned that besides investing in minority equity, companies with these characteristics can also control related companies.

The above content has high similarity with Ackman's investment strategy in Pershing Square Holdings.

Public data shows that the total assets managed by Pershing Square is $18.7 billion, which also belongs to the operation structure of closed-end funds.

The biggest highlight: no performance commission.

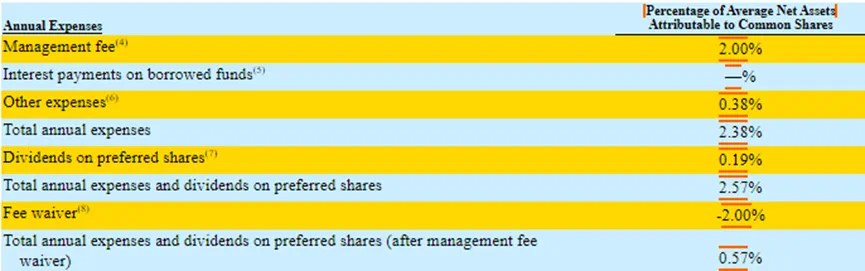

The key is that Ackman made great concessions in the fund fee structure due to the lower-than-expected fundraising this time.

Firstly, this fund does not charge any performance fees. The announcement stated: "This practice has the potential to significantly improve long-term net asset value (NAV) performance."

Secondly, no fixed management fee will be charged in the first 12 months after issuance, and then a management fee of 2.00%/year will be charged.

Thirdly, the net asset value will be disclosed once a week, instead of being announced at the end of the month or quarter like many hedge funds.

The above measures directly challenge the 'conventions' of today's Wall Street hedge funds.

In the future, whether Ackman can achieve the fundraising target of $2 billion remains to be seen.

但令人惊讶的是,这个中等规模的基金发的并不太顺利.

但令人惊讶的是,这个中等规模的基金发的并不太顺利.