Whales with a lot of money to spend have taken a noticeably bearish stance on Vale.

Looking at options history for Vale (NYSE:VALE) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 75% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $1,063,078 and 2, calls, for a total amount of $91,600.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $8.0 and $14.0 for Vale, spanning the last three months.

Insights into Volume & Open Interest

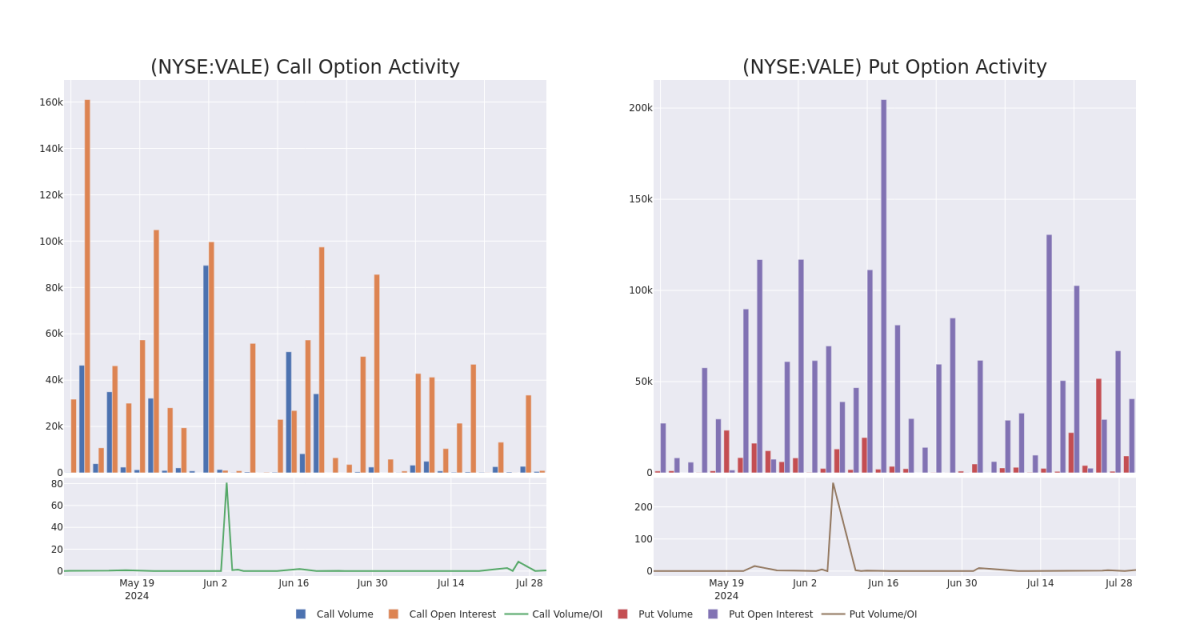

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Vale's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vale's whale activity within a strike price range from $8.0 to $14.0 in the last 30 days.

Vale Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VALE | PUT | TRADE | BEARISH | 12/18/26 | $2.75 | $2.7 | $2.75 | $12.00 | $302.5K | 23.5K | 0 |

| VALE | PUT | TRADE | BEARISH | 08/16/24 | $3.55 | $3.5 | $3.55 | $14.00 | $293.9K | 301 | 828 |

| VALE | PUT | TRADE | BULLISH | 12/18/26 | $2.96 | $2.6 | $2.68 | $12.00 | $211.9K | 23.5K | 2.6K |

| VALE | PUT | TRADE | BEARISH | 12/18/26 | $2.65 | $2.64 | $2.65 | $12.00 | $102.0K | 23.5K | 3.0K |

| VALE | PUT | TRADE | BEARISH | 12/18/26 | $2.75 | $2.74 | $2.75 | $12.00 | $101.7K | 23.5K | 1.4K |

About Vale

Vale SA is a large global miner and the world's largest producer of iron ore and pellets. In recent years the company has sold noncore assets such as its fertilizer, coal, and steel operations to concentrate on iron ore, nickel, and copper. Earnings are dominated by the bulk materials division, primarily iron ore and iron ore pellets. The base metals division is much smaller, consisting of nickel mines and smelters along with copper mines producing copper in concentrate. Vale has agreed to sell a minority 13% stake in energy transition metals, its base metals business, which is expected to become effective in 2024, and which is likely the first step in separating base metals and iron ore.

Having examined the options trading patterns of Vale, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Vale

- Trading volume stands at 16,560,460, with VALE's price up by 1.32%, positioned at $10.83.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 85 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vale with Benzinga Pro for real-time alerts.