Deep-pocketed investors have adopted a bearish approach towards American Airlines Gr (NASDAQ:AAL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AAL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for American Airlines Gr. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 11% leaning bullish and 55% bearish. Among these notable options, 6 are puts, totaling $1,132,212, and 3 are calls, amounting to $155,710.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $8.0 to $25.0 for American Airlines Gr over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $8.0 to $25.0 for American Airlines Gr over the recent three months.

Insights into Volume & Open Interest

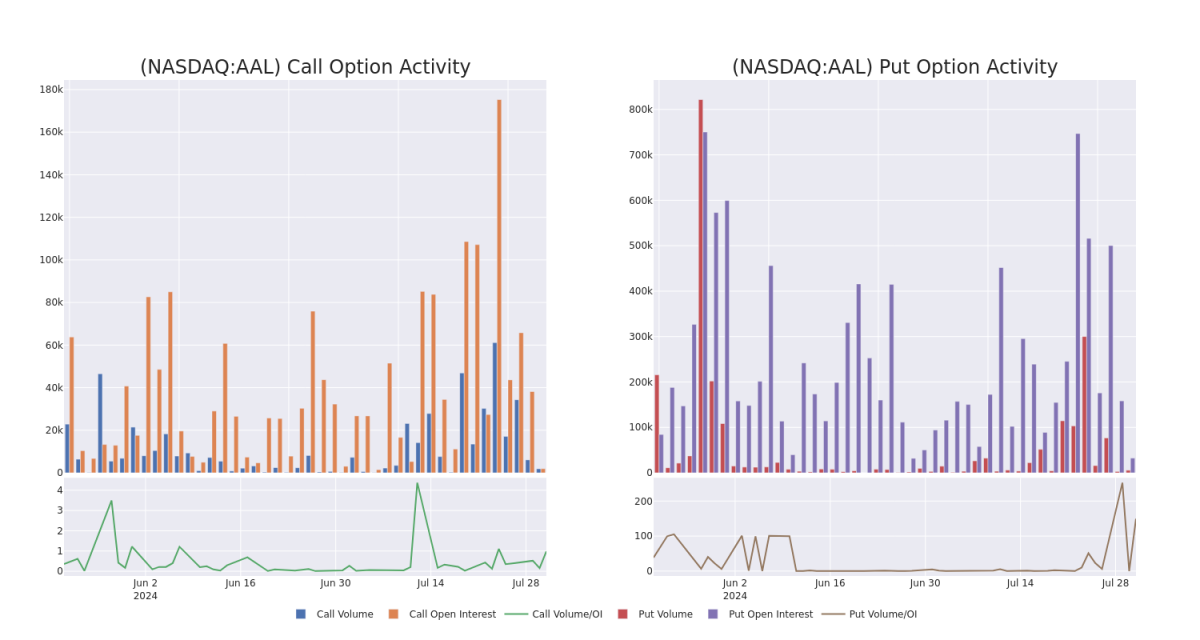

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in American Airlines Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to American Airlines Gr's substantial trades, within a strike price spectrum from $8.0 to $25.0 over the preceding 30 days.

American Airlines Gr 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | SWEEP | BULLISH | 06/20/25 | $2.1 | $2.05 | $2.05 | $12.00 | $441.5K | 24.8K | 2.1K |

| AAL | PUT | TRADE | NEUTRAL | 01/16/26 | $14.35 | $14.25 | $14.3 | $25.00 | $426.1K | 2 | 298 |

| AAL | PUT | SWEEP | BEARISH | 03/21/25 | $4.4 | $4.35 | $4.4 | $15.00 | $124.9K | 1.7K | 286 |

| AAL | CALL | SWEEP | NEUTRAL | 08/09/24 | $0.85 | $0.78 | $0.82 | $10.00 | $82.0K | 579 | 1.0K |

| AAL | PUT | TRADE | BEARISH | 06/20/25 | $2.05 | $2.03 | $2.05 | $12.00 | $61.5K | 24.8K | 2.4K |

About American Airlines Gr

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major US hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of US airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of US legacy carriers.

Where Is American Airlines Gr Standing Right Now?

- With a trading volume of 16,905,192, the price of AAL is down by -1.21%, reaching $10.63.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 78 days from now.

Professional Analyst Ratings for American Airlines Gr

4 market experts have recently issued ratings for this stock, with a consensus target price of $11.75.

- Consistent in their evaluation, an analyst from Barclays keeps a Underweight rating on American Airlines Gr with a target price of $10.

- Reflecting concerns, an analyst from Bernstein lowers its rating to Market Perform with a new price target of $12.

- An analyst from Evercore ISI Group persists with their In-Line rating on American Airlines Gr, maintaining a target price of $13.

- Reflecting concerns, an analyst from Bernstein lowers its rating to Market Perform with a new price target of $12.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.