Check Out What Whales Are Doing With CRM

Check Out What Whales Are Doing With CRM

Whales with a lot of money to spend have taken a noticeably bullish stance on Salesforce.

Looking at options history for Salesforce (NYSE:CRM) we detected 30 trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 16 are puts, for a total amount of $867,792 and 14, calls, for a total amount of $1,254,075.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $300.0 for Salesforce over the last 3 months.

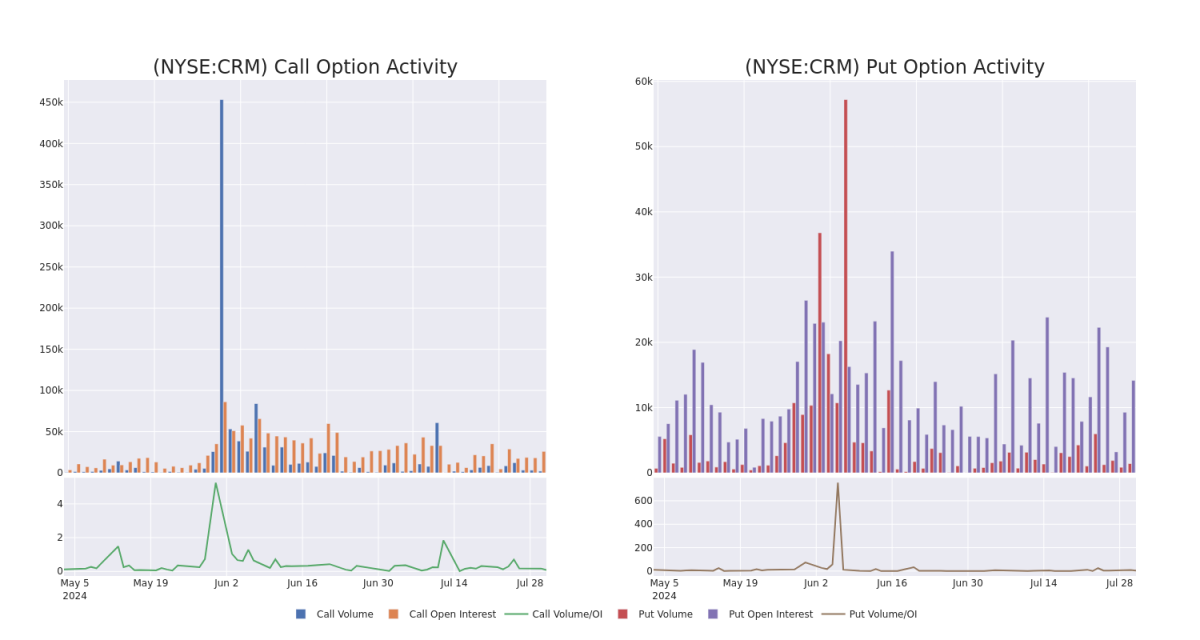

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Salesforce's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Salesforce's significant trades, within a strike price range of $100.0 to $300.0, over the past month.

Salesforce Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | TRADE | BEARISH | 09/20/24 | $11.05 | $10.8 | $10.9 | $270.00 | $327.0K | 3.6K | 304 |

| CRM | CALL | SWEEP | NEUTRAL | 08/16/24 | $0.89 | $0.8 | $0.85 | $280.00 | $219.2K | 3.0K | 271 |

| CRM | CALL | SWEEP | BULLISH | 08/16/24 | $3.95 | $3.9 | $3.95 | $265.00 | $189.2K | 986 | 157 |

| CRM | PUT | SWEEP | BULLISH | 01/16/26 | $58.65 | $58.0 | $58.0 | $300.00 | $133.4K | 1.5K | 36 |

| CRM | PUT | SWEEP | BEARISH | 10/18/24 | $15.1 | $14.9 | $15.1 | $260.00 | $128.3K | 1.1K | 85 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Following our analysis of the options activities associated with Salesforce, we pivot to a closer look at the company's own performance.

Current Position of Salesforce

- Currently trading with a volume of 2,588,764, the CRM's price is down by -1.68%, now at $253.59.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 28 days.

What The Experts Say On Salesforce

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $250.0.

- An analyst from Piper Sandler persists with their Neutral rating on Salesforce, maintaining a target price of $250.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Salesforce with Benzinga Pro for real-time alerts.