Whales with a lot of money to spend have taken a noticeably bearish stance on ServiceNow.

Looking at options history for ServiceNow (NYSE:NOW) we detected 36 trades.

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 47% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $1,125,721 and 27, calls, for a total amount of $1,642,293.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $747.5 to $1000.0 for ServiceNow during the past quarter.

Analyzing Volume & Open Interest

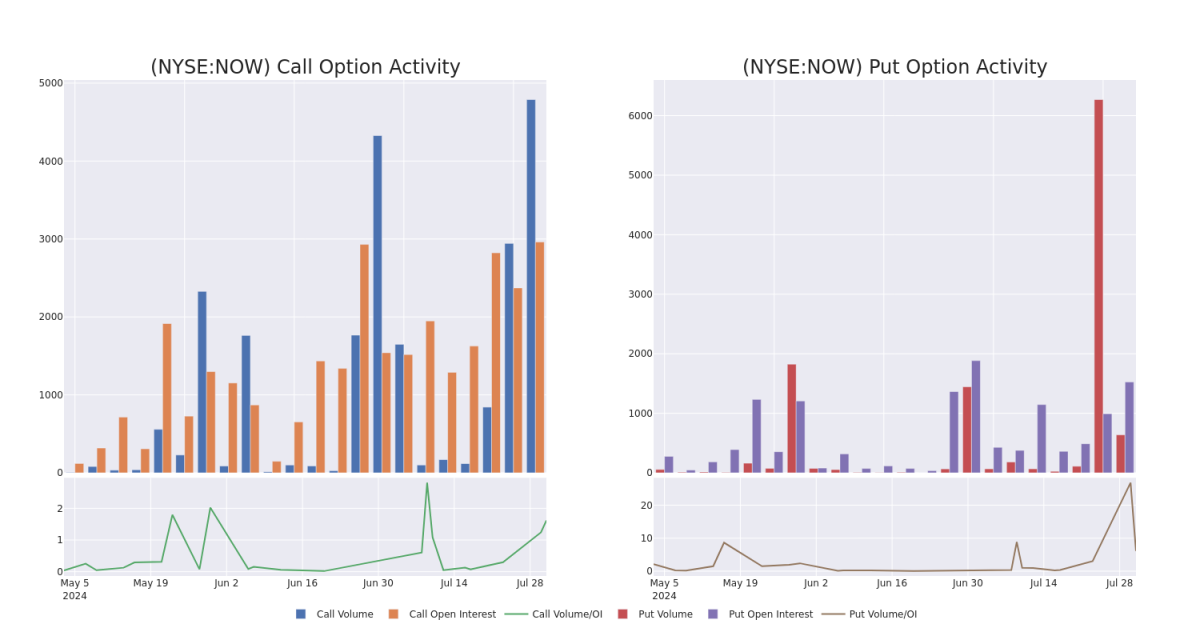

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ServiceNow's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ServiceNow's significant trades, within a strike price range of $747.5 to $1000.0, over the past month.

ServiceNow Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | PUT | SWEEP | NEUTRAL | 01/17/25 | $58.2 | $57.5 | $57.85 | $800.00 | $519.7K | 187 | 95 |

| NOW | CALL | SWEEP | BEARISH | 01/16/26 | $122.3 | $120.8 | $121.55 | $900.00 | $363.1K | 54 | 40 |

| NOW | PUT | SWEEP | BULLISH | 01/16/26 | $80.6 | $77.6 | $79.1 | $750.00 | $237.4K | 48 | 30 |

| NOW | CALL | SWEEP | NEUTRAL | 01/16/26 | $123.0 | $121.3 | $121.35 | $900.00 | $133.5K | 54 | 61 |

| NOW | CALL | SWEEP | BULLISH | 09/20/24 | $19.2 | $18.5 | $19.2 | $860.00 | $128.6K | 129 | 71 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

Present Market Standing of ServiceNow

- Trading volume stands at 705,430, with NOW's price up by 2.33%, positioned at $817.4.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 84 days.

What Analysts Are Saying About ServiceNow

5 market experts have recently issued ratings for this stock, with a consensus target price of $876.0.

- Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for ServiceNow, targeting a price of $850.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for ServiceNow, targeting a price of $900.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on ServiceNow with a target price of $850.

- An analyst from Baird has decided to maintain their Outperform rating on ServiceNow, which currently sits at a price target of $900.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on ServiceNow with a target price of $880.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ServiceNow options trades with real-time alerts from Benzinga Pro.