A Look At The Intrinsic Value Of Star Lake Bioscience Co., Inc.Zhaoqing Guangdong (SHSE:600866)

A Look At The Intrinsic Value Of Star Lake Bioscience Co., Inc.Zhaoqing Guangdong (SHSE:600866)

Key Insights

主要见解

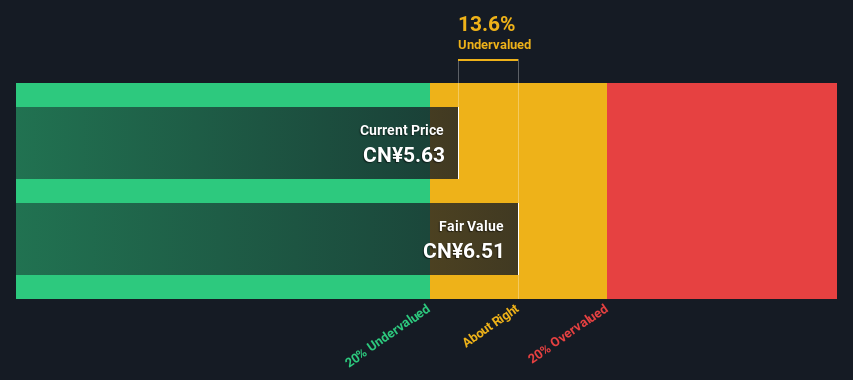

- Using the Dividend Discount Model, Star Lake BioscienceZhaoqing Guangdong fair value estimate is CN¥6.51

- With CN¥5.63 share price, Star Lake BioscienceZhaoqing Guangdong appears to be trading close to its estimated fair value

- Star Lake BioscienceZhaoqing Guangdong's peers are currently trading at a premium of 134% on average

- 使用股息贴现模型,星湖科技 (SHSE:600866) 在广东肇庆的公允价值估算为 CN¥6.51。

- 以每股CN¥5.63的股价计算,星湖科技 (SHSE:600866) 在广东肇庆估算公允价值附近交易。

- 星湖科技 (SHSE:600866) 的同行业板块当前平均溢价幅度为134%。

Today we will run through one way of estimating the intrinsic value of Star Lake Bioscience Co., Inc.Zhaoqing Guangdong (SHSE:600866) by estimating the company's future cash flows and discounting them to their present value. Our analysis will employ the Discounted Cash Flow (DCF) model. It may sound complicated, but actually it is quite simple!

今天我们将通过一种估算星湖科技股份有限公司 (SHSE:600866) 内在价值的方式来估计公司未来的现金流和将其折现为现值。我们的分析将采用折现现金流量 (DCF) 模型。这听起来可能很复杂,但实际上它是相当简单的!

We generally believe that a company's value is the present value of all of the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without flaws. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

我们通常认为,一家公司的价值是其未来所有现金流的现值之和。然而,DCF仅是众多估值指标之一,它并非没有缺陷。对于那些热衷于股权分析的学习者来说,在这里,Simply Wall St分析模型可能值得一提。

Crunching The Numbers

数据统计

We have to calculate the value of Star Lake BioscienceZhaoqing Guangdong slightly differently to other stocks because it is a food company. In this approach dividends per share (DPS) are used, as free cash flow is difficult to estimate and often not reported by analysts. This often underestimates the value of a stock, but it can still be good as a comparison to competitors. We use the Gordon Growth Model, which assumes dividend will grow into perpetuity at a rate that can be sustained. For a number of reasons a very conservative growth rate is used that cannot exceed that of a company's Gross Domestic Product (GDP). In this case we used the 5-year average of the 10-year government bond yield (2.9%). The expected dividend per share is then discounted to today's value at a cost of equity of 7.4%. Compared to the current share price of CN¥5.6, the company appears about fair value at a 14% discount to where the stock price trades currently. Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out.

我们必须针对星湖科技 (SHSE:600866) 进行略微不同的价值计算方式,因为它是一家食品公司。在这种方法中,股息每股 (DPS) 被使用,因为自由现金流很难估算并且往往不被分析师报告。这往往会低估股票的价值,但它仍然可以作为与竞争对手的比较。我们使用戈登增长模型,假设股票分红将以可持续的速率永久增长。由于很多原因,我们使用了一种非常保守的增长率,它不能超过一家公司的国内生产总值 (GDP)。在这种情况下,我们使用了10年期政府债券收益率的5年平均数 (2.9%)。预期每股股息随后通过股权成本为7.4%折扣到今天的价值。与目前每股股价为CN¥5.6相比,该公司在股价的14%折扣下似乎约公平价值。然而,请记住,这只是一个大致的估值,就像任何复杂的公式一样——垃圾输入,垃圾输出。

Value Per Share = Expected Dividend Per Share / (Discount Rate - Perpetual Growth Rate)

每股股息 = 预期每股股息 / (折现率-永久增长率)

= CN¥0.3 / (7.4% – 2.9%)

= CN¥0.3 / (7.4% – 2.9%)

= CN¥6.5

=CN¥6.5

The Assumptions

假设

We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. If you don't agree with these result, have a go at the calculation yourself and play with the assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Star Lake BioscienceZhaoqing Guangdong as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 7.4%, which is based on a levered beta of 0.800. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

我们要指出折现现金流量的最重要的输入因素是折现率和实际现金流量。如果您不同意这些结果,请自己计算并对假设进行更改。DCF模型还不考虑行业可能的周期性或公司未来的资本需求,因此它不能完全反映公司的潜在业绩。我们将星湖科技 (SHSE:600866) 视为潜在股东,使用股权成本而不是资本成本 (或加权平均成本资本,WACC) 作为折现率。在这个计算中,我们使用了7.4%,这是基于一个杠杆比率为0.800的平均贝塔。Beta是一种股票波动性的度量,与整个市场相比。我们从全球可比公司的行业平均贝塔获得我们的贝塔,设置在0.8和2.0之间是一个合理的范围,对于一个稳定的业务来说是一个合理的范围。

Looking Ahead:

展望未来:

Although the valuation of a company is important, it is only one of many factors that you need to assess for a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to "what assumptions need to be true for this stock to be under/overvalued?" For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. For Star Lake BioscienceZhaoqing Guangdong, we've compiled three important aspects you should assess:

虽然公司的估值很重要,但它只是您需要评估一家公司的许多因素之一。DCF模型不是完美的股票估值工具。相反,它应该被视为“假设需要成真这支股票才能被低估或高估的指南”。例如,如果终端价值增长率稍微调整,它可能会极大地改变总体结果。对于星湖科技 (SHSE:600866),我们编制了三个重要的方面,您应该评估:

- Risks: We feel that you should assess the 3 warning signs for Star Lake BioscienceZhaoqing Guangdong we've flagged before making an investment in the company.

- Future Earnings: How does 600866's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

- 风险:在投资之前,我们认为您应该评估我们标记的星湖科技 (SHSE:600866) 的三个警告信号。

- 未来收益:600866的增长率如何与其同行和更广泛的市场相比?通过与我们的免费分析师增长预期图表交互,深入了解未来几年的分析师共识数字。

- 其他高质量选择:你喜欢一个好的多面手吗?浏览我们的高质量股票交互列表,了解还有哪些你可能错过的好东西!

PS. Simply Wall St updates its DCF calculation for every Chinese stock every day, so if you want to find the intrinsic value of any other stock just search here.

PS. Simply Wall St每天都会更新其所覆盖的每只中国股票的DCF计算,因此,如果您想找到任何其他股票的内在价值,只需在此搜索即可。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。