Forecasting the labor market downturn has never been an easy task. But the unique dynamics of the post-pandemic era have made it even harder for economists to determine whether the recent rise in US unemployment rates signals trouble ahead.

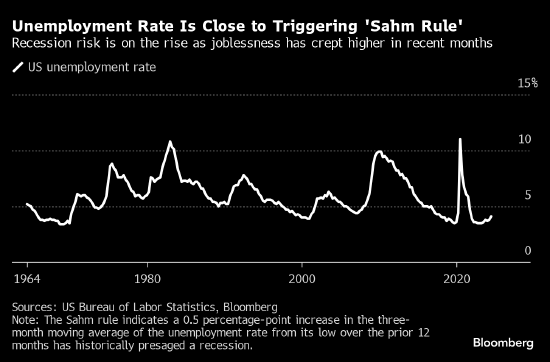

Monthly employment data released on Friday may fuel the debate. The unemployment rate has risen every month for the past three months and is now close to triggering an economic recession indicator developed by former Fed economist Claudia Sahm that has had a perfect record over the past half century.

Other traditional early warning indicators, such as temporary employment and resignation rates, have also been flashing warning signals. But many forecasters believe that the recent deterioration of these indicators can be interpreted as a return to normal as the hot job market cools down after the pandemic.

"This is not a traditional business cycle. This is a cycle where we are coming out of an unusual environment," said RBC Capital Markets US economist Michael Reid. "Because of the jitterball effect of getting rid of the epidemic, the speed of change may be quite deceptive."

The US unemployment rate rose to 4.1% in June, well above the low of 3.4% reached at the beginning of 2023. Economists expect Friday's data to show that the unemployment rate will remain unchanged in July, at least temporarily halting the upward trend in employment growth. However, recent increases in the unemployment rate have still fueled the debate over interest rates.

After the Fed decided on Wednesday to keep interest rates unchanged at more than 20-year highs, Chairman Jerome Powell was asked about the so-called "Sahm rule" at a news conference. He said that policymakers "believes we are seeing the labor market returning to normal", but if "it starts to show signs beyond that, we can handle it well."

It is widely expected that the Fed will begin easing policy in September. But in recent weeks, some well-known economists, including former Fed Vice Chairman Alan Blinder, Goldman Sachs Chief Economist Jan Hatzius, and former New York Fed President William Dudley, have advocated earlier action, in part because of developments in the labor market.

Benign Explanation

A more benign explanation for the recent increase in the unemployment rate is that strict restrictions on the number of immigrants entering the US during the pandemic and the millions of Americans leaving the labor market have artificially depressed the unemployment rate. As these trends reverse and labor force participation rates recover, the unemployment rate is returning to levels it would have been at if not for the pandemic.

Sahm herself said last week that the surge in the number of people entering the labor force "may exaggerate" the extent to which the labor market is softening. She said in a newsletter on July 26 that "the Sahm rule is currently sending the right warning signals about a cooling labor market, but too loudly."

Other indicators such as job vacancies have also had similar trends, with job vacancies down nearly a third since reaching a high of 1.2 million two years ago. Despite the alarming rate of decline, the 8.2 million job vacancies are still significantly higher than the pre-pandemic level. Initial claims for unemployment benefits are the same, remaining at historically low levels despite recent increases.

"In this pandemic era, many obvious rules are being ignored," Powell said on Wednesday. "Many, many accepted views are no longer working, because the situation is really unusual."