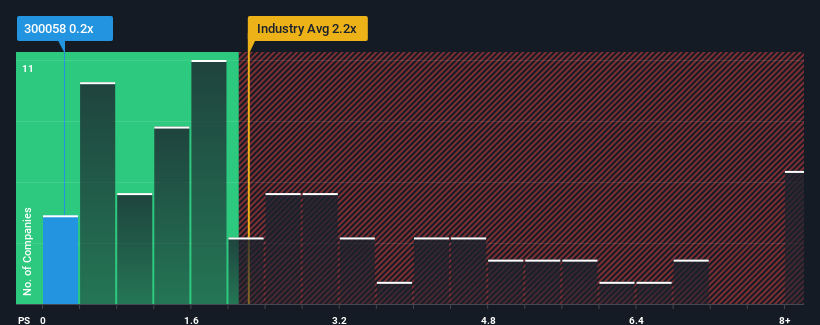

BlueFocus Intelligent Communications Group Co., Ltd.'s (SZSE:300058) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Media industry in China, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does BlueFocus Intelligent Communications Group's P/S Mean For Shareholders?

Recent times have been advantageous for BlueFocus Intelligent Communications Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think BlueFocus Intelligent Communications Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as BlueFocus Intelligent Communications Group's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 52% gain to the company's top line. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 10% over the next year. With the industry predicted to deliver 11% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that BlueFocus Intelligent Communications Group's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for BlueFocus Intelligent Communications Group remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for BlueFocus Intelligent Communications Group with six simple checks on some of these key factors.

If you're unsure about the strength of BlueFocus Intelligent Communications Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com