Whales with a lot of money to spend have taken a noticeably bearish stance on Synopsys.

Looking at options history for Synopsys (NASDAQ:SNPS) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 18% of the investors opened trades with bullish expectations and 81% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $331,324 and 3, calls, for a total amount of $141,500.

From the overall spotted trades, 8 are puts, for a total amount of $331,324 and 3, calls, for a total amount of $141,500.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $450.0 and $550.0 for Synopsys, spanning the last three months.

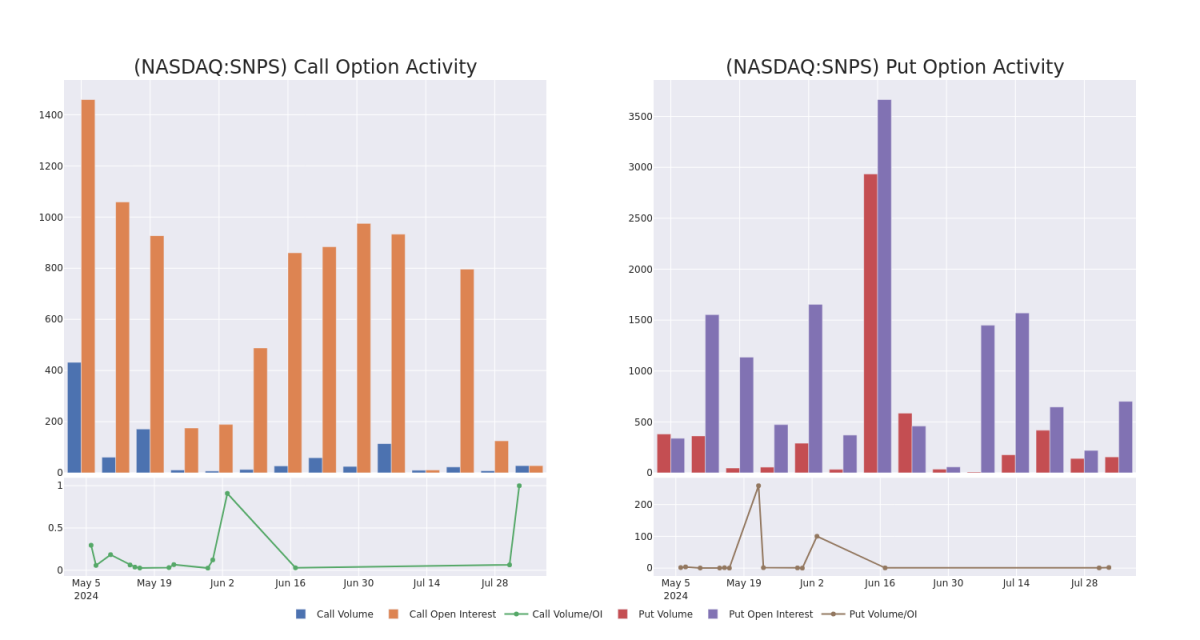

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Synopsys's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Synopsys's whale activity within a strike price range from $450.0 to $550.0 in the last 30 days.

Synopsys Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNPS | CALL | TRADE | BEARISH | 09/20/24 | $37.0 | $32.0 | $32.0 | $510.00 | $80.0K | 11 | 25 |

| SNPS | PUT | TRADE | BEARISH | 09/20/24 | $27.7 | $25.0 | $27.7 | $500.00 | $60.9K | 368 | 22 |

| SNPS | PUT | TRADE | BULLISH | 06/20/25 | $95.0 | $94.0 | $94.0 | $550.00 | $47.0K | 54 | 25 |

| SNPS | PUT | TRADE | BEARISH | 06/20/25 | $92.0 | $88.2 | $92.0 | $550.00 | $46.0K | 54 | 10 |

| SNPS | PUT | TRADE | BEARISH | 12/20/24 | $80.1 | $76.7 | $80.1 | $550.00 | $40.0K | 82 | 5 |

About Synopsys

Synopsys is a provider of electronic design automation software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. The firm's growing SI business allows customers to continuously manage and test the code base for security and quality. Synopsys' comprehensive portfolio is benefiting from a mutual convergence of semiconductor companies moving up-stack toward systems-like companies, and systems companies moving down-stack toward in-house chip design. The resulting expansion in EDA customers alongside secular digitalization of various end markets benefits EDA vendors like Synopsys.

Synopsys's Current Market Status

- Currently trading with a volume of 957,728, the SNPS's price is down by -9.06%, now at $491.7.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 19 days.

What The Experts Say On Synopsys

1 market experts have recently issued ratings for this stock, with a consensus target price of $687.0.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Synopsys with a target price of $687.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Synopsys options trades with real-time alerts from Benzinga Pro.