Financial giants have made a conspicuous bearish move on Okta. Our analysis of options history for Okta (NASDAQ:OKTA) revealed 9 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $106,975, and 6 were calls, valued at $326,822.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $130.0 for Okta over the recent three months.

Insights into Volume & Open Interest

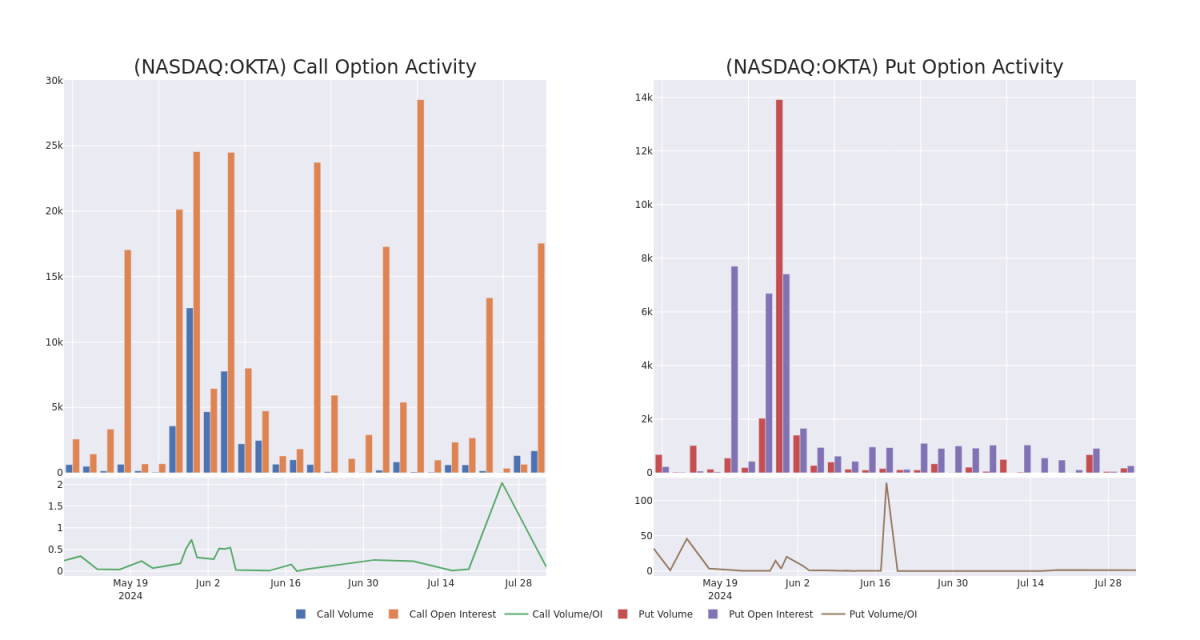

In terms of liquidity and interest, the mean open interest for Okta options trades today is 3562.4 with a total volume of 1,855.00.

In terms of liquidity and interest, the mean open interest for Okta options trades today is 3562.4 with a total volume of 1,855.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Okta's big money trades within a strike price range of $90.0 to $130.0 over the last 30 days.

Okta 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKTA | CALL | SWEEP | BEARISH | 01/17/25 | $1.85 | $1.8 | $1.8 | $130.00 | $143.8K | 16.1K | 802 |

| OKTA | CALL | SWEEP | BEARISH | 01/17/25 | $1.92 | $1.8 | $1.8 | $130.00 | $43.2K | 16.1K | 202 |

| OKTA | CALL | SWEEP | BEARISH | 01/17/25 | $1.92 | $1.8 | $1.8 | $130.00 | $43.2K | 16.1K | 202 |

| OKTA | PUT | SWEEP | BULLISH | 09/06/24 | $9.55 | $8.0 | $8.35 | $90.00 | $41.2K | 150 | 100 |

| OKTA | CALL | TRADE | BEARISH | 01/17/25 | $1.88 | $1.8 | $1.8 | $130.00 | $36.0K | 16.1K | 201 |

About Okta

Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in 2017 and focuses on two key client stakeholder groups: workforces and customers. Okta's workforce offerings enable a company's employees to securely access its cloud-based and on-premises resources. The firm's customer offerings allow its clients' customers to securely access the client's applications.

Where Is Okta Standing Right Now?

- With a volume of 895,952, the price of OKTA is down -3.15% at $88.5.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 26 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Okta options trades with real-time alerts from Benzinga Pro.