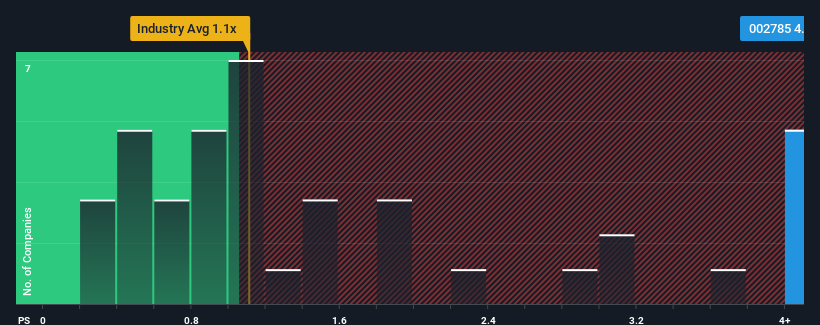

When close to half the companies in the Basic Materials industry in China have price-to-sales ratios (or "P/S") below 1.1x, you may consider Xiamen Wanli Stone Stock Co.,Ltd (SZSE:002785) as a stock to avoid entirely with its 4.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Xiamen Wanli Stone StockLtd's P/S Mean For Shareholders?

The recent revenue growth at Xiamen Wanli Stone StockLtd would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Xiamen Wanli Stone StockLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Xiamen Wanli Stone StockLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 5.6%. The solid recent performance means it was also able to grow revenue by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

If we review the last year of revenue growth, the company posted a worthy increase of 5.6%. The solid recent performance means it was also able to grow revenue by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.9% shows it's about the same on an annualised basis.

In light of this, it's curious that Xiamen Wanli Stone StockLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Xiamen Wanli Stone StockLtd's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't expect to see Xiamen Wanli Stone StockLtd trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Xiamen Wanli Stone StockLtd (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com