Declining Stock and Solid Fundamentals: Is The Market Wrong About StarPower Semiconductor Ltd. (SHSE:603290)?

Declining Stock and Solid Fundamentals: Is The Market Wrong About StarPower Semiconductor Ltd. (SHSE:603290)?

StarPower Semiconductor (SHSE:603290) has had a rough three months with its share price down 10%. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study StarPower Semiconductor's ROE in this article.

斯達半導(SHSE:603290)過去三個月股價下跌了10%。然而,對其穩健的財務狀況進行仔細研究後,您可能會重新考慮。鑑於基本面通常驅動長期市場結果,因此值得關注該公司。特別是,我們決定在本文中研究斯達半導的roe。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

對於股東來說,股東回報率(ROE)是一個重要的考慮因素,因爲它告訴股東他們的資本被有效地再投資了多少。換句話說,它是一個衡量公司股東提供的資本回報率的盈利能力比率。

How To Calculate Return On Equity?

如何計算股東權益報酬率?

The formula for ROE is:

roe的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

淨資產收益率 = 淨利潤(從持續經營中獲得)÷ 股東權益

So, based on the above formula, the ROE for StarPower Semiconductor is:

因此,根據上述公式,斯達半導的roe爲:

13% = CN¥878m ÷ CN¥6.7b (Based on the trailing twelve months to March 2024).

13%= CN¥87800萬 ÷ CN¥67億(基於截至2024年3月的過去十二個月)。

The 'return' is the yearly profit. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.13 in profit.

「回報」是每年的利潤。可以這樣理解,每 1 元股東資本投入,公司就賺取了 0.13 元的利潤。

Why Is ROE Important For Earnings Growth?

ROE爲什麼對淨利潤增長很重要?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

我們已經確定ROE作爲評估公司未來收益的有效指標。現在我們需要評估公司爲未來增長所保留的利潤量,從而給我們一個關於公司增長潛力的想法。假設其他條件都相同,既具有較高ROE又具有較高利潤保留的公司通常是增長率更高的公司,相比之下沒有這些特點的公司會更低。

StarPower Semiconductor's Earnings Growth And 13% ROE

斯達半導的收益增長和13%的roe

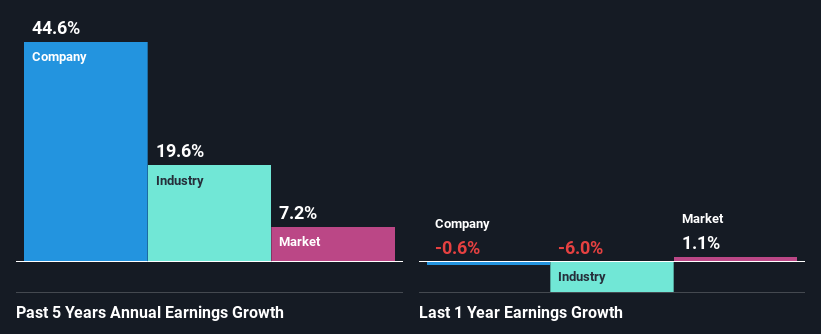

At first glance, StarPower Semiconductor seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 5.8%. Probably as a result of this, StarPower Semiconductor was able to see an impressive net income growth of 45% over the last five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

首先,斯達半導似乎具有不錯的roe。此外,公司roe與行業平均水平(5.8%)相比表現相當出色。可能正是由於此原因,斯達半導在過去五年中看到了45%的驚人淨利潤增長。我們認爲可能還有其他積極影響公司收益增長的因素。例如,在公司管理方面可能做出了一些良好的戰略決策,或者公司擁有較低的派息比率。接下來,我們比較了行業淨利潤增長,發現與行業同期20%的平均增長相比,斯達半導的增長相當高,這是非常好的。

Next, on comparing with the industry net income growth, we found that StarPower Semiconductor's growth is quite high when compared to the industry average growth of 20% in the same period, which is great to see.

另外,在比較行業淨利潤增長率時,我們發現斯達半導的增長率相當高,比同期行業平均增長率20%高,這很不錯。

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for 603290? You can find out in our latest intrinsic value infographic research report.

附加價值的基礎,在很大程度上與其收益增長有關。投資者應該嘗試確定所預期的收益增長或下降(無論哪種情況),是否已定價。這樣做將有助於他們確定該股票的未來前景是有前途的還是不祥的。市場是否已經爲603290的未來展望定價?您可以在我們的最新內在價值信息圖研究報告中找到答案。

Is StarPower Semiconductor Efficiently Re-investing Its Profits?

斯達半導是否有效地重新投資其利潤?

StarPower Semiconductor has a three-year median payout ratio of 27% (where it is retaining 73% of its income) which is not too low or not too high. By the looks of it, the dividend is well covered and StarPower Semiconductor is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

斯達半導的三年中位數派息比率爲27%(它保留了73%的收入),既不太低也不太高。看起來,股息被充分覆蓋,斯達半導正在有效地重新投資其利潤,正如我們上面討論的那樣,這是卓越的增長。

Besides, StarPower Semiconductor has been paying dividends over a period of four years. This shows that the company is committed to sharing profits with its shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 23%. However, StarPower Semiconductor's ROE is predicted to rise to 18% despite there being no anticipated change in its payout ratio.

此外,斯達半導已經連續四年支付股息。這表明該公司致力於與股東分享利潤。根據最新的分析師預測,我們發現公司未來三年的派息比率預計將保持穩定在23%。但是,儘管沒有預期的派息比率變化,斯達半導的roe預計將上升到18%。

Conclusion

結論

In total, we are pretty happy with StarPower Semiconductor's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

總體而言,我們對斯達半導的表現感到非常滿意。特別是,我們很喜歡該公司正在以高的回報率將其利潤的巨大部分重新投資。當然,這導致公司的收益大幅增長。但是,最新的行業分析師預測顯示,該公司的收益增長預計將放緩。要了解該公司未來收益增長預測的更多信息,請查看有關該公司的分析師預測的免費報告。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity