Unfortunately for some shareholders, the Lattice Semiconductor Corporation (NASDAQ:LSCC) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

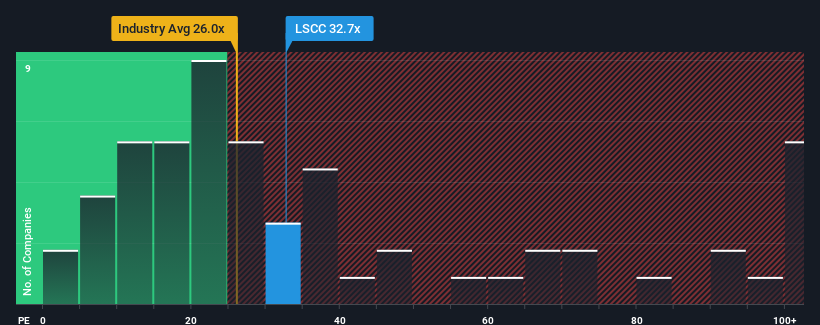

Although its price has dipped substantially, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may still consider Lattice Semiconductor as a stock to avoid entirely with its 32.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Lattice Semiconductor has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Lattice Semiconductor's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Lattice Semiconductor's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Lattice Semiconductor's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.4%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 171% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 1.8% per year over the next three years. With the market predicted to deliver 10% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Lattice Semiconductor is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Lattice Semiconductor's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Lattice Semiconductor's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Lattice Semiconductor with six simple checks.

Of course, you might also be able to find a better stock than Lattice Semiconductor. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com