What Dun & Bradstreet Holdings, Inc.'s (NYSE:DNB) 28% Share Price Gain Is Not Telling You

What Dun & Bradstreet Holdings, Inc.'s (NYSE:DNB) 28% Share Price Gain Is Not Telling You

Dun & Bradstreet Holdings, Inc. (NYSE:DNB) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

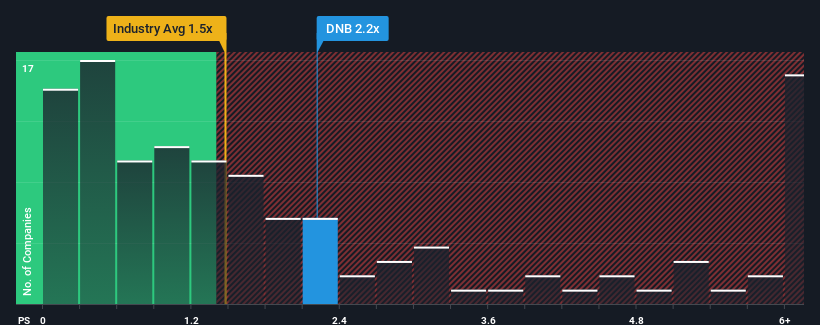

Following the firm bounce in price, given close to half the companies operating in the United States' Professional Services industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Dun & Bradstreet Holdings as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Dun & Bradstreet Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, Dun & Bradstreet Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Dun & Bradstreet Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Dun & Bradstreet Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 5.0% gain to the company's revenues. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.3% per year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 7.1% per year, which is not materially different.

In light of this, it's curious that Dun & Bradstreet Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Dun & Bradstreet Holdings' P/S

The large bounce in Dun & Bradstreet Holdings' shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting Dun & Bradstreet Holdings' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Dun & Bradstreet Holdings is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Dun & Bradstreet Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com