The Abercrombie & Fitch Co. (NYSE:ANF) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 237% in the last twelve months.

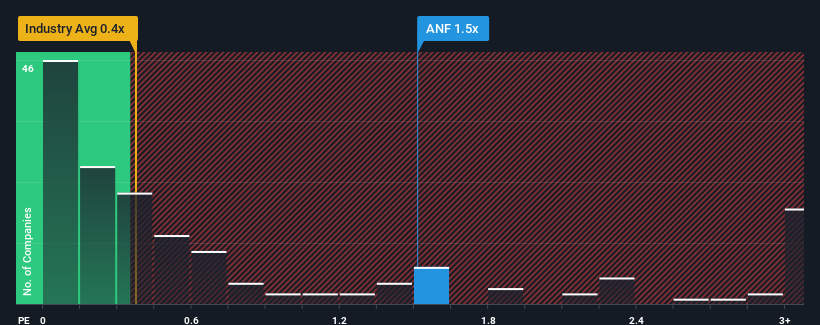

Although its price has dipped substantially, when almost half of the companies in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Abercrombie & Fitch as a stock probably not worth researching with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Abercrombie & Fitch's Recent Performance Look Like?

Abercrombie & Fitch certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Abercrombie & Fitch will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Abercrombie & Fitch would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Abercrombie & Fitch would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 31% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.6% during the coming year according to the seven analysts following the company. That's shaping up to be materially higher than the 3.6% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Abercrombie & Fitch's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Abercrombie & Fitch's P/S Mean For Investors?

There's still some elevation in Abercrombie & Fitch's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Abercrombie & Fitch shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Abercrombie & Fitch that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com