China Shipbuilding Industry Group Power Co., Ltd. (SHSE:600482) Will Pay A CN¥0.10641 Dividend In Three Days

China Shipbuilding Industry Group Power Co., Ltd. (SHSE:600482) Will Pay A CN¥0.10641 Dividend In Three Days

China Shipbuilding Industry Group Power Co., Ltd. (SHSE:600482) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase China Shipbuilding Industry Group Power's shares before the 8th of August to receive the dividend, which will be paid on the 8th of August.

中國動力(SHSE:600482)將於未來3天內進行除息交易。 除息日期是登記股東的截止日期的前一天,這是股東登記在公司賬簿上以有資格獲得分紅支付的截止日期。 除息日是一個需要注意的重要日期,因爲在此日期之後或之後購買股票可能意味着遲到的交割,不會顯示在登記日期上。 意思是,你需要在8月8日之前購買中國動力的股票,以獲得分紅,該分紅將在8月8日支付。

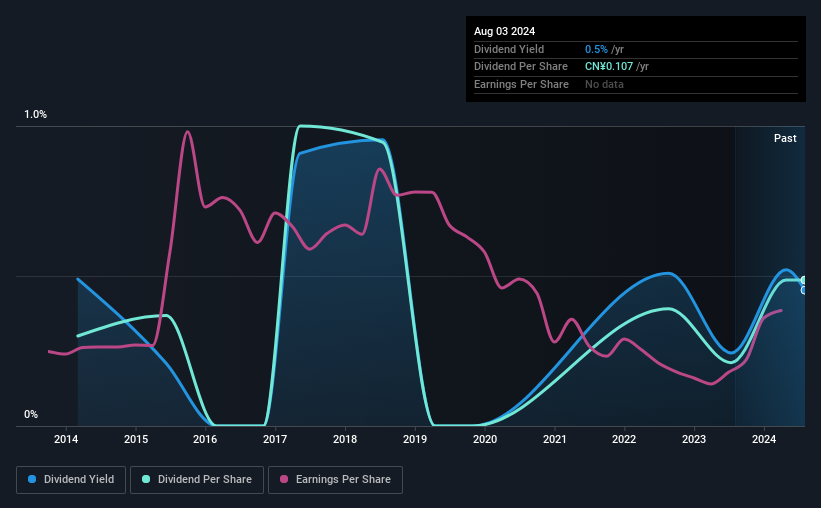

The company's next dividend payment will be CN¥0.10641 per share, on the back of last year when the company paid a total of CN¥0.11 to shareholders. Calculating the last year's worth of payments shows that China Shipbuilding Industry Group Power has a trailing yield of 0.5% on the current share price of CN¥23.63. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether China Shipbuilding Industry Group Power can afford its dividend, and if the dividend could grow.

該公司的下一個股息支付將爲每股CN¥0.10641,在去年公司向股東支付總計CN¥0.11的基礎上。 計算去年的支付總額,表明中國動力當前股價的回溯收益率爲0.5%。分紅是長揸者的投資回報的主要貢獻者,但僅在股息繼續支付的情況下。 因此,我們需要調查中國動力是否能夠支付其分紅,並確定分紅是否能夠增長。

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see China Shipbuilding Industry Group Power paying out a modest 28% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 6.1% of its free cash flow last year.

分紅通常是 出於公司利潤而支付的,因此,如果公司支付的分紅超過了其利潤,則其分紅通常面臨更大的風險。 這就是爲什麼看到中國動力支付了其收益的適度28%就很好了。 然而,對於評估分紅而言,現金流比利潤更爲重要,因此,我們需要看看公司是否產生足夠的現金以支付其分配。 幸運的是,去年它只支付了其自由現金流的6.1%。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

看到股息既有盈利也有現金流的覆蓋是令人鼓舞的。這通常表明股息是可持續的,只要收益沒有急劇下降。

Click here to see how much of its profit China Shipbuilding Industry Group Power paid out over the last 12 months.

點擊此處查看中國動力過去12個月支付的利潤金額。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. China Shipbuilding Industry Group Power's earnings per share have fallen at approximately 13% a year over the previous five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

當收益下降時,股息公司變得更難分析和安全擁有。 如果業務進入衰退並且股息被削減,則公司的價值可能會急劇下降。 中國動力的每股收益在過去五年中每年下降約13%。 最終,當每股收益下降時,可以支付股息的餅乾大小也會縮小。

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. China Shipbuilding Industry Group Power has delivered an average of 5.0% per year annual increase in its dividend, based on the past 10 years of dividend payments.

衡量公司股息前景的另一個關鍵方法是測量其歷史股息增長率。根據過去10年的股息支付,中國動力的股息平均每年增長5.0%。

To Sum It Up

總結一下

Has China Shipbuilding Industry Group Power got what it takes to maintain its dividend payments? China Shipbuilding Industry Group Power has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. In summary, it's hard to get excited about China Shipbuilding Industry Group Power from a dividend perspective.

中國動力有沒有能力維持其分紅支付? 中國動力的現金和利潤支付比率相對較低,這可能意味着即使收益每股大幅下降,分紅也是可持續的。 但仍然需要注意,收益下降是一個警示標誌。

Want to learn more about China Shipbuilding Industry Group Power's dividend performance? Check out this visualisation of its historical revenue and earnings growth.

想了解更多關於中國動力的股息表現的信息嗎?查看其歷史營收和盈利增長的可視化。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般來說,我們不建議僅僅購買第一個股息股票。下面是一個經過策劃的有趣的、股息表現良好的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。