Those holding Shanghai Medicilon Inc. (SHSE:688202) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 66% share price decline over the last year.

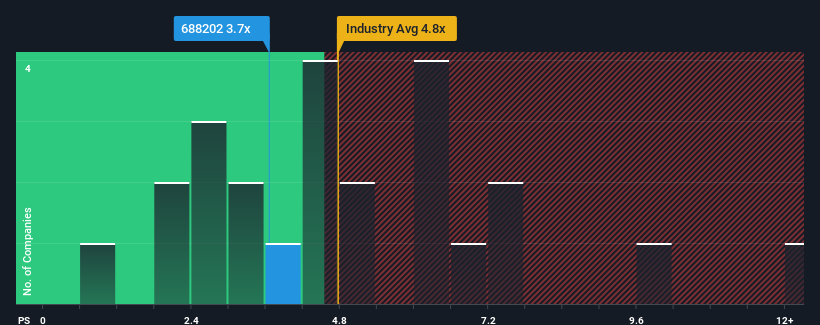

In spite of the firm bounce in price, it would still be understandable if you think Shanghai Medicilon is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 3.7x, considering almost half the companies in China's Life Sciences industry have P/S ratios above 4.8x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Shanghai Medicilon Performed Recently?

With revenue that's retreating more than the industry's average of late, Shanghai Medicilon has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Medicilon will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Shanghai Medicilon?

In order to justify its P/S ratio, Shanghai Medicilon would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Shanghai Medicilon would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. Even so, admirably revenue has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 81% over the next year. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Shanghai Medicilon's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Shanghai Medicilon's P/S?

Despite Shanghai Medicilon's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Shanghai Medicilon's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Shanghai Medicilon that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com