Q2 investment income was 18.75 billion US dollars.

Berkshire Hathaway, owned by Buffett, released its Q2 2024 financial report on the evening of August 3 Beijing time.

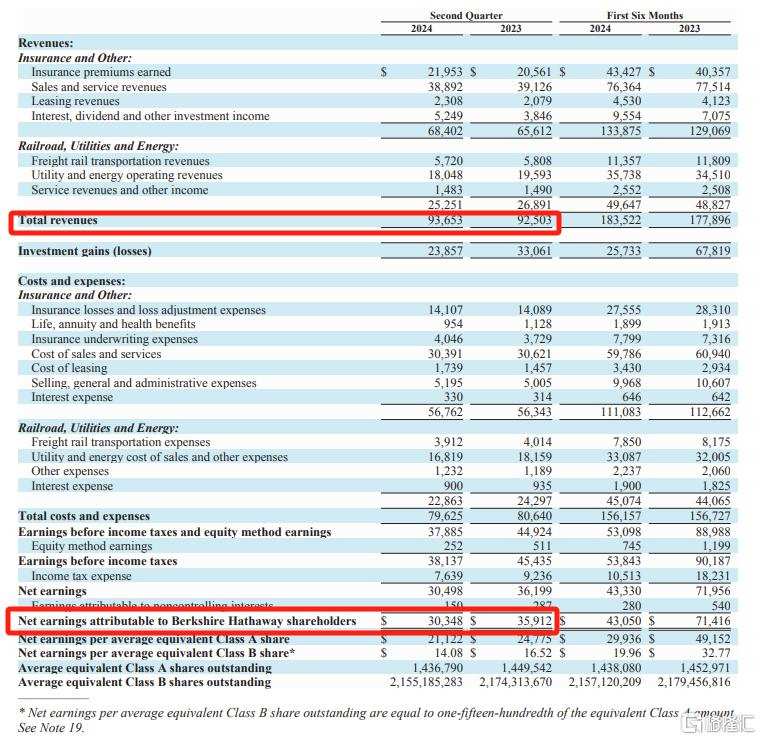

The financial report shows that the revenue of Berkshire Hathaway A in Q2 2024 was USD 93.653 billion, compared to USD 92.503 billion in the same period last year, with a market expectation of USD 91.09 billion; the net profit in Q2 was USD 30.348 billion (including investment income from listed companies), compared to USD 35.912 billion in the same period last year, with a market expectation of USD 17.786 billion.

In Q2 of this year, Berkshire Hathaway's investment income was USD 18.75 billion, compared to USD 25.869 billion in the same period last year; the company's operating profit was USD 11.598 billion, compared to USD 10.043 billion in the same period last year.

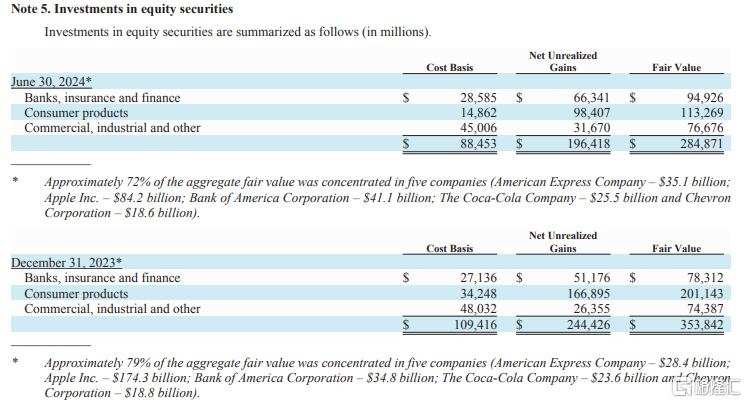

The fair value of the fixed income securities investment held is USD 16.969 billion, including USD 4.517 billion, USD 11.02 billion, and USD 1.21 billion for investment fair value of US bonds, foreign bonds, and corporate bonds, respectively; the net sold value of stocks in Q2 was USD 75.5 billion, and around USD 0.345 billion was used to buy back company stocks.

At the end of Q2, the cash reserve was a new record high of USD 276.9 billion, a significant increase from USD 189 billion in Q1.

Reduced holdings of Apple by nearly half.

As of June 30, in the total fair value of equity investment, 72% was concentrated in five companies, namely Apple ($84.2 billion), Bank of America ($41.1 billion), American Express ($35.1 billion), Coca-Cola ($25.5 billion), and Chevron ($18.6 billion).

According to Berkshire Hathaway A's 10-Q released on Saturday, the company significantly reduced its holdings of Apple shares from 0.789 billion shares in Q1 to approximately 0.4 billion shares, a nearly 50% decrease.

Berkshire Hathaway currently holds about 2.6% of Apple's shares, worth about USD 88 billion based on last Friday's closing price of USD 219.86.

Previously, Berkshire Hathaway reduced its holdings of Apple shares by about 13% in Q1.

At the Berkshire Hathaway annual meeting in May, Buffett explained the reason for his reduction of Apple shares. He said that if the US government wants to make up for the soaring fiscal deficit and increase capital gains tax, then a small sale of Apple this year will benefit Berkshire Hathaway shareholders in the long run, which is a reasonable tax avoidance.

He also said that by the end of 2024, Apple is likely to remain the largest stock holding of Berkshire Hathaway. Buffett said that unless there are major changes, Apple will be the largest investment.

Continuously selling Bank of America for 12 trading days.

In addition to reducing its holdings of Apple, Buffett also took the rare and continuous action of reducing its holdings of Bank of America.

A series of information recently disclosed by the SEC also shows that Berkshire Hathaway has disclosed four times to sell Bank of America's stocks since July 17.

In the 12 trading days from July 17 to August 1, Berkshire Hathaway continuously sold Bank of America, selling about 90.42 million shares with a total amount of about USD 3.8 billion. Berkshire Hathaway's shareholding percentage of Bank of America decreased by about 8.8% in total.

So far, Buffett has been silent on the reasons and intentions for reducing his holdings in Bank of America. Some market views speculate that Buffett may be preparing in advance for the US Federal Reserve's monetary policy shift.