A Closer Look At Jabil Inc.'s (NYSE:JBL) Impressive ROE

A Closer Look At Jabil Inc.'s (NYSE:JBL) Impressive ROE

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Jabil Inc. (NYSE:JBL).

虽然有些投资者已经精通财务指标(致敬),但本文是为那些想学习回报率(ROE)以及其重要性的人而写的。为了使课堂务实,我们将利用ROE更好地了解捷普科技(NYSE:JBL)。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

股东要考虑的关键因素之一是净资产收益率或roe,因为它告诉他们公司如何有效地重新投资他们的资本。简单点说,它衡量了公司与股东权益相关的盈利能力。

How Do You Calculate Return On Equity?

怎样计算ROE?

The formula for return on equity is:

权益回报率的计算公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

净资产收益率 = 净利润(从持续经营中获得)÷ 股东权益

So, based on the above formula, the ROE for Jabil is:

因此,根据上述公式,Jabil的ROE为:

62% = US$1.4b ÷ US$2.3b (Based on the trailing twelve months to May 2024).

62% = 14亿美元 ÷ 23亿美元(基于截至2024年5月的过去12个月)。

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.62 in profit.

“回报率”是在过去12个月的税后收入。一个概念化的方式是,对于每$1的股东资本,公司将赚取$0.62的利润。

Does Jabil Have A Good ROE?

捷普科技的ROE如何?

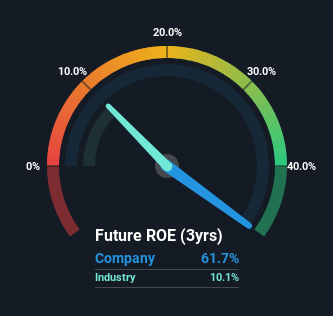

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. Pleasingly, Jabil has a superior ROE than the average (10%) in the Electronic industry.

确定公司ROE是否良好的一个简单方法是将其与行业平均水平进行比较。这种方法的局限性在于,即使在同一行业分类中,有些公司也非常不同。令人高兴的是,捷普科技在电子行业的平均ROE(10%)之上拥有更高水平的ROE。

That's clearly a positive. With that said, a high ROE doesn't always indicate high profitability. A higher proportion of debt in a company's capital structure may also result in a high ROE, where the high debt levels could be a huge risk . To know the 3 risks we have identified for Jabil visit our risks dashboard for free.

这显然是一个积极的因素。但是,高ROE并不总是表明高盈利能力。公司资本结构中债务比例较高可能会导致高ROE,其中高债务水平可能构成巨大风险。要了解我们已经为捷普科技确定的3个风险,请免费访问我们的风险控制面板。

How Does Debt Impact Return On Equity?

债务如何影响股东回报率?

Most companies need money -- from somewhere -- to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

大多数公司需要资金来增加利润。这些资金可以来自保留收益,发行新股份(股权)或债务。在前两个选择的情况下,ROE将反映出这种用于增长的现金支出。在后一种情况下,使用债务将提高回报,但不会改变股本。这将使ROE看起来比不使用债务时更好。

Jabil's Debt And Its 62% ROE

捷普科技的债务及其62%的ROE值得注意。值得注意的是,捷普科技使用债务较多,导致其债务/股本比率为1.26。虽然它的ROE表现相当出色,但如果没有使用债务,它可能会更低。投资者应仔细考虑,如果该公司不能轻松借款,其业绩如何,因为信贷市场会随时间变化而改变。

It's worth noting the high use of debt by Jabil, leading to its debt to equity ratio of 1.26. Its ROE is pretty impressive but, it would have probably been lower without the use of debt. Investors should think carefully about how a company might perform if it was unable to borrow so easily, because credit markets do change over time.

Conclusion

结论

Return on equity is one way we can compare its business quality of different companies. Companies that can achieve high returns on equity without too much debt are generally of good quality. All else being equal, a higher ROE is better.

ROE是我们比较不同公司业务质量的一种方法。一般而言,能够在不过度依赖于债务的情况下获得高回报的公司通常是优质的公司。除此之外,其他条件相同,更高的ROE更好。

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So I think it may be worth checking this free report on analyst forecasts for the company.

话虽如此,虽然ROE是业务质量的有用指标,但您需要研究各种因素来确定购买股票的正确价格。利润增长速度与反映在股票价格中的预期是特别重要的考虑因素。因此,我认为值得查看该公司分析师预测的免费报告。

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

如果您想查看另一家可能具有更好财务状况的公司 - 具有高股本回报率和低债务的公司,那么请不要错过这份有趣公司列表,该列表免费提供。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。