Sylvamo Corporation (NYSE:SLVM), is not the largest company out there, but it saw a double-digit share price rise of over 10% in the past couple of months on the NYSE. While good news for shareholders, the company has traded much higher in the past year. As a US$2.8b market cap stock, it seems odd Sylvamo is not more well-covered by analysts. However, this is not necessarily a bad thing given that there are less eyes on the stock to push it closer to fair value. Is there still an opportunity to buy? Let's examine Sylvamo's valuation and outlook in more detail to determine if there's still a bargain opportunity.

What's The Opportunity In Sylvamo?

According to our price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justfied. In this instance, we've used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock's cash flows. We find that Sylvamo's ratio of 14.29x is trading slightly below its industry peers' ratio of 14.7x, which means if you buy Sylvamo today, you'd be paying a reasonable price for it. And if you believe Sylvamo should be trading in this range, then there isn't much room for the share price to grow beyond the levels of other industry peers over the long-term. Furthermore, Sylvamo's share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. This may mean it is less likely for the stock to fall lower from natural market volatility, which suggests less opportunities to buy moving forward.

What kind of growth will Sylvamo generate?

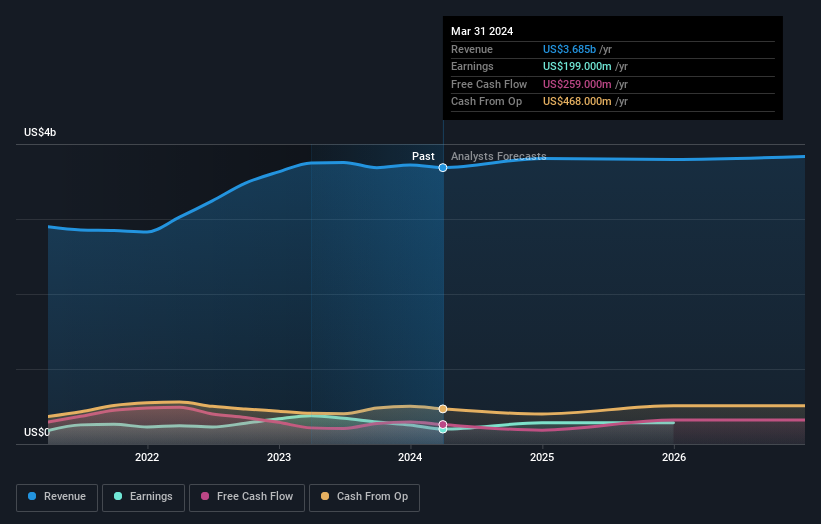

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to grow by 42% over the next year, the near-term future seems bright for Sylvamo. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What This Means For You

Are you a shareholder? It seems like the market has already priced in SLVM's positive outlook, with shares trading around industry price multiples. However, there are also other important factors which we haven't considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at SLVM? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio?

Are you a shareholder? It seems like the market has already priced in SLVM's positive outlook, with shares trading around industry price multiples. However, there are also other important factors which we haven't considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at SLVM? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio?

Are you a potential investor? If you've been keeping an eye on SLVM, now may not be the most optimal time to buy, given it is trading around industry price multiples. However, the positive outlook is encouraging for SLVM, which means it's worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. In terms of investment risks, we've identified 3 warning signs with Sylvamo, and understanding these should be part of your investment process.

If you are no longer interested in Sylvamo, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com