Unfortunately for some shareholders, the Dong Yi Ri Sheng Home Decoration Group Co.,Ltd. (SZSE:002713) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

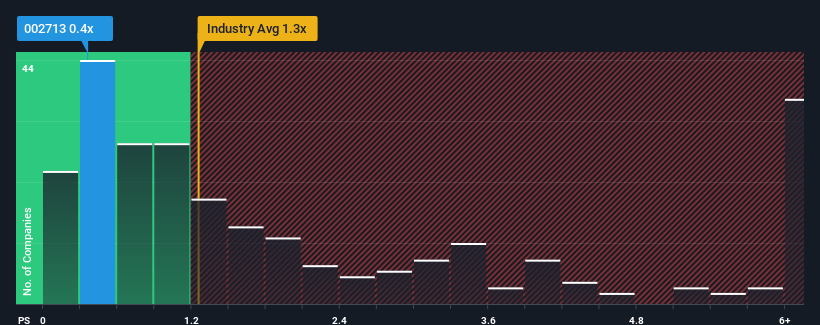

Following the heavy fall in price, Dong Yi Ri Sheng Home Decoration GroupLtd's price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the wider Consumer Services industry in China, where around half of the companies have P/S ratios above 3.1x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How Has Dong Yi Ri Sheng Home Decoration GroupLtd Performed Recently?

The recent revenue growth at Dong Yi Ri Sheng Home Decoration GroupLtd would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. Those who are bullish on Dong Yi Ri Sheng Home Decoration GroupLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dong Yi Ri Sheng Home Decoration GroupLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Dong Yi Ri Sheng Home Decoration GroupLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Dong Yi Ri Sheng Home Decoration GroupLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 4.3% gain to the company's revenues. Still, lamentably revenue has fallen 25% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 33% shows it's an unpleasant look.

With this information, we are not surprised that Dong Yi Ri Sheng Home Decoration GroupLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Dong Yi Ri Sheng Home Decoration GroupLtd's P/S?

Having almost fallen off a cliff, Dong Yi Ri Sheng Home Decoration GroupLtd's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Dong Yi Ri Sheng Home Decoration GroupLtd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Dong Yi Ri Sheng Home Decoration GroupLtd that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com