Many analysts believe that this shareholding is more for risk management needs rather than questioning the long-term development prospects of Apple. Strong financial conditions and the upcoming AI upgrade cycle mean that Apple still has long-term appeal.

What did 'stock god' see in Buffet's significant sale of Apple stock? Why did he reduce his holdings so drastically?

According to some analysis, Buffett lacks confidence in Apple's growth prospects, while most Wall Street analysts urge investors to remain calm and not overinterpret this move.

According to Monday's media reports, most analysts believe that investors need not overreact, and Apple's strong financial position, brand loyalty, and potential in fields such as artificial intelligence mean that it remains an attractive long-term investment choice.

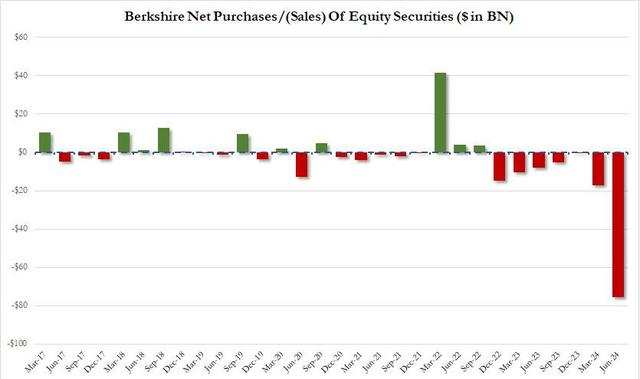

According to data released by Berkshire on Saturday, the company reduced its Apple holdings by nearly half in the second quarter, and the value of its holdings fell from around $140 billion at the end of March to around $84 billion now.

It is worth noting that this reduction occurred during a period of strong gains in the US stock market, during which Apple's stock price rose 23%, and the S&P 500 repeatedly hit new highs. Moreover, this is not the first time Berkshire has reduced its stake in Apple. At the annual shareholder meeting in May, Buffett hinted to investors that the reduction was due to tax considerations.

Is it for risk management?

Since Buffett first disclosed his investment in Apple in 2016, the company's stock price has surged nearly 900%, bringing billions of unrealized profits to Berkshire. In view of this background, many analysts believe that this reduction is more out of the need for risk management than questioning Apple's long-term development prospects.

Joe Gilbert, senior portfolio manager at Integrity Asset Management, said:

Buffett's reduction in Apple is only a consideration for risk management. If he has any concerns about Apple's long-term prospects, he will completely clear the position. Similar to Berkshire's reduction of other stock positions, Buffett has considerable unrealized returns on Apple's stock.

CFRA research analyst Cathy Seifert pointed out:

Even after this reduction, Apple is still Berkshire's largest single holding. If you have such a large position, you will take profit and reduce some concentration risks. Berkshire's investment portfolio is still quite concentrated.

Some analysts also pointed out that Berkshire's reduction this time may be related to broader economic concerns. Last Friday's employment data was below expectations, causing market concerns about economic recession, causing the Nasdaq to fall into a technical adjustment range and the panic index (VIX) to approach 25.

It is worth mentioning that a few days before Berkshire announced changes in its investment portfolio, Apple had just released its quarterly report. The financial report showed that the company's revenue returned to a growth track and hinted that new AI features will drive iPhone sales growth in the next few quarters. Although technology stocks have experienced a correction, Apple's stock price remained stable after the financial report was released and finally ended the week with an increase.

Many analysts, including Wedbush analyst Dan Ives, still see a bright future for Apple. Ives said:

Apple is in a major upgrade cycle that will drive revenue growth in 2025 and 2026. Although some people may interpret this as a signal of lack of confidence, Apple has just submitted a strong quarterly report, and there is still a super cycle driven by AI. We believe it is not time to exit now.