The main indexes of A-shares opened lower and rose during the morning session. As of midday closing, the Shanghai Composite Index rose 0.07%, the Shenzhen Component Index rose 0.37%, and the Chinext Price Index rose 0.42%.

The major A-share indexes opened low and rose throughout the morning. The Shanghai Composite Index rose 0.07% to 2907.33 points by noon, the Shenzhen Component Index rose 0.37%, and the Chinext Price Index rose 0.42%. Over 3200 individual stocks rose, with a total turnover of 443.8 billion yuan in the first half of the day, down 0.3 billion yuan from the previous day.

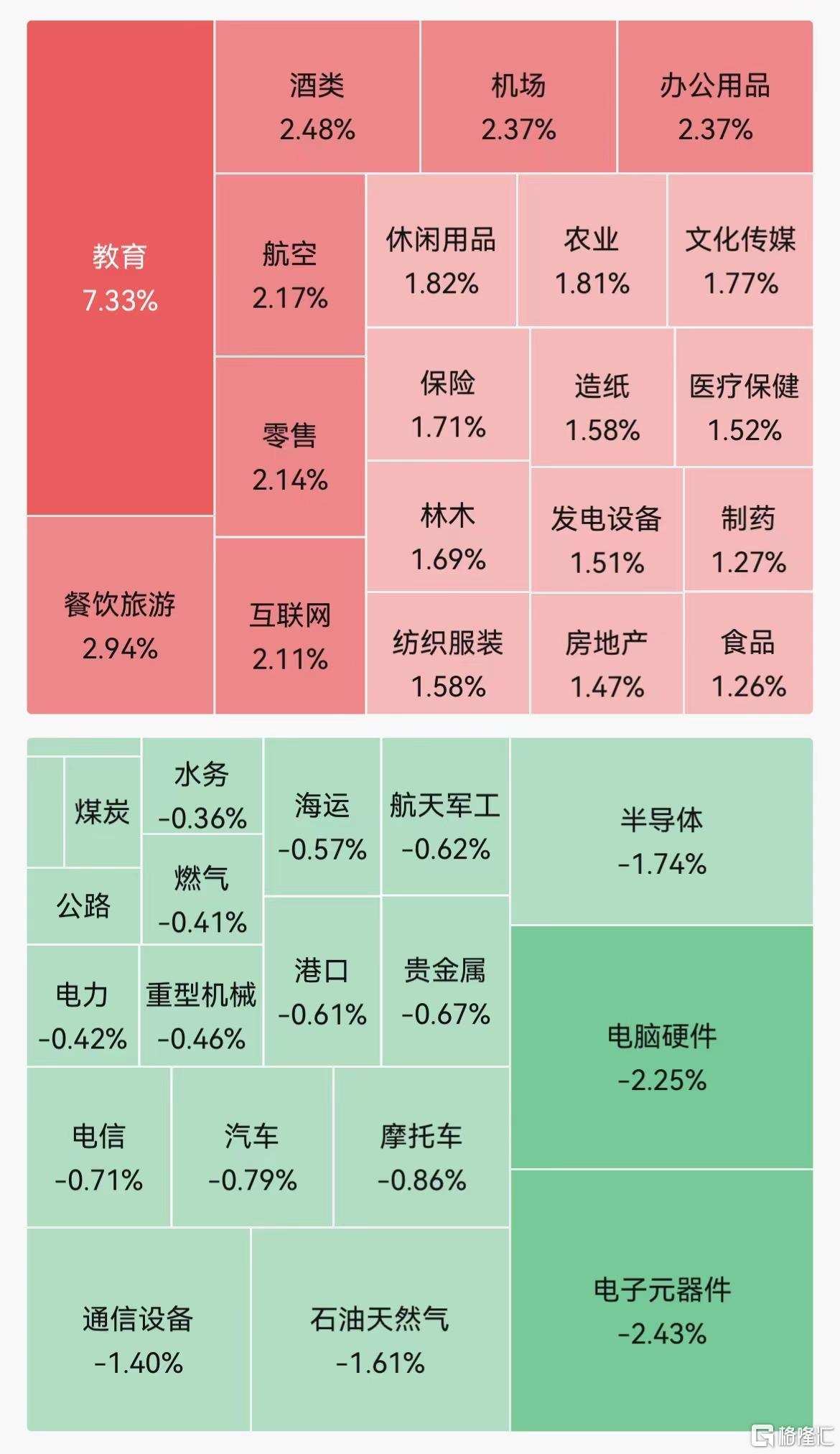

On the market, education stocks performed strongly, with trading in Kaiwen Education, Offcn Education Technology, and Shanghai Xinnanyang Only Education & Technology hitting the limit up. The State Council of China issued the "Opinions on Promoting the High-Quality Development of Service Consumption," mentioning the promotion of the quality and efficiency of vocational education. Film and television stocks fluctuated and rose, with Omnijoi Media Corporation and Shanghai Film up more than 9% and 6%, respectively. The State Film Administration of China will provide over 0.3 billion yuan in preferential subsidies for movie-going. Game stocks rose collectively with Fuchun Technology, Mingchen Health, and G-bits Network Technology limit-up. The issuance of import licenses for games was normalized to bi-monthly. Baijiu stocks rebounded, with Shanghai Guijiu limit-up, and Jiugui Liquor and Luzhou Laojiao up more than 4%. Leading sectors included tourism, medical services, and insurance.

Consumer electronics concept stocks generally fell, with Shenglan Technology down more than 11%, Luxshare Precision Industry and Foxconn Industrial Internet down more than 5%. Chip stocks fell, with Zhejiang Mtcn Technology down over 8%, and Shanghai Guoj Jiu Zhou Microelectronics down over 6%. Auto and precious metals sectors fell the most.

Consumer electronics concept stocks generally fell, with Shenglan Technology down more than 11%, Luxshare Precision Industry and Foxconn Industrial Internet down more than 5%. Chip stocks fell, with Zhejiang Mtcn Technology down over 8%, and Shanghai Guoj Jiu Zhou Microelectronics down over 6%. Auto and precious metals sectors fell the most.

Education stocks performed strongly, with Kaiwen Education and Offcn Education Technology limit-up.

Kaiwen Education, Offcn Education Technology, Shanghai Xinnanyang Only Education & Technology, and Action Education were limit-up. Dou Shen Education rose more than 9%, and Xueda (Xiamen) Education Technology Group, Qtone Education Group(Guangdong), and China Hi-Tech Group followed. On the news side, the State Council of China recently issued the "Opinions on Promoting the High-Quality Development of Service Consumption," which puts forward that high-level higher education institutions, scientific research institutions, and social organizations open high-quality educational resources to meet the diversified and personalized learning needs of the public. Promote the quality and efficiency of vocational education and build high-level vocational schools and majors.

Game stocks rose collectively, with Mingchen Health limit-up.

Fuchun Technology, Mingchen Health, and G-bits Network Technology were limit-up, Tianzhou Culture rose nearly 8%, Shanghai Yaoji Technology rose more than 6%, and Shenzhen ZQGame, 37 Interactive Entertainment Network Technology Group, Kingnet Network, and Rastar Group followed. On the news side, the National Press and Publication Administration of China updated the import license approval information for online games in 2024 on August 2, adding 15 new games, including Lei Ting Games' "The Cairo Business Tycoon" and Hubei Century Network Technology Inc.'s "Dynasty Warriors Unleashed."

Film and television stocks fluctuated and rose, with Omnijoi Media Corporation up more than 9%. Shanghai Film rose more than 6%, Huayi Brothers Media Corporation, Jinyi Media Corporation, Zhejiang Huace Film & TV, etc, rose more than 3%, and Wanda Film Holding, Zhejiang Talent Television and Film, Hengdian Entertainment, and Ciwen Media Co.,Ltd. followed. On the news side, the State Film Administration of China recently held the launch ceremony for the National Film Public Consumption Season in 2024. It is understood that the consumption season will last from August to October and will provide a total of more than 0.3 billion yuan in preferential subsidies for movie-going.

Omnijoi Media Corporation rose more than 9%, Shanghai Film rose more than 6%, Huayi Brothers Media Corporation, Jinyi Media Corporation, and Zhejiang Huace Film & TV rose more than 3%, and Wanda Film Holding, Zhejiang Talent Television and Film, Hengdian Entertainment, and Ciwen Media Co.,Ltd. followed. On the news side, the State Film Administration of China will provide over 0.3 billion yuan in preferential subsidies for movie-going.

Baijiu stocks rebounded, with Shanghai Guijiu hitting the daily limit, Guilin Lingui Rosewood Furniture and Hubei Yihua Chemical both rising more than 9%, and Luzhou Laojiao also up slightly.

Shanghai Guijiu rose limit, Jiugui liquor, Luzhou Laojiao, Shanxi Xinghuacun Fen Wine Factory, and Gansu Huangtai Wine-Marketing Industry all rose more than 4%, and Yingjia Distillery, Shede Spirits, Wuliangye Yibin and other liquor companies followed. On the news front, UBS Securities recently downgraded the ratings of multiple liquor stocks, and Wuliangye Yibin and Luzhou Laojiao and other liquor companies have responded, with Wuliangye Yibin stating that the company's product pricing is very firm, and the current strategy is to control the volume and maintain prices.

Consumer electronics concept stocks fell sharply, with Shenglan Technology falling more than 10%.

Shenglan Technology fell more than 10%, Luxshare Precision Industry, Lingyi Itech, Foxconn Industrial Internet fell more than 5%, Kewang Technology, Lens Technology, Shenzhen Sunway Communication and other stocks all declined. Foxconn Industrial Internet released its 2024 interim results yesterday. During the reporting period, the company achieved revenue of RMB 266.09 billion, a year-on-year increase of 28.69%; the company achieved a net profit attributable to the parent of RMB 8.74 billion, a year-on-year increase of 22.04%. Both the company's revenue and net profit indicators reached new highs since Foxconn Industrial Internet went public.

消费电子概念股普跌,胜蓝股份跌超11%,立讯精密、工业富联跌超5%;芯片股走弱,中晶科技跌超8%,源杰科技跌超6%;汽车、贵金属等板块跌幅居前。

消费电子概念股普跌,胜蓝股份跌超11%,立讯精密、工业富联跌超5%;芯片股走弱,中晶科技跌超8%,源杰科技跌超6%;汽车、贵金属等板块跌幅居前。