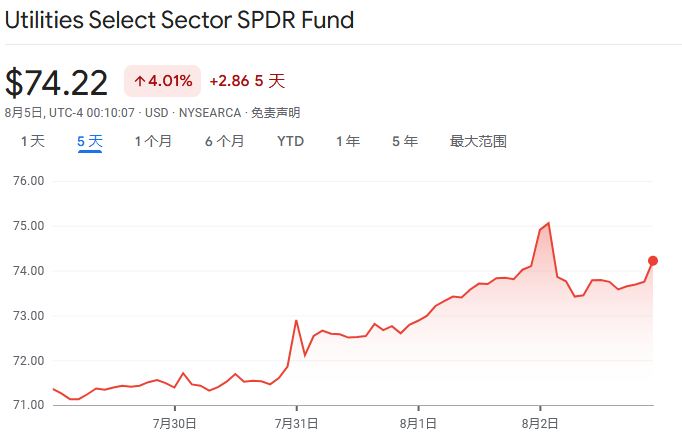

As US chip stocks cooled down, public utility stocks continued to rise. The US Public Utilities ETF (XLU) rose 4% last week, breaking through the $74 mark, driven by the AI boom causing a surge in demand for electrical utilities and a skyrocketing price of electricity in the USA.

Recently, while chip stocks in US stocks have fallen, public utility stocks have risen against the trend.

The US public utility selected industry etf (code XLU) rose 4% in the past 5 trading days, breaking through the $74 mark. The public utilities sector may usher in a new spring.

In the past two years, because the market is concerned about the continuous inflation, the Federal Reserve has maintained interest rates at a high level after continued interest-rate increases, and the yield of 10-year US Treasuries has remained above 4% for most of the time.

In the past two years, because the market is concerned about the continuous inflation, the Federal Reserve has maintained interest rates at a high level after continued interest-rate increases, and the yield of 10-year US Treasuries has remained above 4% for most of the time.

According to FactSet data, the average return of public utility stocks during this period was 3.4%, and the dividend yield was not as good as that of US Treasury bonds, which has put pressure on public utility stocks that depend on stable dividends.

XLU has also been unable to break through the $72 mark, while major US indices during the same period achieved double-digit growth.

But from last week, the situation may be reversed. On the occasion of the decline of tech stocks such as Mag 7, the public utility etf XLU rose against the trend and broke through the key position, indicating that investors have more confidence in holding public utility stocks.

The US economic slowdown and AI fever have spurred a surge in electricity demand and lifted the public utilities sector in the US stock market.

Some analysts pointed out that the driving factors behind this change include weak US macroeconomic data and the surge in electricity demand triggered by the AI fever.

From a macroeconomic perspective, US non-farm employment was weak in July, the unemployment rate rose gradually, and combined with the July ISM manufacturing PMI data falling short of expectations, concerns about a US economic recession intensified. The market generally bets on the Federal Reserve's interest rate cuts in September, and the yield of 10-year Treasuries falls to about 3.8%, making the dividend yield of public utility stocks more attractive.

On the other hand, the surge in electricity demand triggered by the AI fever has also driven the rise of US public utility stocks.

On Tuesday last week, the electricity market auction held by PJM, the largest grid operator in the US, skyrocketed to $269.92 per megawatt per day, an increase of more than 800% from a year ago, and also broke the record of $174.11 per megawatt per day in 2010.

After this news, the stock price of Vistra, one of the largest power companies in the US, rose more than 15%.

Goldman Sachs warned that more power capacity was needed for grid stability. However, any new grid expansion could take several years to come online, which basically means that electricity prices will remain high for a period of time.

Therefore, including Vistra, Constellation Energy, and NRG Energy, these three public utility companies have become one of the top 10 performing companies in the S&P 500 index by riding the wave of soaring electricity prices.

More importantly, compared to buying expensive tech stocks such as Nvidia, Microsoft and Google, investing in public utility stocks at the present time is relatively cheap for participating in the AI boom.

Jay Jacobs, head of active ETFs at BlackRock, said that as investors look for AI opportunities outside of large tech stocks, it is expected that investors will continue to invest in public utility stocks or related ETFs at least this year.

Investors' eyes have passed the Mag 7 and are waiting for the next opportunity. With large tech companies such as Microsoft and Google investing billions of dollars in AI data centers, supplying power to these AI devices and the rise of new energy vehicles, the rise of public utility stocks is just a matter of time.

Randy Conner, President of Churchill, also said: "Public utilities have become our preferred industry." Perhaps it is time to enjoy the honeymoon period brought by public utility stocks.

过去两年,因市场担忧通胀持续,美联储在持续加息后将利率维持在较高水平,10年期美国国债收益率大部分时间也保持在4%以上。

过去两年,因市场担忧通胀持续,美联储在持续加息后将利率维持在较高水平,10年期美国国债收益率大部分时间也保持在4%以上。