Global stock markets have evaporated 6.4 trillion dollars in three weeks, and the key assumptions supporting the rise have been shaken. Traders speculate that market panic may cause the financial system to fail and loans to slow down, which will eventually push the global economy into recession. The Federal Reserve may need to cut interest rates urgently to deal with the crisis.

After the global stock market was hit hard, traders feared that the “big crash” had just begun.

On August 6, traders speculated that market panic could cause the financial system to fail and loans to slow down, which would eventually push the global economy into recession. Wall Street analysts expect that the Federal Reserve may need to cut interest rates urgently to deal with the crisis.

Few people think that the market has bottomed out. Vishnu Varathan, head of economics and strategy at Mizuho Bank, said that traders think trying to buy falling assets at the right time is like trying to grab a falling knife. Today, “there are falling knives everywhere.”

Few people think that the market has bottomed out. Vishnu Varathan, head of economics and strategy at Mizuho Bank, said that traders think trying to buy falling assets at the right time is like trying to grab a falling knife. Today, “there are falling knives everywhere.”

Global stock markets have evaporated 6.4 billion dollars in three weeks, and key assumptions about the rise have been shaken

On Monday, the global stock market collapsed. The Nikkei 225 and TSE indices both plummeted by more than 12%. South Korea recorded the biggest decline since 2008. The S&P Dow fell the deepest in two years, and Nvidia fell 15% at one point...

“Black Monday 1987” appears to be happening again. Senior market and economic observer Ed Yardeni said that the sudden collapse of the market reminded him of 1987, when the Dow Jones Industrial Average fell 23% in one day.

Over the past few weeks, there have been signs that the stock market has declined. According to calculations, in just three weeks, the global stock market has evaporated around 6.4 billion dollars.

The current market panic created a range of risks. Traders pointed out that if stock sell-offs are not stopped in time, they may disrupt the financial system, slow down loans, and become the last straw to push the global economy into recession.

Investors are aware that the key assumptions supporting the current rise in the stock market have been shaken, such as the US economy remaining strong, AI will rapidly change business models around the world, Japan will not raise interest rates or fall short of expectations.

However, weak US economic data for July, as well as disappointing earnings reports from major tech companies, had an impact on the market. Meanwhile, Japan has raised interest rates twice during the year.

This series of attacks made investors suddenly realize that boosting Nvidia's stock price by 11 times in less than two years, or buying large amounts of junk loans packaged in bonds, or carrying out arbitrage transactions in yen... these acts themselves are risky.

Against this backdrop, global interest rate cuts are heating up dramatically, and the market is even pricing the Federal Reserve to cut interest rates as a “bailout”. Some radical analysts believe that the Federal Reserve has reason to act before the September meeting, and the possibility of cutting interest rates by 25 basis points within a week is 60%.

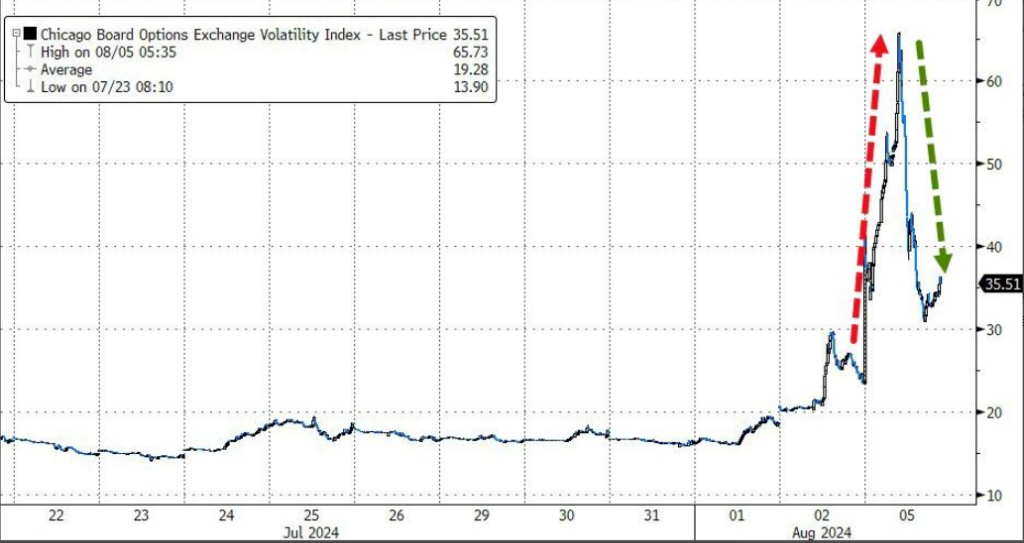

The VIX Panic Index soars, and the fears are not over

On August 5, local time, the VIX Panic Index broke several months of calm and once soared to 65 during the intraday period, the biggest intraday increase since data was recorded in 1990. However, it then fell back to around level 40.

Mizuho Bank analyst Shoki Omori said he was surprised by the scale of the stock sell-off and was prepared to face significant market fluctuations. “It broke all my expectations,” he said. “We are entering some unimaginable areas of trading. Ready for more.”

The major shock in global stock markets on Monday continued to affect other Asian, European, and American markets, and even penetrated credit markets. As a result, two US companies delayed loan transactions totaling $3.8 billion — wireless infrastructure provider SBA Communications and theme park operator SeaWorld Parks & Entertainment.

Although the stock market recovered from a low point until the end of the US stock market, the Nasdaq Composite Index fell 3.4%, and the bond market initially stabilized. But it did little to reassure upset traders, and this is probably not a false surprise.

Few people think that the market has bottomed out. Miller Tabak strategist Maley said he is still very worried about market trends. “We are still worried about earnings and the economy.”

Whether this global market turmoil marks the final stage of the global sell-off that began last week, or is just the beginning of a long-term decline, remains uncertain. The market is currently digesting multiple risk factors, and there may be more volatility in the coming weeks.

几乎很少有人认为,市场已经触底。瑞穗银行经济和战略主管Vishnu Varathan说道,交易员们认为试图在正确的时间买入正在下跌的资产,就像试图抓住一把下落的刀子,今天“到处都是下落的刀子”。

几乎很少有人认为,市场已经触底。瑞穗银行经济和战略主管Vishnu Varathan说道,交易员们认为试图在正确的时间买入正在下跌的资产,就像试图抓住一把下落的刀子,今天“到处都是下落的刀子”。