As a series of global macro risks continue to disrupt the market and trigger a chain reaction, US stocks continued to adjust significantly under panic sentiment on Monday. The $.SPX.US$ fell by 3.0%, while the $.DJI.US$ fell by 2.6%, marking the largest single-day decline in about two years. The $.VIX.US$, also known as the "fear index" on Wall Street, soared by 180% before the market opened on Monday, recording the largest increase ever, but eventually retreated to less than 65% as market sentiment gradually calmed down.

With the VIX index reaching levels not seen since the most severe period of the financial crisis, some investors are trying to understand this phenomenon and identify any possible trading opportunities or insights into market trends.

What Is the Fear Index and Why Is It Surging Recently?

What Is the Fear Index and Why Is It Surging Recently?

The $.VIX.US$ measures the market's expectation of volatility in the S&P 500 index for the next 30 days. Maintained by the Chicago Board Options Exchange (CBOE), the VIX is calculated based on the implied volatility of options on the $.SPX.US$, reflecting the level of fear and pressure in the market. Implied volatility typically rises during market turmoil or economic downturns. According to S&P Global, a VIX level above 30 is considered extremely high, indicating significant turbulence in the market.

The VIX index surpassed the crucial level of 65 on Monday, a situation that has only occurred twice in history: during the 2008 financial crisis (reaching 80.86) and in March 2020 during the outbreak of the COVID-19 pandemic (reaching 82.69). The surge in VIX this time has been influenced by a series of ongoing global macro events, including concerns about the weakening economic and employment data exacerbating fears of a recession in the US, unwinding of a large number of yen carry trades triggering sell-offs, disappointing earnings or guidance from high-valued tech stocks denting market sentiment, and escalating geopolitical tensions in the Middle East.

Significant Clues in Monday's VIX Surge

Significant Clues in Monday's VIX Surge

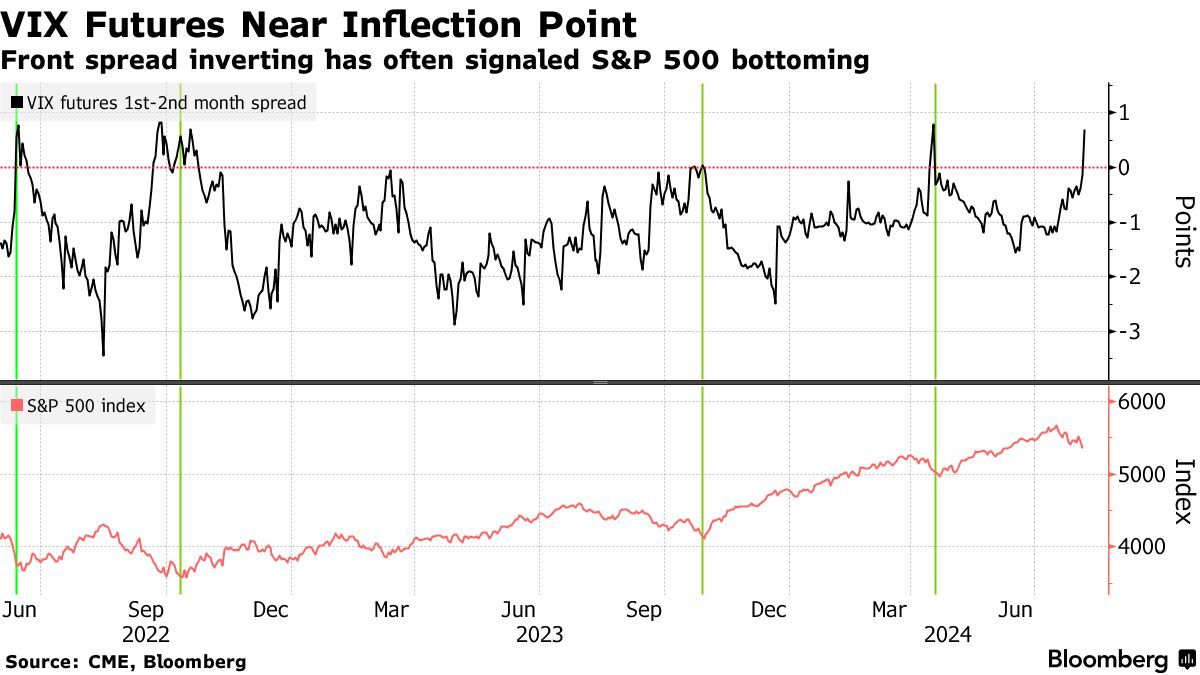

According to Jonathan Krinsky, the chief market technician at BTIG, the VIX index surged on Monday as panicked investors sought immediate protection. As a result, the spot price of VIX soared relative to the second-month VIX futures price, causing the spread between spot VIX and the next-month futures contract to briefly fall to nearly negative 30 points. This is even lower than the recent lowest level during the peak of the sell-off period caused by the COVID-19 pandemic. Typically, when the spread inverts by at least 10 basis points or more on a closing basis, it may indicate that the stock-market correction is reaching its bottom.

Similar phenomena have also occurred in futures contracts of different maturities. According to Bloomberg data, a reversal was observed in the Chicago Board Options Exchange Volatility Index futures on Monday, with the front-month contract for August closing higher than the next-month contract for September. This also indicates that investors believe the near-term uncertainty is higher than the future uncertainty. Interestingly, the S&P 500 index was close to its lows during the past four occurrences of this phenomenon, including June and October 2022, October 2023, and April 2024.

Exploring Trading Potential During Extreme Panic

Exploring Trading Potential During Extreme Panic

1. A Sharp Spike in VIX Could Indicate a Bullish Contrarian Signal:

Due to the strong negative correlation between VIX and stock market returns, a decline in the volatility index may stabilize the S&P 500 index. This is why some people believe that VIX can predict the turning point of SPX. In other words, although a surge in the VIX index usually occurs simultaneously with a sharp market decline, this process may be temporary, and the historical high of the VIX index usually precedes the stock market rebound. After extreme volatility spikes and then peaks and falls, it may indicate that the most painful period has passed and that stocks will once again be attractive.

Historically, when the VIX index has experienced a significant increase (up 95% from the bottom within one year without a 20% correction), it has fallen an average of 19% in the following month and 34% on average in the next year. These correspond to the S&P 500 index rebounding 2% in the following month and 12% in the next year.

"You have to watch the VIX. When the VIX peaks and starts to roll over and fall down, the recovery can be just as quick," Fundstrat head of research Tom Lee said Monday.

Moreover, from a fundamental perspective, some of the concerns behind the panic may have been overblown.

On the one hand, the latest US non-manufacturing ISM index for July released on Monday showed a reading of 51.4, better than the expected 51. The service sector has escaped from the worst contraction in four years recorded in June and returned to the expansion zone. Chris Williamson, chief business economist at S&P Global Market Intelligence, pointed out that as the service sector accounts for a relatively large proportion of the US economy, the PMI data for July indicates that the US economy continued to grow at the beginning of the third quarter, with a growth rate equivalent to an annualized GDP growth rate of 2.2%. This has somewhat calmed the extremely fragile market sentiment after a surge in unemployment rate data.

Given its basic prediction of a "soft landing", David Lefkowitz, head of US equities at UBS Global Wealth Management, believes that the risk-return outlook for the US stock market looks good, and counter-cyclical bullish signals are beginning to emerge.

Jamie Cox, managing partner at Harris Financial Group, said that the sell-off looked like "hysteria" and that concerns about a US slowdown had been misguided.

On the other hand, this round of volatility may have been amplified by concerns about economic recession and geopolitical issues, as well as liquidity issues, in a situation where the market was overcrowded and had previously made excessive profits. Therefore, if the market can withstand the spread of liquidity shocks in the short term, a rebound can be expected. Moreover, the Fed now has enough policy space to lower interest rates and boost the economy, and stabilize financial markets, as the Fed's policy rate is still at the highest level in more than 20 years, ranging from 5.25% to 5.5%, 138bps higher than the implied rate level by the Taylor rule.

Keith Lerner, co-chief investment officer at Truist Advisory Services, believes that the further downside risk of the S&P 500 index is only about 5%, that is, the index would fall to a low point of around 4,900 to 5,000 points:

"The template tends to be there's a spike in the VIX, everyone has been caught offsides, and there's a battle between fear and greed."

2. Extreme VIX Values Unlikely to Last Long Due to Mean Reversion:

The VIX index exhibits mean reversion characteristics, tending to fluctuate around its average value. According to Dow Jones market data, as of 2023, the 10-year average value of the VIX index stands at 18.13. When the VIX exceeds its normal range between 10 and 30, the power of mean reversion offers opportunities for trading volatility.

While investors cannot directly invest in the VIX, they can trade through tracking VIX futures contracts and exchange-traded funds (ETFs), as well as exchange-traded notes (ETNs) that hold these futures contracts.

If investors anticipate extreme increases in the VIX index leading to a market pullback, they can profit from shorting volatility through ETFs. Additionally, options are another major tool. Data from Cboe Global Markets showed that last Friday, options traders opened new bets in hopes of profiting from a decline in the VIX. Options trading volumes tied to the VIX reached a near-record 3.4 million, with the largest increase seen in put contracts.

Furthermore, due to the usual presence of a positive price spread (contango) in VIX futures trading, where futures prices are higher than spot prices, investors can consider mean reversion in price spreads if a market crash leads to a negative price spread (backwardation).

However, if investors believe that the volatile situation will persist and expect an upward trend in the VIX that could harm their positions, they can hedge their portfolio's potential losses caused by stock price declines by purchasing VIX futures, options, or ETFs. These products increase in value as volatility rises.

Source: MarketWatch, Investopedia, Bloomberg