At US$91.00, Is U.S. Physical Therapy, Inc. (NYSE:USPH) Worth Looking At Closely?

At US$91.00, Is U.S. Physical Therapy, Inc. (NYSE:USPH) Worth Looking At Closely?

U.S. Physical Therapy, Inc. (NYSE:USPH), might not be a large cap stock, but it received a lot of attention from a substantial price movement on the NYSE over the last few months, increasing to US$108 at one point, and dropping to the lows of US$90.75. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether U.S. Physical Therapy's current trading price of US$91.00 reflective of the actual value of the small-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let's take a look at U.S. Physical Therapy's outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

U.S. Physical Therapy, Inc.(紐交所:USPH)雖然不是大盤股,但近幾個月在紐交所上出現了 substantial 的價格波動,一度上漲至 108 美元,最低跌至 90.75 美元。有些股價波動可以讓投資者以較低的價格進入股票,並有潛力以較低價格買入。需要回答的一個問題是,U.S. Physical Therapy 目前的交易價格 91.00 美元反映了該小市值股票的實際價值嗎?或者目前被低估,爲我們提供了買入的機會?讓我們根據最新的財務數據研究 U.S. Physical Therapy 的前景和價值,看看是否有任何觸發價格變化的因素。

What's The Opportunity In U.S. Physical Therapy?

U.S. Physical Therapy 的機會在哪裏?

According to our price multiple model, where we compare the company's price-to-earnings ratio to the industry average, the stock currently looks expensive. In this instance, we've used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock's cash flows. We find that U.S. Physical Therapy's ratio of 77.84x is above its peer average of 25.97x, which suggests the stock is trading at a higher price compared to the Healthcare industry. If you like the stock, you may want to keep an eye out for a potential price decline in the future. Since U.S. Physical Therapy's share price is quite volatile, this could mean it can sink lower (or rise even further) in the future, giving us another chance to invest. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

根據我們的價格倍增模型,在該模型中,我們將公司的市盈率與行業平均值進行比較,現在的股票看起來是昂貴的。在這種情況下,我們使用了市盈率,因爲沒有足夠的信息可靠地預測股票的現金流。我們發現 U.S. Physical Therapy 的市盈率爲 77.84 倍,超過了同行業的平均市盈率 25.97 倍,這表明該股票正在以較高的價格交易相比於醫療保健行業。如果你喜歡這支股票,你可能需要留意未來潛在的價格下跌。由於 U.S. Physical Therapy 的股價相當波動,這可能意味着它未來可能會下跌(或上漲),我們還有另一個投資機會。這基於其高 beta 值,beta 值也是衡量某隻股票相對於整個市場波動性的一個好指標。

What does the future of U.S. Physical Therapy look like?

U.S. Physical Therapy 的未來如何?

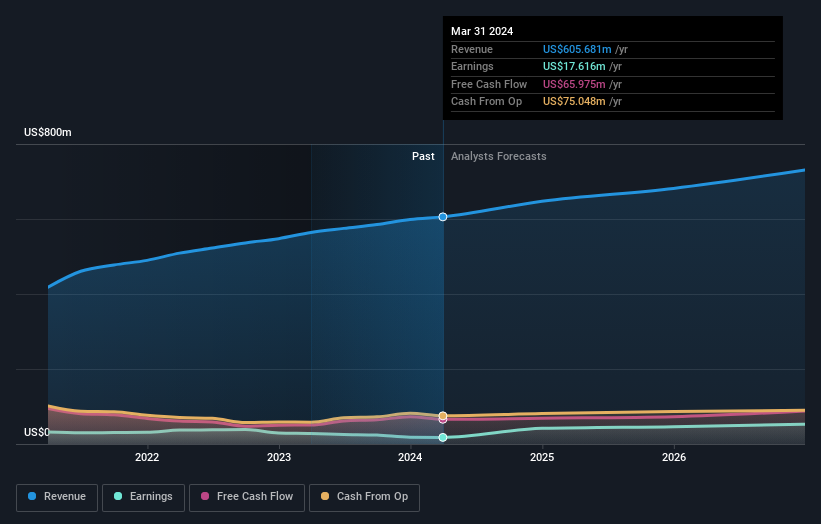

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations. U.S. Physical Therapy's earnings over the next few years are expected to double, indicating a very optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

如果投資者正在尋找其組合中的成長性,也許在購買其股票之前考慮公司前景會更好。以一個便宜的價格購買一個前景有看好的優秀公司股票始終是一個好投資,因此讓我們也來看看公司的未來預期。U.S. Physical Therapy 的收益在未來幾年內有望翻一番,預示着一個非常樂觀的未來。這應該會導致更強的現金流,反過來又會推動股票價值的提高。

What This Means For You

這對您意味着什麼?

Are you a shareholder? USPH's optimistic future growth appears to have been factored into the current share price, with shares trading above industry price multiples. At this current price, shareholders may be asking a different question – should I sell? If you believe USPH should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

你是股東嗎?USPH 的樂觀增長前景似乎已經被納入了當前股價,股票交易在行業價值倍數之上。在當前價格下,股東們可能會問一個不同的問題——我應該賣出嗎?如果你認爲 USPH 價格應該低於當前價格,那麼在其價格降至行業市盈率時高價賣出,然後再買回來是可以盈利的。但在做出這個決定之前,請看看其基本面是否有變化。

Are you a potential investor? If you've been keeping an eye on USPH for a while, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the optimistic prospect is encouraging for USPH, which means it's worth diving deeper into other factors in order to take advantage of the next price drop.

你是潛在投資者嗎?如果你一直關注 USPH,現在可能不是進入該股票的最佳時機。價格已經超過了同行業的股票,這意味着可能沒有更多的誤價上漲空間,但是樂觀的前景仍然值得深入挖掘其他因素以利用下一次價格下跌。

So while earnings quality is important, it's equally important to consider the risks facing U.S. Physical Therapy at this point in time. In terms of investment risks, we've identified 5 warning signs with U.S. Physical Therapy, and understanding them should be part of your investment process.

因此,雖然收益質量很重要,但同時也要考慮當前時點 U.S. Physical Therapy 面臨的風險。就投資風險而言,我們已經確定了與 U.S. Physical Therapy 相關的 5 個警告標誌,了解這些標誌應該是你投資過程中的一部分。

If you are no longer interested in U.S. Physical Therapy, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

如果你已經不再對 U.S. Physical Therapy 感興趣,你可以使用我們的免費平台查看我們的超過 50 只增長潛力高的股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。