Goldman Sachs' analysis of 40 years of data shows that buying US stocks after a drop of similar magnitude in the past month is usually profitable.

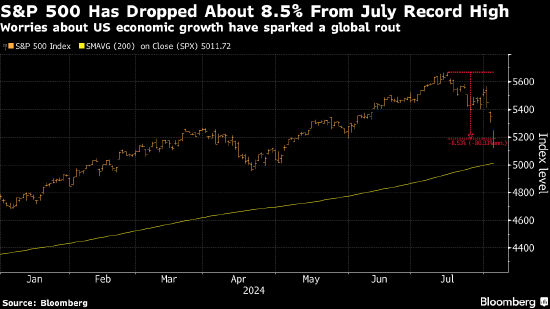

Goldman Sachs' strategy team, led by David Kostin, stated that since 1980, the median return of the S&P 500 index in the three months after falling 5% from its recent peak is 6%. The benchmark index has fallen 8.5% from its mid-July peak.

'A 10% correction is often an attractive buying opportunity,' Kostin wrote in the report, noting that past bouncebacks have not been as strong as after smaller drops. Studies show that in 84% of cases, the return after a 5% drop is positive.

Global markets returned to relative calm on Tuesday, with some of the hardest-hit indexes rebounding from the recent falls driven by concerns over a US economic slowdown and extreme valuations in tech stocks. JPMorgan's quant strategists said institutional investors bought the dip on Monday, purchasing around $14 billion during trading hours and selling $6.7 billion at the close.

Kostin's team did not provide recommendations based on the survey results, but warned that the outlook for the benchmark index after a 10% plunge is different from a pullback before an economic growth period.

They noted that while cyclical stocks sensitive to economic growth lagged defensive stocks in this month's sell-off, the US stock market still has not fully priced in the expectation of economic contraction. Goldman Sachs strategists including Peter Oppenheimer said in another report that they expected global equities to fall further, but predicted that they would not enter a bear market, defined as a drop of 20% from recent high.

Meanwhile, Citigroup's strategy team warned this week that the scenario of an economic recession has not been fully priced in by the market.