Financial giants have made a conspicuous bullish move on Vertiv Hldgs. Our analysis of options history for Vertiv Hldgs (NYSE:VRT) revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $640,885, and 3 were calls, valued at $100,340.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $86.0 for Vertiv Hldgs, spanning the last three months.

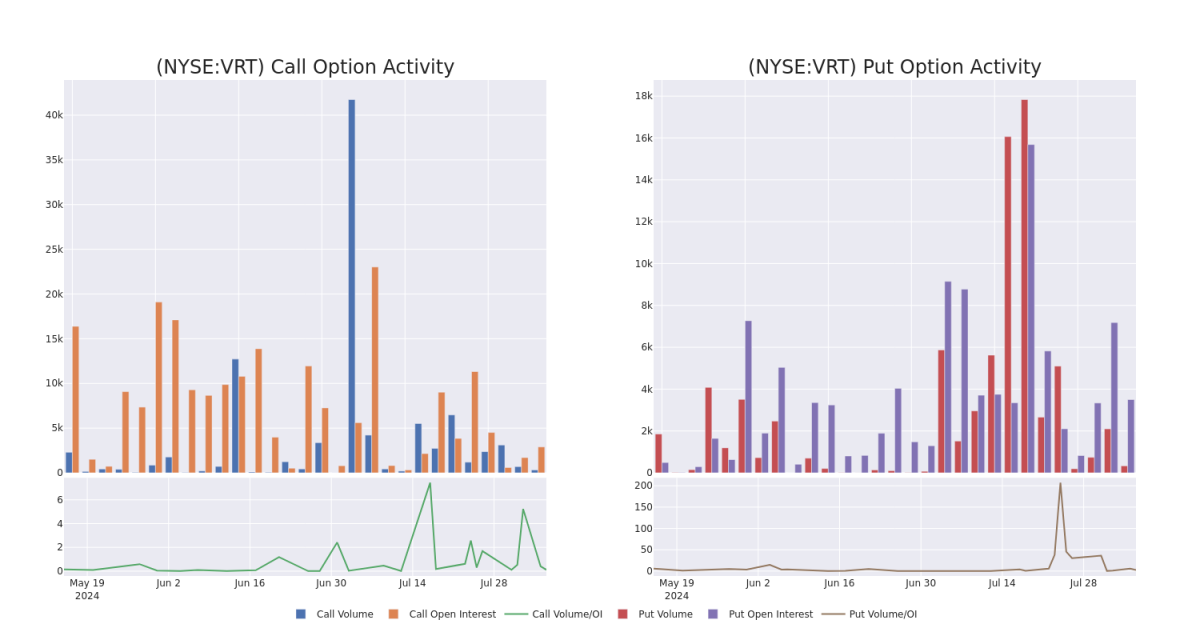

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vertiv Hldgs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vertiv Hldgs's substantial trades, within a strike price spectrum from $70.0 to $86.0 over the preceding 30 days.

Vertiv Hldgs Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | PUT | SWEEP | BULLISH | 01/17/25 | $16.5 | $16.3 | $16.3 | $77.50 | $409.2K | 2.2K | 250 |

| VRT | PUT | SWEEP | BULLISH | 01/17/25 | $15.0 | $14.6 | $14.6 | $75.00 | $73.0K | 568 | 50 |

| VRT | PUT | TRADE | BULLISH | 10/18/24 | $20.0 | $18.5 | $18.8 | $85.00 | $60.1K | 21 | 32 |

| VRT | PUT | TRADE | BEARISH | 08/16/24 | $17.7 | $16.4 | $17.7 | $86.00 | $56.6K | 40 | 32 |

| VRT | CALL | TRADE | BEARISH | 12/20/24 | $11.2 | $11.0 | $11.0 | $70.00 | $44.0K | 83 | 0 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Having examined the options trading patterns of Vertiv Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Vertiv Hldgs

- With a volume of 3,098,109, the price of VRT is up 0.53% at $68.09.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 78 days.

Expert Opinions on Vertiv Hldgs

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $98.5.

- An analyst from TD Cowen has decided to maintain their Buy rating on Vertiv Hldgs, which currently sits at a price target of $93.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Vertiv Hldgs with a target price of $104.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.