Decoding Chevron's Options Activity: What's the Big Picture?

Decoding Chevron's Options Activity: What's the Big Picture?

Investors with significant funds have taken a bullish position in Chevron (NYSE:CVX), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in CVX usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Chevron. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 66% being bullish and 33% bearish. Of all the options we discovered, 8 are puts, valued at $1,973,385, and there was a single call, worth $47,460.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $130.0 and $140.0 for Chevron, spanning the last three months.

Volume & Open Interest Development

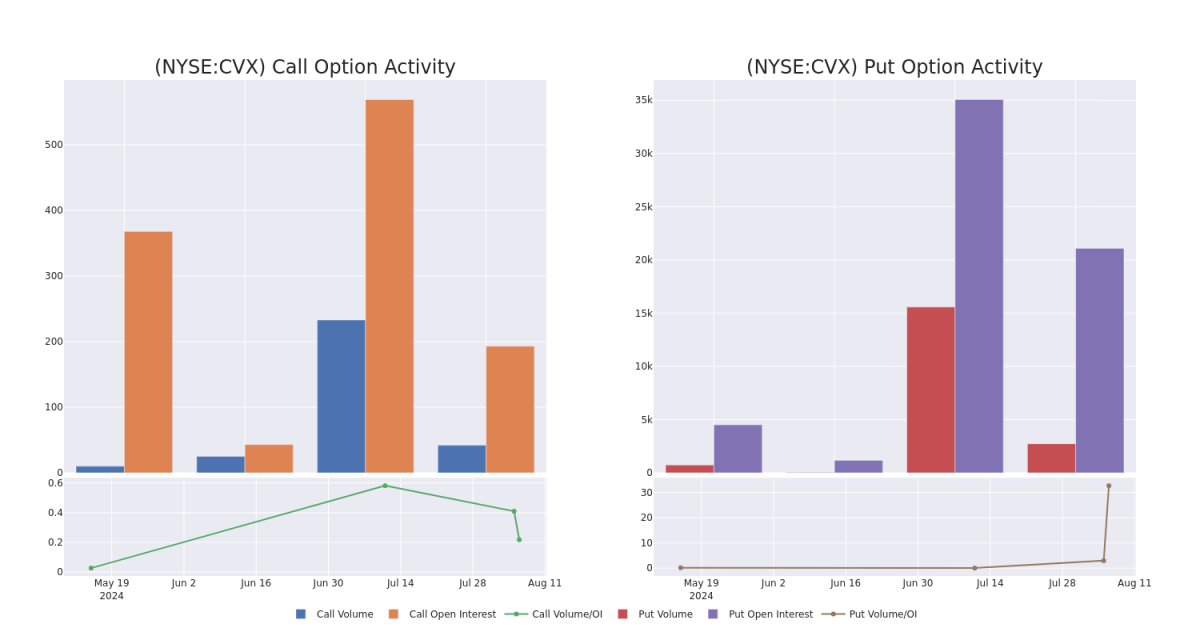

In today's trading context, the average open interest for options of Chevron stands at 4256.8, with a total volume reaching 2,771.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Chevron, situated within the strike price corridor from $130.0 to $140.0, throughout the last 30 days.

Chevron Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | TRADE | BULLISH | 12/18/26 | $15.3 | $14.4 | $14.45 | $130.00 | $1.2M | 27 | 870 |

| CVX | PUT | TRADE | BULLISH | 09/20/24 | $3.55 | $3.4 | $3.46 | $140.00 | $346.0K | 6.1K | 27 |

| CVX | PUT | SWEEP | BULLISH | 06/20/25 | $11.0 | $10.9 | $10.9 | $140.00 | $143.4K | 1.8K | 175 |

| CVX | PUT | SWEEP | BULLISH | 09/20/24 | $3.5 | $3.45 | $3.45 | $140.00 | $71.0K | 6.1K | 1.2K |

| CVX | PUT | SWEEP | BULLISH | 06/20/25 | $11.0 | $10.9 | $10.9 | $140.00 | $56.6K | 1.8K | 243 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

Having examined the options trading patterns of Chevron, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Chevron's Current Market Status

- Trading volume stands at 1,710,304, with CVX's price up by 0.19%, positioned at $144.94.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 80 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.